When navigating the complexities of Bollinger Bands trading, honing in on three key tips can significantly elevate your strategy's effectiveness.

These strategies not only enhance your understanding of market dynamics but also provide practical insights into optimizing your trades.

By incorporating these fundamental principles, you'll be equipped to maneuver the intricacies of Bollinger Bands trading with finesse and precision, potentially leading to more favorable outcomes.

Bollinger Bands Basics

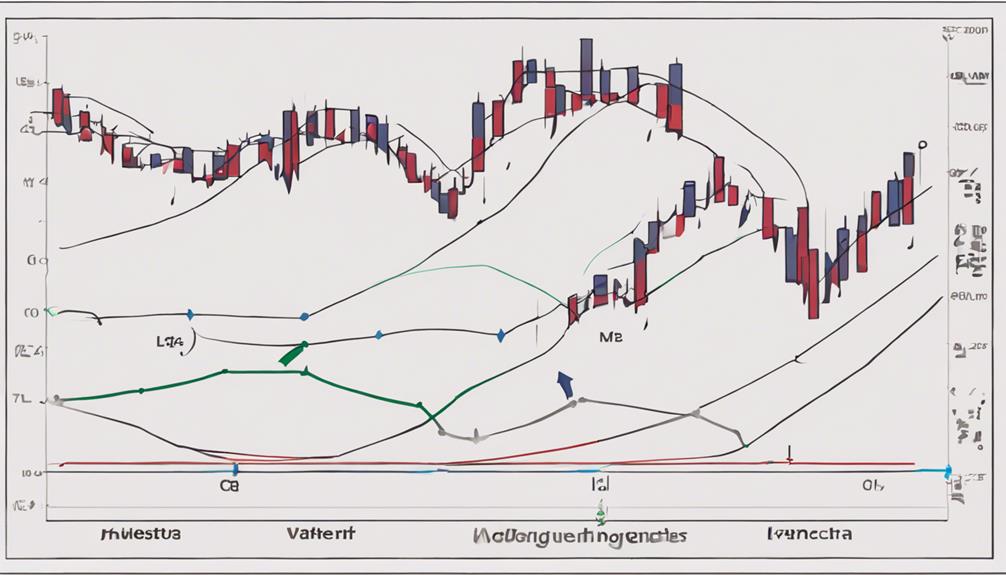

Indispensable for understanding market dynamics, Bollinger Bands consist of a middle band, upper band, and lower band that collectively provide valuable insights into price volatility.

The middle band is typically a Simple Moving Average (SMA), while the upper band signifies statistically high price levels and the lower band denotes statistically low levels.

Market volatility is reflected in the band width, expanding during turbulent market conditions and contracting in calmer periods. Observing price action near these bands is crucial for conducting effective technical analysis across different markets and securities.

In Forex trading, the default settings for Bollinger Bands commonly used are (20,2), serving as a standard starting point for analysis. Understanding these fundamental aspects of Bollinger Bands lays a strong foundation for interpreting market trends and making informed trading decisions.

Setting Optimal Parameters

Understanding how to set optimal parameters for Bollinger Bands is essential for refining your trading strategy and maximizing its effectiveness in analyzing market dynamics. Typically, a 20-day simple moving average and a standard deviation of 2 are used for Bollinger Bands. Adjusting the standard deviation can impact the sensitivity to price movements, widening or narrowing the bands.

Shortening the lookback period increases responsiveness to recent price changes, while longer periods result in smoother bands, potentially reducing false signals. Getting the right balance in parameter settings is crucial for crafting effective Bollinger Bands trading strategies.

Implementing Entry and Exit Signals

To effectively implement entry and exit signals with Bollinger Bands, consider utilizing price movements relative to the upper and lower bands to guide your trading decisions. Entry signals can be identified when the price crosses above the upper band, indicating a potential uptrend entry opportunity. On the other hand, exit signals may be triggered when the price touches the upper band, suggesting it could be a suitable time to take profits.

Additionally, entry points can arise when the price bounces off the lower band, presenting a potential buying opportunity. Exiting a trade as the price approaches or crosses below the lower band could signal a downtrend reversal. It's beneficial to combine these signals with other technical indicators to enhance the overall effectiveness of your Bollinger Bands trading strategy.

Managing Risk Effectively

Implementing proper risk management techniques is crucial for safeguarding your trading capital and maximizing long-term profitability in your Bollinger Bands trading strategy.

To manage risk effectively, consider implementing proper position sizing, limiting exposure to 1-2% of your trading capital per trade.

Use stop-loss orders strategically based on technical analysis to protect profits and minimize losses.

Diversify your trades across different assets to reduce correlation risk.

Employ trailing stops to secure profits while managing risk as the trade progresses favorably.

Continuously assess and adjust your risk management strategies according to market conditions, trade performance, and overall portfolio risk to adapt to changing circumstances and optimize your Bollinger Bands trading strategy.

Are the Trading Strategies for Bollinger Bands the Same for Commodities?

Yes, the trading strategies for Bollinger Bands can be effective for commodities as well. Some effective commodity trading tips using Bollinger Bands include looking for breakouts, utilizing multiple timeframes, and considering price trends along with volume. It’s important to adapt these strategies to the specific characteristics of the commodities market.

– How Can I Implement Bollinger Bands Trading Strategy Effectively for Day Trading?

When day trading with Bollinger Bands, it’s crucial to understand the market volatility and use the bands as a guide for entry and exit points. By combining the bands with other technical indicators, you can increase the accuracy of your trading signals and effectively implement this strategy for profitable day trading.

Fine-Tuning Your Strategy

How can you optimize your Bollinger Bands trading strategy by fine-tuning key parameters to enhance trade precision and effectiveness?

Start by adjusting Bollinger Bands settings such as the lookback period or standard deviation to align with your trading preferences.

Experiment with different moving average types like exponential or weighted moving averages to improve responsiveness.

Customize your strategy by modifying Bollinger Bands settings for precise trend identification tailored to the asset's volatility.

By fine-tuning your strategy, you can enhance trade entry and exit points, capturing potential price movements more effectively.

Remember to adjust settings as needed to adapt to changing market conditions and continuously improve your overall trading strategy.

Frequently Asked Questions

What Is the Best Trading Strategy Using Bollinger Bands?

For the best trading strategy using Bollinger Bands, focus on combining trend identification with volatility analysis. Look for price action near bands to spot entry/exit points. Use multiple timeframes for effectiveness and confirm signals with indicators like RSI.

Which Indicator Works Best With Bollinger Bands?

When trading with Bollinger Bands, the Relative Strength Index (RSI) stands out as the best indicator. It helps you confirm buy/sell signals accurately by identifying overbought/oversold conditions. Adjust settings to suit your style.

What Is the Best Time Frame for Bollinger Bands?

For Bollinger Bands, the best time frame is typically 20 periods with a 2 standard deviation setting. Shorter time frames like 5 or 15 minutes suit day trading, while longer ones such as daily or weekly are ideal for swing trading.

What Is the Success Rate of the Bollinger Bands Strategy?

The success rate of the Bollinger Bands strategy can fluctuate greatly, impacted by market conditions and risk management. Combining it with other indicators and adapting to market changes can enhance your trading outcomes significantly.

Conclusion

Now that you have mastered the art of utilizing Bollinger Bands in your trading strategy, you're equipped to navigate the markets with precision and confidence.

By customizing settings, combining indicators, and managing risk effectively, you have the tools to make informed decisions and maximize your profits.

Your trading journey is like a skilled sailor navigating turbulent waters, using the stars to guide you towards success.

Keep refining your strategy and watch your portfolio sail to new heights.