The Ultimate Oscillator stands out in the realm of technical analysis for its ability to offer a comprehensive perspective on market momentum by incorporating multiple timeframes. This strategic amalgamation of different periods enables traders to gain a nuanced understanding of price movements and make informed decisions.

However, what truly sets the Ultimate Oscillator apart lies in its capacity to provide not just signals but actionable insights that can significantly impact trading outcomes. By delving deeper into its intricacies, traders can unlock a world of possibilities that traditional oscillators may not readily offer, making it a tool worth exploring further.

Importance of Ultimate Oscillator

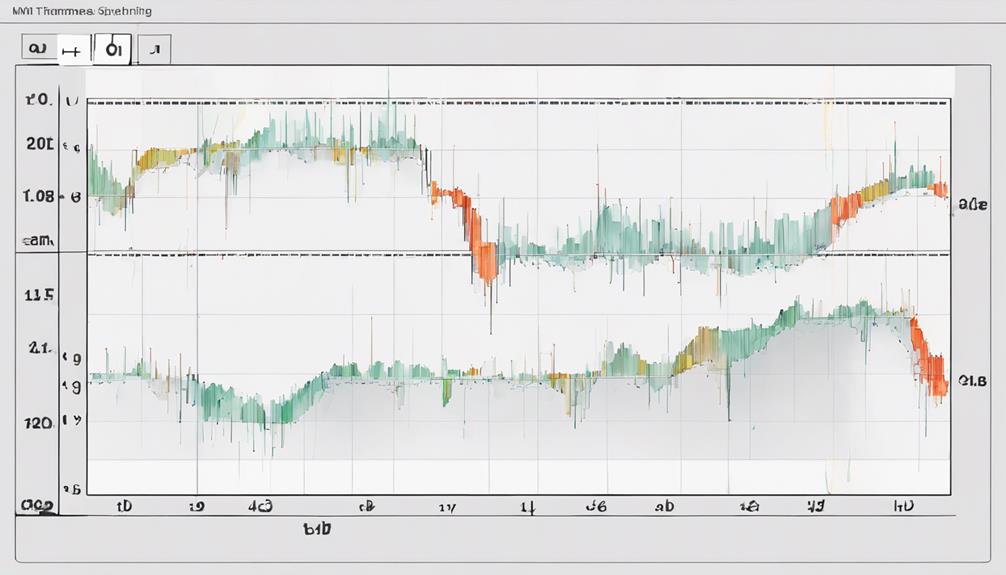

The importance of the Ultimate Oscillator lies in its unique multi-timeframe methodology, which combines 7, 14, and 28 periods to provide traders with robust and reliable momentum signals.

This oscillator must not be overlooked in trading strategies as it helps traders navigate the market with more precision. By utilizing a weighted average of these periods, the Ultimate Oscillator smooths out price movements, reducing market noise and false signals. This approach enhances the accuracy of buy signals below 30 and sell signals above 70, allowing traders to capitalize on potential market reversals.

Moreover, the Ultimate Oscillator's ability to identify divergences between price action and the oscillator adds another layer of sophistication to trading decisions. This feature enables traders to spot potential trend weakening or reversals early on, giving them an edge in the market.

Functionality and Working Mechanism

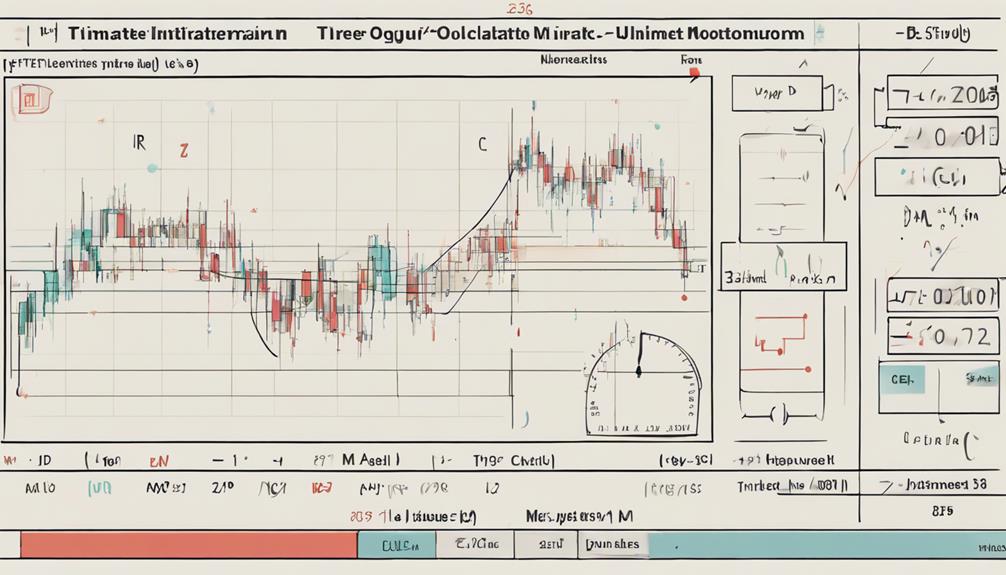

Incorporating a unique multi-timeframe methodology, the Ultimate Oscillator functions by combining 7, 14, and 28 periods to accurately measure price momentum and provide traders with reliable signals for trend analysis. Developed by Larry Williams in 1976, this oscillator emphasizes a weighted average approach to reduce volatility and enhance signal precision. By utilizing three different timeframes, the Ultimate Oscillator calculates buying pressure based on true range and averages, enabling traders to identify potential trend reversals effectively.

One of the key strengths of the Ultimate Oscillator lies in its ability to generate buy/sell signals through divergences, allowing traders to spot shifts in momentum and potential trend changes. Its multi-timeframe construction plays a crucial role in smoothing out price fluctuations and reducing false signals, thereby improving the overall reliability of the indicator. By considering price movements across varying time periods, the Ultimate Oscillator offers traders a comprehensive view of market dynamics, aiding in the identification of profitable trading opportunities and trend reversals.

Calculation Essentials and Process

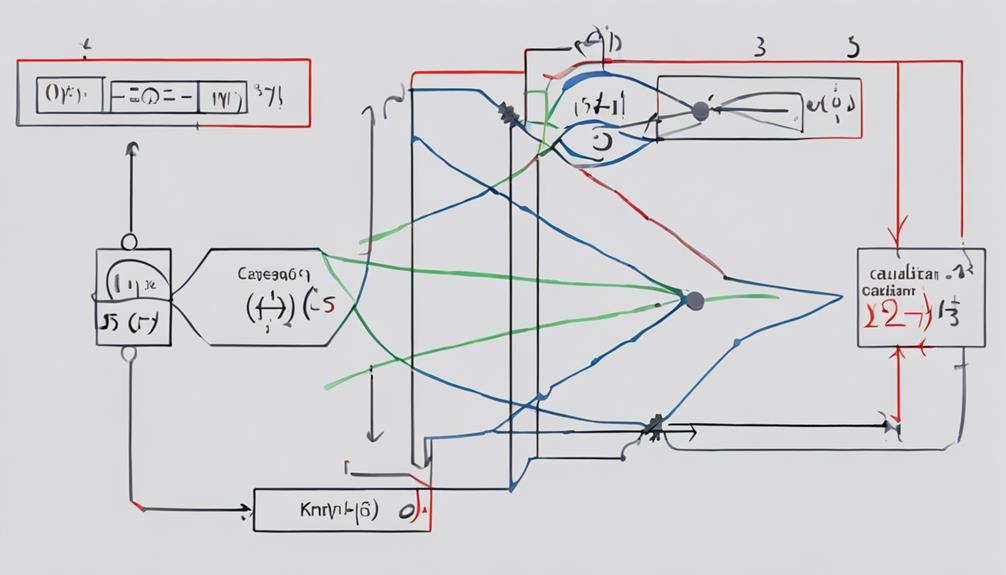

Utilizing a sophisticated algorithm, the Ultimate Oscillator calculates buying pressure across distinct timeframes to generate a robust momentum indicator. By considering the 7, 14, and 28 period timeframes, this oscillator combines the weighted averages of buying pressure to provide a more reliable indication of market momentum.

The calculation process involves determining the true range, calculating buying pressure, and then combining these averages in specific proportions. The Ultimate Oscillator typically oscillates between 0 and 100, with key levels at 30 and 70 used to identify potential overbought and oversold conditions in the market.

Moreover, buy and sell signals are triggered based on divergences between price movements and the readings of the Ultimate Oscillator. These divergences serve as critical points for traders to make informed decisions about market entry or exit positions. Understanding the calculation essentials and process of the Ultimate Oscillator is fundamental for traders looking to leverage this powerful tool for technical analysis.

Advantages and Benefits

Enhancing trading strategies with the Ultimate Oscillator involves harnessing its unique ability to pinpoint overbought and oversold conditions while confirming market trends. The oscillator offers various advantages and benefits that make it a valuable tool for traders:

- Reliable Trade Signals: By combining three timeframes, the Ultimate Oscillator reduces market volatility, providing more reliable buy/sell signals. This increases the accuracy of trading decisions and minimizes false signals.

- Detecting Bearish Divergence: The oscillator excels at identifying bearish divergence, where the price of an asset moves opposite to the indicator. This early detection helps traders anticipate potential trend reversals and adjust their positions accordingly.

- Confirming Market Strength: Utilizing buying pressure calculations for each timeframe, the Ultimate Oscillator helps traders determine the underlying strength of the market. This insight is crucial for understanding the sustainability of trends and making informed trading choices based on market conditions.

Practical Applications in Trading

The practical applications of the Ultimate Oscillator in trading extend beyond mere signal generation, encompassing a comprehensive analysis of market dynamics and trends. This technical analysis tool is particularly useful for identifying overbought and oversold conditions, indicating potential trend reversals.

By detecting bullish or bearish divergences accurately, traders can make more informed decisions on when to enter or exit positions. Moreover, the Ultimate Oscillator serves as a momentum oscillator, aiding in confirming market trends and adjusting trading strategies accordingly.

When combined with other technical indicators, such as moving averages or volume analysis, it enhances the accuracy of buy and sell signals. This multi-timeframe approach provides traders with a holistic view of market trends, enabling them to develop more robust trading strategies.

In essence, the Ultimate Oscillator equips traders with valuable insights to fine-tune their approaches and adapt to changing market conditions effectively.

What Are the Practical Applications of the Ultimate Oscillator?

The ultimate oscillator measurement concept is widely used in various fields, including finance, engineering, and physics. In finance, it helps to analyze stock market trends and make informed investment decisions. In engineering, it is used for vibration analysis and control. In physics, it aids in measuring energy levels and wave frequencies.

Frequently Asked Questions

What Does the Awesome Oscillator Indicate?

The Awesome Oscillator indicates the momentum of a security by comparing its 5-period and 34-period simple moving averages. It helps traders identify trend strength through colored histogram bars above or below the zero line.

What Is the Difference Between MACD and Ultimate Oscillator?

The key disparity between MACD and the Ultimate Oscillator lies in their underlying methodologies. MACD relies on moving average crossovers for signals, while the Ultimate Oscillator integrates three timeframes to gauge momentum, offering a more comprehensive market analysis approach.

What Is the Difference Between RSI and Ultimate Oscillator?

The Ultimate Oscillator differs from RSI by utilizing a weighted average of three timeframes to enhance signal accuracy and reduce false readings. This multi-timeframe approach aids in better trend confirmation and provides improved insights into potential trend reversals.

What Is the Difference Between Stochastic and Ultimate Oscillator?

The Ultimate Oscillator differs from the Stochastic Oscillator by incorporating three timeframes for momentum analysis, emphasizing divergences over overbought/oversold conditions. It offers stability with weighted averages, contrasting the Stochastic's rapid response to price changes.

Conclusion

In conclusion, the Ultimate Oscillator stands out as a vital tool in technical analysis, offering a unique multi-timeframe approach to measuring momentum accurately. Its ability to identify buying pressure and generate reliable trade signals based on divergences makes it a significant indicator for traders.

With its capability to pinpoint overbought and oversold conditions, the Ultimate Oscillator proves to be an invaluable asset when integrated with other indicators for effective trading strategies.