Pivot Points Analysis serves as a cornerstone in the arsenal of tools available to traders, offering a structured approach to interpreting market dynamics. By pinpointing crucial levels of support and resistance, this method lays the groundwork for strategic decision-making.

However, the true value of pivot points lies in their ability to transcend mere numbers on a chart. They embody a deeper understanding of market psychology and can unlock a realm of possibilities for traders seeking to elevate their performance.

Understanding Pivot Points Analysis

Utilizing a systematic approach rooted in historical price data, the concept of pivot points analysis serves as a fundamental tool for traders seeking to decipher market dynamics with precision.

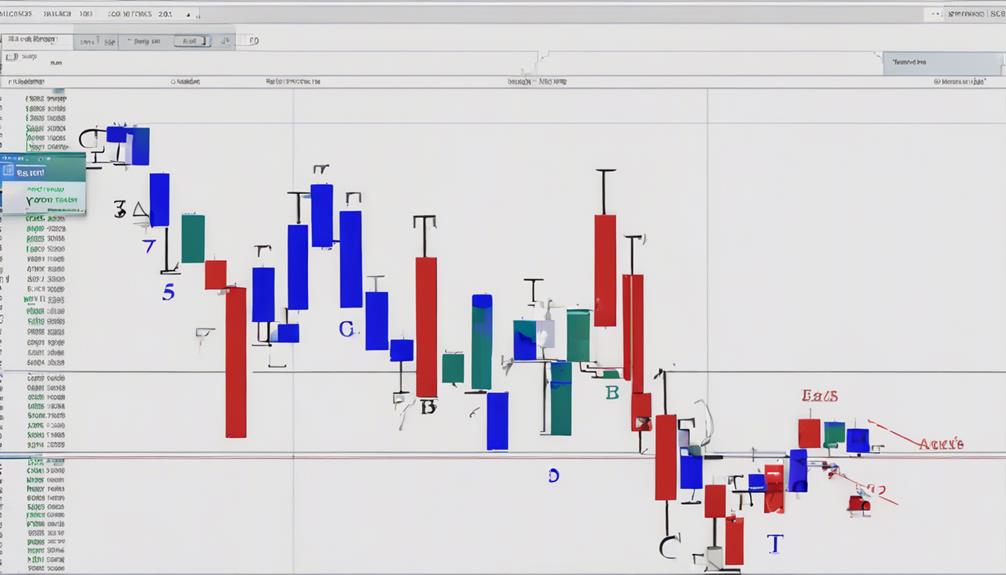

By calculating support and resistance levels based on the previous day's high, low, and close prices, pivot points provide traders with crucial reference points to identify potential price reversals and trend changes in the market. These levels play a vital role in determining optimal entry and exit points for trades, thereby enhancing decision-making processes and overall trading strategies.

Different types of pivot points, including Standard, Fibonacci, Camarilla, Woodies, and DeMarks, offer traders unique insights into market behavior, enabling them to spot patterns and make informed trading decisions.

Through pivot points analysis, traders can gain a deeper understanding of market movements, effectively navigate price fluctuations, and capitalize on opportunities presented by evolving market trends.

Identifying Key Price Levels

Identifying key price levels through pivot points analysis is essential for traders to make informed decisions and effectively manage their trading strategies. Utilizing pivot points as a technical analysis indicator helps traders in various ways:

- Support and Resistance Levels: Pivot points aid in identifying these crucial levels, indicating where the price is likely to encounter barriers.

- Entry and Exit Points: By recognizing key price levels, traders can determine optimal points to enter or exit trades, enhancing the effectiveness of their strategies.

- Stop-loss Orders: Understanding pivot points assists in placing stop-loss orders at appropriate levels to limit potential losses.

- Market Patterns and Trend Reversals: Pivot points provide insights into market patterns and potential trend reversals, guiding traders in adapting their positions accordingly.

Enhancing Entry and Exit Points

Pivot points analysis plays a pivotal role in optimizing entry and exit points for traders, facilitating strategic decision-making based on key support and resistance levels. By identifying these levels, traders can determine optimal entry points to initiate trades and exit points to lock in profits or cut losses effectively.

Utilizing pivot points enhances trade timing by providing clear reference points for making well-informed decisions on when to enter or exit positions. Traders rely on pivot points to establish strategic entry and exit positions with defined risk levels, enabling them to set appropriate stop-loss and take-profit orders for efficient risk management in their trading activities.

This methodical approach supported by pivot points analysis not only assists in enhancing entry and exit points but also contributes to overall trade precision and improved profitability through disciplined decision-making based on reliable technical indicators.

Improving Risk Management

Implementing effective risk management strategies, such as utilizing pivot points, is crucial for traders to enhance trade safety and protect their capital.

By setting stop-loss orders based on pivot points, traders can precisely define their risk exposure and maintain a disciplined approach to trading.

This method not only helps in controlling potential losses but also contributes to ensuring a favorable risk-reward ratio in trading decisions.

Risk Assessment Strategies

How can traders enhance their risk assessment strategies to improve overall risk management efficiency in trading? Utilizing pivot points for risk management can significantly benefit traders in optimizing their trading approach. Here are four key strategies for enhancing risk assessment with pivot points:

- Identifying Key Levels: Utilize pivot points to pinpoint crucial support and resistance zones for setting stop-loss levels.

- Determining Risk-Reward Ratios: Pivot point analysis aids in evaluating potential profits against probable losses, guiding traders in making informed decisions.

- Adjusting Position Sizes: Manage risk effectively by adapting position sizes based on support and resistance levels identified through pivot points.

- Maintaining Discipline: Implement pivot points to stay disciplined and control emotions during trading, fostering a structured and focused trading mindset.

Enhancing Trade Safety

Enhancing trade safety through meticulous risk management practices is paramount for traders seeking to optimize their overall trading performance and profitability. Pivot points play a crucial role in this endeavor by helping traders set precise stop-loss levels based on key support and resistance zones.

By using pivot points, traders can establish clear risk parameters, ensuring defined exit points and protective stop levels. These key levels act as objective reference points, reducing emotional decision-making and enhancing discipline in trading.

Implementing pivot points in risk management strategies not only improves trade safety but also assists in maintaining consistency and minimizing potential losses. Overall, pivot points serve as valuable tools for traders looking to enhance risk management and protect their capital effectively.

Gauging Market Sentiment

Market sentiment in trading is often assessed by monitoring whether prices are currently trading above or below pivot points. To gauge market sentiment effectively, traders rely on the following key aspects:

- Bullish Sentiment: When prices are trading above pivot points, it signifies a bullish sentiment prevailing in the market. This indicates a positive outlook among traders regarding the asset's price trajectory.

- Bearish Sentiment: Conversely, trading below pivot points suggests bearish sentiment. Traders interpret this as a signal of negative market sentiment and a potential downward trend in prices.

- Reference Levels: Pivot points serve as crucial reference levels for traders to evaluate market sentiment. These levels help traders in understanding the prevailing sentiment and making informed decisions based on the price action around these points.

- Trend Continuations: By analyzing market sentiment through pivot points, traders can anticipate trend continuations. This insight enables traders to align their strategies with the prevailing market sentiment for more effective trading outcomes.

Navigating Volatility With Confidence

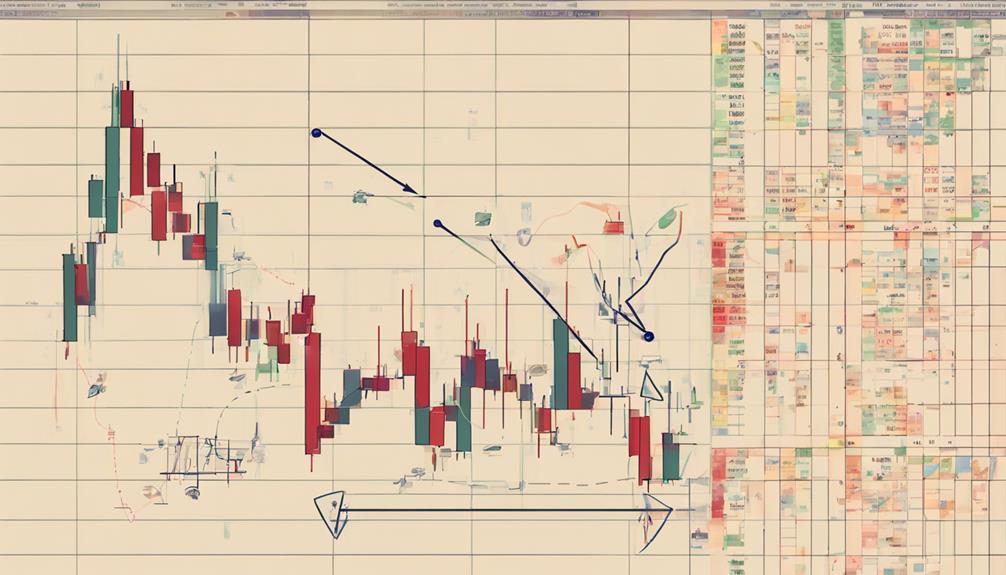

Navigating market volatility with confidence involves leveraging pivot points as key indicators of support and resistance levels during price fluctuations, aiding traders in making informed decisions. Pivot points act as crucial reference points that help traders identify potential price reversals and determine optimal entry and exit points.

During volatile market conditions, pivot points assist in setting effective stop-loss and take-profit levels to manage risks associated with sudden price movements. By using pivot points as part of their analysis, traders can adopt a structured approach to risk management, leading to enhanced trading confidence.

Additionally, pivot points allow traders to adapt their strategies to the evolving market dynamics, enabling them to trade with more assurance even in high volatility scenarios. This data-driven approach not only supports traders in navigating turbulent market conditions but also empowers them to make calculated trading decisions based on solid technical analysis.

Precision in Trading Decisions

Precision in trading decisions is paramount for traders seeking consistent success in the financial markets. When utilizing pivot points analysis, traders can enhance their decision-making process by leveraging key price levels and technical indicators to improve accuracy in their trades. Here are four ways precision is achieved through pivot points analysis:

- Identifying Entry and Exit Points: Pivot Point calculation helps traders pinpoint optimal entry and exit points, reducing uncertainty in trading strategies.

- Setting Stop-Loss Orders and Take-Profit Targets: By recognizing support and resistance levels, traders can set stop-loss orders and take-profit targets more effectively to manage risk and reward.

- Detecting Potential Reversal Points: Pivot points aid in identifying potential reversal points in the market, enabling traders to anticipate changes in price direction.

- Enhancing Trading Strategy: Incorporating Fibonacci pivot points and pivot point analysis into a trading strategy fosters precision in decision-making, leading to more consistent outcomes.

What Are the Key Benefits of Using Pivot Points Analysis in Trading?

Pivot points analysis trading techniques can provide valuable insight for traders. By using key support and resistance levels, traders can make informed decisions on entry and exit points. This strategy helps identify potential market reversals and trends, allowing for more accurate predictions and effective risk management.

Frequently Asked Questions

Why Are Pivot Points Important in Trading?

Pivot points are crucial in trading due to their ability to identify significant support and resistance levels. They serve as visual indicators for potential price reversals, aiding in risk management and strategic decision-making for traders.

Do Professional Traders Use Pivot Points?

Professional traders rely on pivot points as crucial indicators for market analysis and decision-making. These strategic levels assist in identifying entry and exit points, setting stop-loss orders, and optimizing profit targets, enhancing trading precision and profitability.

What Is the Best Pivot Point Trading Strategy?

The best pivot point trading strategy involves utilizing pivot levels for precise entry, stop-loss, and take-profit placements, enhancing trading accuracy. Combining pivot points with candlestick patterns aids in identifying trend changes, supporting informed trading decisions.

How Do You Use Pivot Points for Predictions?

Pivot points aid traders in forecasting future price movements by identifying key support and resistance levels. By analyzing these levels, traders can predict potential trend changes, assess market sentiment shifts, and set profit targets and stop-loss levels effectively.

Conclusion

In conclusion, Pivot Points Analysis serves as a powerful tool for traders to navigate the complexities of the market.

By identifying key support and resistance levels, enhancing entry and exit points, and improving risk management, traders can make informed decisions and boost profitability.

Like a compass guiding a ship through turbulent waters, pivot points provide direction and stability in the ever-changing landscape of trading.