When it comes to navigating the MACD indicator, it's essential to grasp the fundamental steps for effective analysis. By understanding the core principles behind MACD calculations and signal line interpretations, you lay a solid foundation for your trading decisions.

However, the real value lies in the practical application and strategic nuances that can truly elevate your trading game. Explore how these ten key steps can unlock the full potential of the MACD indicator and transform your approach to technical analysis.

Understanding the MACD Indicator

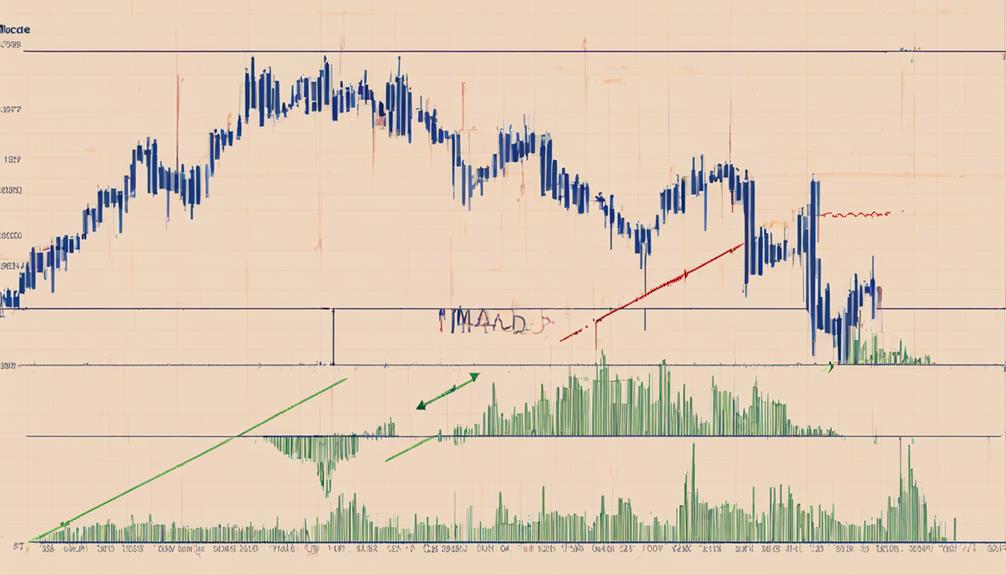

To grasp the essence of the MACD Indicator, analyze how it merges two exponential moving averages to evaluate momentum and trend direction. The MACD line, calculated by subtracting the 26-day EMA from the 12-day EMA, is a key component.

Additionally, the signal line, which is the 9-day EMA of the MACD line, aids in generating trading signals. The histogram, derived from the variance between the MACD line and the signal line, offers a visual representation of the difference between the two.

Understanding how these elements interact provides insight into price momentum and potential trend changes. By monitoring the MACD, signal line, and histogram dynamics, you can gain valuable information on market trends and potential entry or exit points.

Interpreting MACD Line Crossovers

When the MACD Line crosses above or below the Signal Line, it signifies a potential change in market trend direction.

A bullish signal emerges as the MACD Line moves above the Signal Line, indicating a possible uptrend. Conversely, a bearish signal materializes when the MACD Line crosses below the Signal Line, suggesting a potential downtrend.

Traders keen on confirming trend changes and making informed buy or sell decisions often rely on MACD Line crossovers. The timing and direction of these crossovers are critical in deciphering market momentum and predicting potential price movements.

Analyzing MACD Histogram Trends

When analyzing MACD histogram trends, focus on interpreting the movements to identify potential market shifts.

Look for histogram bars above the zero line as they indicate bullish signals, showcasing strong upward momentum.

Conversely, bars below the zero line signify bearish crossovers, highlighting potential downtrends in the market.

Interpreting Histogram Movements

Analyzing MACD histogram trends involves closely monitoring the relationship between the MACD line and the signal line to gauge momentum shifts in the market. Rising histogram bars indicate increasing momentum, suggesting potential price movements, while falling bars signal decreasing momentum and possible trend weakening.

Zero line crossovers on the histogram are critical as they indicate potential trend reversals. By interpreting the MACD histogram alongside other MACD signals, traders can gain comprehensive insights into market dynamics. Remember, the histogram's movements provide valuable information about momentum changes within a trend, helping traders make informed decisions about potential market movements.

Utilize this tool effectively to enhance your trading strategies and stay ahead of market trends.

Identifying Bullish Signals

To identify bullish signals in the MACD histogram, focus on the transition of histogram bars from negative to positive territory. When the histogram bars cross above the zero line, it indicates a shift towards bullish momentum.

Positive histogram trends signify strengthening bullish momentum in the market, suggesting potential opportunities for long positions. Traders seek consistent uptrends in the MACD histogram to confirm favorable market conditions for buying. Rising histogram bars reflect increasing buying pressure and the possibility of price appreciation.

Analyzing these bullish signals on the MACD histogram provides insight into market trends and helps traders make informed decisions. Keep an eye on the histogram for indications of strengthening bullish momentum, which can guide your trading strategies effectively.

Spotting Bearish Crossovers

To effectively identify potential downtrends in trading, observe the MACD histogram for bearish crossovers signaling a shift towards selling or entering short positions in the market.

Here are four key points to consider when spotting bearish crossovers:

- Bearish crossovers occur when the MACD line crosses below the signal line, indicating a potential downtrend.

- Analyze the MACD histogram trends for bearish signals and potential price reversals.

- Watch for the histogram bars decreasing in size and moving below the zero line as confirmation of a bearish crossover.

- Traders use bearish crossovers to consider selling positions or entering short trades in anticipation of a price decline.

Understanding these dynamics can assist in making informed trading decisions and managing risks effectively.

Recognizing MACD Signal Line Crossovers

When observing MACD signal line crossovers, focus on the interaction between the MACD line and the signal line to anticipate potential shifts in market trends.

A bullish signal occurs when the MACD line crosses above the signal line, indicating a possible uptrend. Conversely, a bearish signal is generated when the MACD line crosses below the signal line, suggesting a potential downtrend.

Traders often rely on MACD signal line crossovers to validate buy or sell signals and pinpoint entry or exit points in the market. By monitoring these crossovers, traders can better assess momentum changes and make well-informed decisions based on trend reversals.

Understanding the dynamics of MACD line and signal line interactions is crucial for interpreting market movements accurately.

Identifying MACD Divergence Signals

To effectively identify MACD divergence signals, you must grasp the concept of divergence and its significance in technical analysis.

By spotting bullish divergence, where the price sets lower lows while the MACD shows higher lows, you can anticipate potential upward price movements.

Conversely, recognizing bearish divergence, characterized by higher highs in price alongside lower highs on the MACD, can help you predict possible downward price shifts.

Understanding Divergence Concept

Understanding MACD Divergence involves recognizing instances where price movements contradict the trend indicated by the MACD indicator. This concept is crucial for traders as it can signal potential trend reversals or shifts in momentum.

Here are four key points to help you grasp the concept effectively:

- MACD divergence occurs when the price movement contradicts the MACD indicator's trend.

- Bullish divergence occurs when the price makes lower lows while the MACD makes higher lows.

- Bearish divergence happens when the price makes higher highs while the MACD makes lower highs.

- Divergence signals are used by traders to anticipate market direction changes and make informed trading decisions.

Understanding these aspects of MACD Divergence can enhance your ability to interpret market movements accurately.

Spotting Bullish Divergence

Spotting Bullish Divergence on the MACD indicator can provide traders with valuable insights into potential trend reversals and buying opportunities in the market. This phenomenon occurs when the price creates a lower low, but the MACD indicator generates a higher low, signaling a potential trend reversal to the upside.

Traders often interpret bullish divergence as a buy signal, indicating a shift towards upward momentum. It's crucial to confirm this signal with other technical indicators to enhance its reliability. By identifying bullish divergence accurately, traders can seize advantageous buying opportunities in the market, positioning themselves strategically for potential gains.

Keep an eye on the MACD indicator for signs of bullish divergence as it could be a precursor to a favorable trend reversal.

Recognizing Bearish Divergence

When analyzing the MACD indicator for potential trading signals, recognizing bearish divergence is crucial for anticipating market trends and adjusting your trading strategy accordingly. Here are four key points to consider when identifying bearish divergence:

- Bearish divergence occurs when the price reaches a new high, but the MACD fails to confirm it.

- It signals a weakening upward momentum and a potential price reversal to the downside.

- Traders often see bearish divergence as a warning to reduce long positions or even open short ones.

- Confirmation of bearish divergence happens when the MACD histogram shows declining peaks while the price keeps rising.

Recognizing bearish divergence on the MACD indicator is essential for traders to stay ahead of potential trend reversals and make informed decisions.

Utilizing MACD in Trend Confirmation

To effectively utilize MACD in trend confirmation, pay close attention to the crossovers between the MACD line and the signal line. The MACD line crossing above the signal line indicates a potential bullish trend, suggesting upward momentum in the market.

Conversely, a bearish trend is signaled when the MACD line crosses below the signal line, indicating a potential downward movement. By analyzing these crossovers, traders can confirm the strength and direction of a trend, aiding in decision-making for entering or exiting positions based on the prevailing market conditions.

Trend confirmation with MACD provides valuable insights into market dynamics and helps traders align their strategies with the current trend, enhancing the effectiveness of their trading decisions.

Applying MACD in Trade Entry

When applying MACD in trade entry, you should focus on trade signal confirmation and timing entry points effectively. Look for bullish crossovers as the MACD line crosses above the signal line, indicating potential buying opportunities.

Conversely, bearish crossovers signal potential selling points, enhancing your trade entry decisions.

Trade Signal Confirmation

For enhanced trade signal confirmation and improved trade entry decisions, utilize MACD crossovers with the signal line. By waiting for the MACD line to cross above or below the signal line, you can confirm trade entries effectively.

Here are four key points to consider:

- Look for bullish signals when the MACD line crosses above the signal line.

- Watch for bearish signals when the MACD line crosses below the signal line.

- Trade entry confirmation using MACD helps reduce false signals.

- Applying MACD in trade entry enhances accuracy in capturing potential price movements.

Timing Entry Points

Utilize MACD crossovers, particularly when the MACD line intersects the signal line, to precisely time entry points in your trades.

A bullish MACD crossover, where the MACD line crosses above the signal line, indicates a potential buy signal, suggesting a favorable entry point for long positions.

Conversely, a bearish MACD crossover, with the MACD line crossing below the signal line, signifies a sell signal, prompting consideration for selling or shorting a position.

When timing entry points, take into account the gap between the MACD line and the signal line; wider gaps imply stronger momentum.

For increased confidence in your trades, you can confirm MACD crossovers with other technical indicators or chart patterns to validate entry signals.

Managing Risk With MACD

To effectively manage risk using the MACD indicator, consider utilizing the MACD histogram to identify potential shifts in market momentum. Here are four key strategies to enhance risk management with MACD:

- Set Stop-Loss Orders: Use MACD crossovers to place stop-loss orders and protect profits.

- Combine with Other Indicators: Utilize tools like RSI alongside MACD to confirm signals and strengthen risk management strategies.

- Adjust Position Sizes: Align your position sizes with risk tolerance and market conditions based on MACD signals.

- Monitor Divergence Patterns: Anticipate changes in trend direction by observing MACD divergence patterns and adjust risk levels accordingly.

Enhancing Strategies With MACD

Enhance your trading strategies with the MACD indicator by incorporating advanced techniques for improved market analysis and decision-making. Utilize MACD histogram reversals to assess market strength and anticipate potential trend shifts.

Implement zero line crosses on the MACD to confirm trends and predict market movements accurately. Combine MACD crossovers with other technical indicators to enhance the reliability of your trading signals.

By analyzing the MACD histogram squeeze, you can identify breakout opportunities and signals of low volatility in the market. Adjusting MACD settings allows for customization to suit your trading style and preferences, optimizing overall performance.

Integrating these strategies can provide a comprehensive approach to utilizing the MACD indicator effectively in your trading decisions.

Utilizing MACD for Exit Signals

Utilizing the MACD indicator for exit signals involves monitoring key crossovers and histogram reversals to identify optimal points to consider closing a position. When using the MACD for exit signals, consider the following:

- MACD Line Crossing Below Signal Line: This can signal potential exits.

- MACD Histogram Reversals: Use these to confirm exit signals based on momentum shifts.

- Bearish Crossover: A bearish crossover on the MACD can indicate a good time to consider exiting a long position.

- Weakening Momentum Signs: Monitor the MACD for signs of weakening momentum to make timely exit decisions.

What Are Some Advanced Techniques for Navigating the MACD Indicator?

When using the MACD indicator, consider using histogram divergence as one of the top MACD indicator tips. This advanced technique involves monitoring the gap between the MACD line and the signal line to anticipate changes in momentum before they occur. By mastering this method, traders can make more informed decisions.

Frequently Asked Questions

What Is the Best Strategy for Macd?

To determine the best strategy for MACD, assess your goals, risk tolerance, and time horizon. Consider crossovers, histogram reversals, and zero crosses for trend identification. Use MACD crossovers for buy/sell signals and histogram reversals for momentum insight.

How Do You Properly Use Macd?

To properly use MACD, understand its components: MACD line, signal line, and histogram. Watch for crossovers between the MACD and signal lines for trend changes. Analyze the histogram for momentum and use divergence for trend reversals. Additional indicators can confirm signals.

What Is the MACD Entry Strategy?

When trading, the MACD entry strategy involves seeking buy signals by observing the MACD line surpassing the signal line. This method helps identify potential market entry points, especially when the MACD line moves above the signal line, indicating upward momentum.

What Are the 3 Components of MACD Indicator?

The three components of the MACD indicator are the MACD line, the signal line, and the histogram. The MACD line is calculated as the 12-day EMA minus the 26-day EMA, providing insights into trend strength.

Conclusion

As you navigate the MACD indicator with precision and skill, remember that success lies in the details. By mastering the calculation, interpreting crossovers, and utilizing divergence signals effectively, you can make informed trading decisions.

Enhance your strategies, manage risk, and optimize trade entries and exits with the power of MACD. Stay ahead of the curve and maximize your trading potential with these top 10 steps.

The key to success is in your hands.