Enhancing the functionality of your Zig Zag indicator through optimization can significantly impact your technical analysis skills. By implementing ten simple steps, traders can unlock the full potential of this tool and gain valuable insights into market trends and price movements.

From fine-tuning percentage deviation parameters to integrating additional technical tools, each step plays a crucial role in maximizing the effectiveness of the Zig Zag indicator.

Stay tuned to discover how these optimization techniques can elevate your trading strategies and decision-making processes in the dynamic world of finance.

Understanding the Zig Zag Indicator

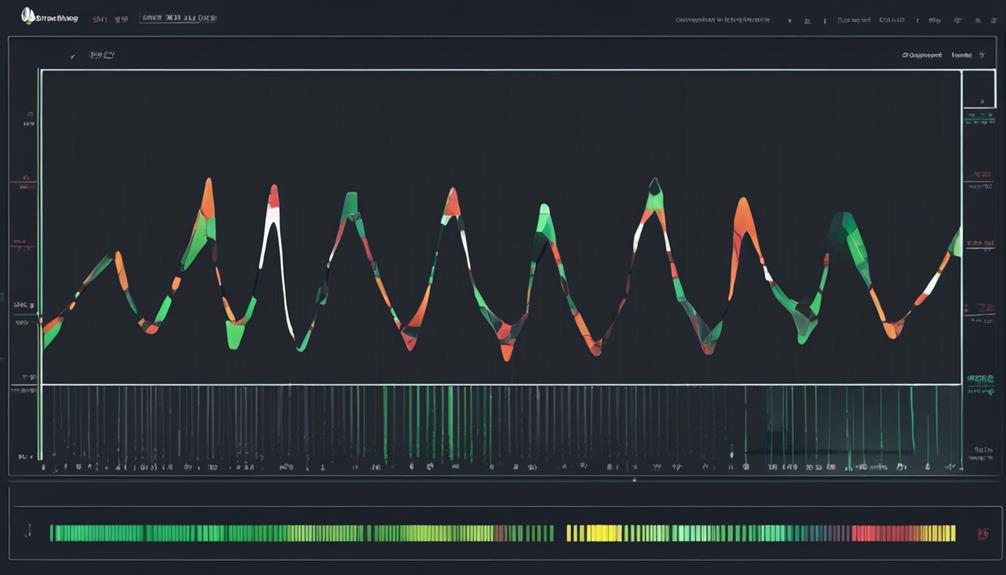

The Zig Zag indicator is a crucial tool in technical analysis for smoothing price movements and pinpointing key trend reversals. This indicator effectively reduces noise in price charts by filtering out minor fluctuations, allowing traders to focus on significant price changes. It achieves this by connecting swing highs and swing lows, illustrating trend changes visually.

When the price changes direction by a specified amount (typically set as a percentage), the Zig Zag indicator plots a new line. This feature helps traders identify important turning points in the market, enabling them to make informed trading decisions. To enhance the effectiveness of the Zig Zag indicator, traders often adjust its parameters. By optimizing these settings, such as the percentage change required to create a new line, traders can fine-tune the indicator to better suit their trading style and preferences.

The Zig Zag indicator is commonly used alongside other technical analysis tools to confirm signals and improve overall trading accuracy.

Importance of Optimizing Zig Zag

Optimizing the Zig Zag indicator is a crucial step towards enhancing its efficacy in identifying trends and patterns within price action. When considering the importance of optimizing the Zig Zag indicator, several key factors come into play:

- Enhanced Accuracy: By optimizing parameters such as percentage price movement and depth, traders can reduce noise and improve the accuracy of signals generated by the Zig Zag indicator. This increased precision can lead to more reliable trend identification and trading decisions.

- Adaptability to Market Conditions: Adjusting the parameters of the Zig Zag indicator allows traders to tailor its functionality to different market conditions. This flexibility enables the indicator to effectively capture trends in varying market environments, enhancing its overall utility.

- Reliable Support and Resistance Levels: Through optimization, traders can increase the reliability of support and resistance levels identified by the Zig Zag indicator. This can provide valuable insights for determining entry and exit points, contributing to more informed trading strategies.

Calculating Zig Zag Effectively

When calculating Zig Zag effectively, the selection of a suitable starting point based on swing highs or lows is paramount for accurate trend analysis and signal generation.

To calculate Zig Zag, define a percentage price movement threshold to filter out noise and identify significant swings. Once the threshold is set, identify the next swing high or low based on this defined percentage movement.

Connect these points with a trendline to track price movements accurately. Repeat this process up to the most recent swing high or low to optimize Zig Zag calculations.

Enhancing Zig Zag Accuracy

Enhancing the accuracy of the Zig Zag indicator involves implementing data smoothing techniques to reduce noise and better capture significant price movements.

Fine-tuning parameter adjustments, such as tightening deviation parameters and customizing depth settings, can help filter out false signals and improve the indicator's precision.

Data Smoothing Techniques

Utilizing advanced data smoothing techniques is essential for refining the accuracy of the Zig Zag indicator in financial analysis. These techniques, such as moving averages or exponential smoothing, play a crucial role in enhancing the performance of the indicator by reducing noise and highlighting significant trend changes. By smoothing out data, traders can gain a clearer understanding of underlying market trends and patterns, leading to more reliable signals and informed decision-making in trading. Embrace the power of data smoothing techniques to unlock the true potential of the Zig Zag indicator and navigate the complexities of the financial markets with confidence and precision.

3 Ways Data Smoothing Techniques Enhance Trading Experience:

- Improved Signal Clarity

- Enhanced Trend Visibility

- Better Decision-Making Confidence

Parameter Adjustment Tips

To refine the accuracy of the Zig Zag indicator in financial analysis, adjusting key parameters is crucial for enhancing its effectiveness in capturing significant price movements and trends. Lowering the percentage settings in the indicator can help reduce noise, making it more accurate.

Tightening the deviation parameter increases sensitivity to price movements, while adjusting the depth parameter to a lower value can provide more trading opportunities by increasing the frequency of Zig Zag lines. Utilizing tighter parameter values makes the indicator more responsive to short-term price fluctuations.

Customizing these parameters based on market conditions and asset volatility is essential for optimizing the Zig Zag indicator to accurately identify trends in the financial markets.

Filtering False Signals

Filtering out false signals in the Zig Zag indicator can significantly enhance its accuracy in identifying genuine price movements and trends in financial analysis. To achieve this, consider the following strategies:

- Adjust the Zig Zag indicator's depth parameter to increase the number of price movements needed to establish a new swing, thereby filtering out minor fluctuations.

- Fine-tune the deviation percentage to reduce noise and prevent insignificant price changes from triggering new lines, improving the indicator's precision.

- Lower the Zig Zag indicator's parameters such as percentage change or point value to heighten sensitivity to significant price movements and trend reversals. Combining these techniques can help refine the Zig Zag indicator's performance and minimize the occurrence of false signals.

Utilizing Zig Zag Patterns Efficiently

Efficient application of Zig Zag patterns in technical analysis requires a keen understanding of market dynamics and indicator parameters. Adjusting the Zig Zag indicator parameters, such as depth and deviation, is crucial for optimizing pattern recognition. Lower deviation percentages create smoother Zig Zag patterns, suitable for identifying minor price fluctuations, while higher percentages are better suited for capturing significant price movements.

It is vital to consider market volatility and the timeframe being analyzed when fine-tuning the Zig Zag indicator to efficiently identify trends. Utilizing Zig Zag patterns can help traders pinpoint support and resistance levels, aiding in making well-informed entry and exit decisions. To enhance the effectiveness of Zig Zag patterns, traders can combine this indicator with other technical tools for confirmation and to strengthen their overall trading strategies.

Customizing Zig Zag Settings

When customizing Zig Zag settings, adjusting the indicator's percentage setting can significantly impact the number of reversals displayed on the chart. This parameter determines the minimum price movement percentage required for a new trend to be drawn.

Here are three key considerations when customizing Zig Zag settings:

- Sensitivity vs. Accuracy: Lowering the percentage setting increases the sensitivity of the Zig Zag indicator, capturing more minor price fluctuations. However, this may result in more frequent but potentially less reliable trend changes. Conversely, raising the percentage setting can lead to fewer but more significant reversals, enhancing the indicator's accuracy.

- Adaptability to Market Conditions: Customizing the percentage setting allows traders to adapt the Zig Zag indicator to different market conditions. In volatile markets, a lower percentage setting might be more suitable to capture rapid price movements, while in stable markets, a higher setting could filter out noise and provide clearer trend signals.

- Personalized Trading Preferences: Traders can customize the percentage setting based on their trading style and risk tolerance. Aggressive traders may prefer a lower percentage setting for quick entries and exits, while conservative traders may opt for a higher setting to confirm trend changes before taking action.

Implementing Zig Zag Strategies

To effectively apply Zig Zag strategies in trading, understanding how to interpret and leverage the indicator's signals is essential for making informed decisions in the market.

Adjusting the Zig Zag indicator's percentage settings is crucial to optimize its performance for different stocks and market conditions. By experimenting with values ranging from 5% to 10%, traders can determine the most suitable settings that align with their trading strategy.

It is advisable to introduce a delay in trading signals when utilizing the Zig Zag indicator to prevent the pitfall of looking into the future, ensuring the integrity of decision-making processes.

Moreover, combining the Zig Zag indicator with other technical tools can provide confirmation and enhance the accuracy of trading decisions.

Backtesting Zig Zag strategies is recommended to evaluate their effectiveness and tailor them to fit individual trading styles and risk management approaches effectively. By incorporating these practices, traders can harness the full potential of the Zig Zag indicator within their trading strategies.

Avoiding Zig Zag Indicator Mistakes

To optimize the effectiveness of the Zig Zag indicator, it is crucial to steer clear of common mistakes that traders often encounter. By avoiding errors such as setting the percentage too high or relying solely on the indicator for trading decisions, one can enhance the accuracy of their technical analysis.

Implementing best practices and seeking expert advice on utilizing the Zig Zag indicator can lead to more informed and successful trading strategies.

Common Zig Zag Errors

Common errors in utilizing the Zig Zag indicator can significantly impact its effectiveness in trend analysis and trading decisions.

- Using default settings without customization for specific assets or timeframes can lead to inaccurate signals and missed opportunities.

- Mistaking temporary price fluctuations for significant trend reversals when interpreting Zig Zag indicator signals can result in premature trading decisions.

- Failing to calibrate the Zig Zag indicator parameters properly may lead to false signals and reduced accuracy in identifying trends.

Best Practice Tips

Implementing best practices when utilizing the Zig Zag indicator is crucial for accurate trend analysis and informed trading decisions. To avoid mistakes, it is important to set the indicator depth at an optimal level to capture both short and long-term price reversals effectively.

Adjusting the deviation percentage helps filter out minor price fluctuations, enhancing the clarity of Zig Zag lines. Use the Zig Zag indicator in conjunction with other technical tools to validate signals and avoid relying solely on it for decision-making.

Beware of over-optimizing settings, as this can result in false signals and unreliable analysis. Regularly reviewing and adjusting parameters based on market conditions is key to improving the accuracy of the Zig Zag indicator.

Expert Advice on Zigzag

When utilizing the Zig Zag indicator, it is essential to heed expert advice to avoid common mistakes that may compromise the accuracy of trend analysis and trading decisions.

Expert Advice on Zigzag:

- Avoid setting the Zig Zag indicator too sensitive to prevent excessive noise and false signals.

- Ensure the indicator parameters are optimized for the specific market conditions and asset being traded.

- Be cautious of adjusting the Zig Zag indicator too frequently, as it can lead to inconsistent results.

Monitoring Zig Zag Performance

Assessing the effectiveness of the Zig Zag indicator involves analyzing its ability to filter out price noise and accurately identify swing highs and lows in varying market conditions. The Zig Zag indicator's performance can be monitored by evaluating how well it distinguishes between significant price movements and mere fluctuations.

By tracking the indicator's ability to pinpoint swing highs and lows, traders can assess its reliability in signaling potential trend reversals. It is essential to observe the Zig Zag indicator across different timeframes to determine its adaptability and accuracy in various market scenarios.

Additionally, customizing the indicator's parameters can impact its performance in trend analysis, making it crucial to evaluate the effects of such adjustments. Monitoring the Zig Zag indicator's performance provides insights into its effectiveness in identifying trends and filtering out noise, aiding traders in making informed decisions based on its signals.

Continuous Improvement With Zig Zag

To enhance the effectiveness of the Zig Zag indicator, continuous improvement strategies can be implemented through adjustments in its parameters to better adapt to changing market dynamics and optimize trend identification.

Key Strategies for Continuous Improvement with Zig Zag:

- Adjust Percentage Settings: Experimenting with different percentage settings can help tailor the Zig Zag indicator to varying market conditions. Higher percentage settings may smooth out minor price fluctuations, while lower settings can provide more immediate trend signals.

- Fine-Tune Depth Parameters: By experimenting with different depth parameters, traders can refine the sensitivity of the Zig Zag indicator. Finding the right balance between responsiveness and filtering out noise is crucial for accurate trend identification.

- Customize Deviation Percentage: Customizing the deviation percentage of the Zig Zag indicator can assist in reducing noise and enhancing trend clarity. Regularly reviewing and adjusting these parameters in response to changing volatility levels can lead to better performance and improved trading decisions.

Can Advanced Simplified Approaches Also Help Optimize the Zig Zag Indicator?

Advanced zig zag indicator approaches can indeed help optimize this popular technical analysis tool. By incorporating more advanced techniques and strategies, traders can fine-tune their use of the zig zag indicator to better identify trends, reversals, and potential entry/exit points in the market.

Frequently Asked Questions

What Is the Best Setting for the Zigzag Indicator?

The optimal setting for the Zig Zag indicator balances sensitivity to price changes and noise reduction. A percentage change between 5% and 10% is generally effective. Lower settings increase sensitivity but also noise, while higher settings smooth out the indicator.

What Is the Zigzag Line Strategy?

The Zigzag Line Strategy is a method that leverages the Zig Zag indicator to identify trend reversals and significant price movements. By setting specific parameters, traders can pinpoint entry and exit points, reducing noise and enhancing trend analysis.

What Is the Zigzag Trading Algorithm?

The Zigzag trading algorithm behaves like a skilled navigator in the turbulent seas of market volatility, pinpointing significant price swings amidst the chaos. Through its meticulous calculations, it aids traders in identifying potential trend reversals and making informed trading decisions.

What Is the Zigzag Indicator Implementation?

The Zigzag indicator implementation involves plotting points on a price chart to identify trend reversals. It assists in filtering out market noise, emphasizing significant price movements, and can be tailored by traders to adjust sensitivity levels for enhanced analysis.

Conclusion

In conclusion, optimizing the Zig Zag indicator is crucial for effective technical analysis in trading. By adjusting parameters and combining it with other tools, traders can enhance trend identification and make informed decisions. Continuous monitoring and improvement are key to maximizing the utility of this indicator.

Like a compass guiding a ship through turbulent waters, the Zig Zag indicator can steer traders towards profitable opportunities in the dynamic financial markets.