Exploring the realm of Gann Theory can provide traders with a structured approach to analyzing market trends and making informed decisions. By following the seven best steps for applying Gann Theory effectively, traders can unlock a world of strategic insights and predictive tools.

From understanding the basics to mastering advanced techniques, each step plays a crucial role in enhancing trading precision and profitability. Through a systematic application of Gann Theory, traders can navigate the complexities of the market with a methodical approach that offers both clarity and potential for success.

Understanding Gann Theory Basics

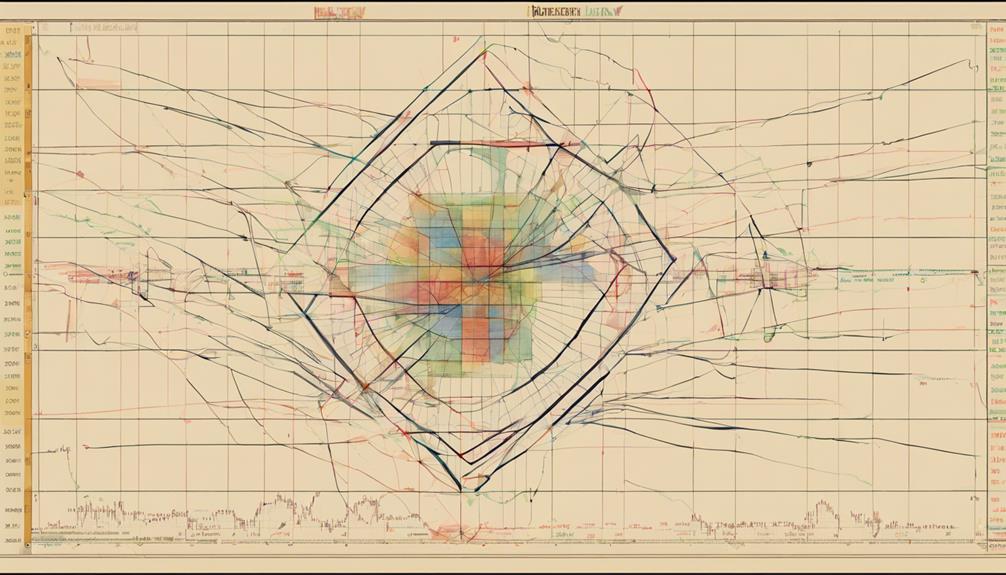

Understanding the foundational principles of Gann Theory is paramount for mastering its application in financial markets. At the core of Gann Theory are the concepts of Gann angles and support and resistance levels. Gann angles, also known as Gann lines, are drawn at different angles on price charts to help identify potential areas of support and resistance. These angles are based on the idea that price movements tend to follow geometric patterns and angles. Traders use Gann angles to forecast potential price movements and determine key entry and exit points.

Moreover, support and resistance levels play a crucial role in Gann Theory as they indicate price levels where a trend is likely to pause or reverse. By understanding how to identify these levels accurately, traders can make informed decisions about when to enter or exit trades. Mastering the basics of Gann Theory, including Gann angles and support and resistance levels, provides traders with a solid foundation for effectively applying this analytical approach in financial markets.

Identifying Key Gann Tools

Having grasped the foundational principles of Gann Theory, the focus now shifts towards identifying key Gann tools essential for comprehensive market analysis and accurate forecasting.

- Gann Angles: These include key angles like 1×1, 2×1, and 1×2, aiding in predicting support and resistance levels crucial for determining potential price movements.

- Gann Fans: Consisting of angles such as 45 degrees, 75 degrees, and 90 degrees, Gann Fans are instrumental in identifying trends and potential trend changes within the market.

- Gann Squares: These grids with spiral numbering provide a structured approach to pinpoint significant price levels and patterns, aiding traders in making informed decisions.

- Gann Hexagons: Geometric patterns drawn from pivot points help visualize potential reversals and trend continuations, providing valuable insights into market dynamics.

Applying Gann Angles Strategically

Gann angles provide traders with valuable insights into market dynamics by offering precise angle measurement techniques for trend analysis. Identifying trend reversals becomes more effective through the strategic application of Gann angles, which highlight critical price levels.

Additionally, integrating time and price analysis into Gann angles enhances traders' ability to make informed decisions based on the intersection of these key factors.

Angle Measurement Techniques

When utilizing Gann angles in technical analysis, traders often draw lines at specific angles to anticipate significant price levels accurately.

- Gann angles are typically drawn at 45 degrees to predict key support and resistance levels effectively.

- Traders employ angle measurement techniques like 1X2, 1X1, and 2X1 to forecast price movements with precision.

- These angles help in identifying trend strength by examining the slope and positioning of the lines.

- Understanding how to draw Gann angles accurately is crucial for successful implementation in trading strategies.

Identifying Trend Reversals

Trend reversals in technical analysis can be effectively identified by strategically applying Gann angles to pinpoint potential shifts in market direction. Gann angles, such as the 1×1, 2×1, or 1×2 angles, play a crucial role in signaling trend reversals. Breakouts or bounces at these key angles often confirm potential reversal points, especially when accompanied by strong price reactions.

It is essential to observe how price action interacts with Gann angles as this can reflect changing market sentiment. To enhance the accuracy of trend reversal identification, it is advisable to use multiple Gann angles rather than relying solely on one angle. Integrating Gann angles with other technical indicators provides a comprehensive analysis for confirming trend reversals and validating signals.

Time and Price Analysis

Upon integrating Gann angles strategically in time and price analysis, traders gain valuable insights into forecasting potential support and resistance levels based on the synchronization of price movements.

- Gann angles analyze price movements using time and price synchronization.

- The 1X1 angle signifies a 45-degree slope, showing equilibrium between time and price.

- Traders utilize Gann angles to assess trend strength and identify possible reversal points.

- The convergence of Gann angles with price movements offers crucial information for making informed trading decisions.

Utilizing Gann Fans Effectively

In effectively utilizing Gann Fans, traders can harness the power of 9 distinct angles emanating from a central pivot point to pinpoint trend directions and key support/resistance levels in the market. These angles, ranging from 7.5 to 82.5 degrees, each carry significance in determining trend strength or potential reversal points.

By applying Gann Fans, traders can identify crucial Support and Resistance Zones, aiding in decision-making regarding entry and exit points. The visual representation provided by Gann Fans allows for a clearer understanding of the main trend and aids in anticipating potential trend changes based on how prices interact with these angles.

Moreover, Gann Fans serve as effective tools for recognizing key price levels and trend continuations, giving traders a strategic advantage in the market. When combined with other Gann tools such as angles and squares, a more comprehensive analysis of market movements and potential breakouts can be achieved.

Mastering Gann Square Techniques

Mastering Gann Square Techniques involves understanding Gann Square Basics, Applying Gann Angles, and Utilizing Gann Fans for comprehensive analysis.

By grasping the intricacies of these points, traders can enhance their ability to forecast price movements accurately.

Precision in aligning these techniques is paramount for successful implementation in stock trading strategies.

Gann Square Basics

Within the realm of technical analysis, understanding the fundamentals of Gann Square techniques is essential for accurate price forecasting and market analysis. The Gann Square basics are crucial for mastering price forecasting and interpreting market movements effectively. Key points to consider include:

- The Gann Square comprises concentric squares with numbers from 1 to 81, forming a clockwise spiral.

- Calculations within the Gann Square involve time, price, square roots, and midpoints for precise price forecasting.

- Essential forecasting numbers on the cross and diagonals of the Gann Square provide critical analysis points.

- The Cardinal Cross and Ordinal Cross lines within the Gann Square are significant in determining market movements accurately.

Aligning time and price meticulously within the Gann Square is paramount for making informed predictions in stock trading.

Applying Gann Angles

Applying Gann angles in Gann Square techniques is pivotal for enhancing predictive accuracy and market analysis proficiency. Gann angles, drawn from significant highs and lows, play a crucial role in forecasting future price movements accurately. By aligning price and time through Gann fan angles, traders can make precise predictions. These angles aid in determining support, resistance levels, trend strength, and the timing of market tops and bottoms.

Understanding how to draw Gann fan angles is essential for effective application in trading strategies. Gann angles provide valuable insights into market direction and strength, empowering traders to make informed decisions. Mastering the use of Gann angles is fundamental for improving trading outcomes and maximizing profitability.

Utilizing Gann Fans

Utilizing Gann fans in Gann Square techniques provides traders with a comprehensive framework for identifying trends and forecasting market movements with precision. Gann fans consist of nine angles radiating from a pivot point, aiding in trend identification and potential reversal points. Mastering Gann square techniques involves aligning price and time effectively, enhancing market analysis.

Understanding Gann fan angles is crucial for visualizing future price movements accurately. By applying these angles correctly, traders can improve their forecasting abilities and make informed decisions in the market. Proper utilization of Gann fans can significantly enhance the accuracy of trend predictions and overall trading performance.

Implementing Gann Hexagons in Analysis

Implementing Gann hexagons in technical analysis involves utilizing geometric patterns derived from pivot points and significant price levels to gain insight into potential market reversals and trend continuations. These hexagons are a key tool in Gann Theory, offering traders a visual representation of price movements and potential turning points.

By plotting these hexagons on price charts based on key market data points, traders can identify areas of support and resistance, as well as potential breakout levels. Gann hexagons provide a unique perspective on market dynamics, allowing traders to anticipate trend changes and plan their trading strategies accordingly.

Understanding the formation and implications of Gann hexagons enhances technical analysis skills, enabling traders to make more informed decisions based on the patterns observed. Overall, incorporating Gann hexagons into analysis can help traders navigate the complexities of the market and improve their trading outcomes.

Advanced Gann Theory Integration

The integration of advanced Gann Theory techniques, such as combining Gann angles with Fibonacci retracement levels and incorporating planetary movements for precise market timing, elevates the accuracy and depth of price forecasting strategies. When delving into advanced Gann theory integration, several key points emerge:

- Integrating Gann angles with Fibonacci retracement levels enhances the precision of price forecasting by providing multiple layers of support and resistance.

- Combining Gann squares with Gann fans offers a holistic view of market trends, enabling traders to identify critical turning points with more clarity.

- Utilizing Gann hexagons alongside Gann angles aids in recognizing complex patterns and forecasting potential reversals based on geometric formations.

- Incorporating planetary movements and time cycles into Gann analysis enriches market timing strategies, allowing traders to align their trades with astrological phenomena for enhanced accuracy and insight.

How Do the Key Strategies for Gann Theory Application Align with the Best Steps for Effective Application?

The key Gann theory strategies involve the use of geometrical angles and patterns to analyze market movements. Similarly, the best steps for effective application include thorough research and understanding of market trends. By aligning Gann theory strategies with effective application steps, traders can make informed and strategic decisions in the market.

Frequently Asked Questions

How Do You Use Gann Theory?

Utilize Gann theory by employing Gann angles, fans, squares, and hexagons to analyze markets effectively. Identify support/resistance levels, trend directions, reversal points, price patterns, and breakout opportunities. Combine these tools for a comprehensive market trend and price movement analysis.

What Is the Most Important Gann Angle?

The most critical Gann angle is the 45-degree angle, also known as the 1X1 angle. It symbolizes equilibrium and trend strength, providing key insights into significant market movements and pivotal price levels. Traders often rely on this angle for trend analysis and decision-making.

What Is the 180 Degree Rule in the Stock Market?

The 180 degree rule in the stock market signifies a price reversal following a move equivalent to 180 degrees from a major peak or trough. Traders utilize this principle to forecast potential trend shifts, aligning with Gann Theory's geometric patterns and angle concepts.

What Are the Important Numbers in Gann?

Gann theory emphasizes key numbers such as 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, and 144. These figures play a crucial role in Gann's mathematical calculations for price and time forecasting, aiding traders in identifying significant levels for market analysis.

Conclusion

In conclusion, by following the seven key steps outlined in this article, traders can effectively apply Gann Theory to enhance their stock trading strategies.

Through a thorough understanding of Gann indicators, mastering various tools like angles, fans, squares, and hexagons, and implementing strategic analysis techniques, traders can make informed decisions in the market.

Embracing the complexity of Gann Theory can lead to improved market predictions and potentially increase trading success.