You may think you've got a handle on Fibonacci retracement, but this guide will challenge your current approach.

By breaking down the intricate steps involved, it sheds light on how mastering Fibonacci retracement can be the key to unlocking profitable trading strategies.

Understanding the nuances of Fibonacci levels and their interplay with market dynamics could be the missing link in your trading arsenal, elevating your success to new heights.

Understanding Fibonacci Retracement Levels

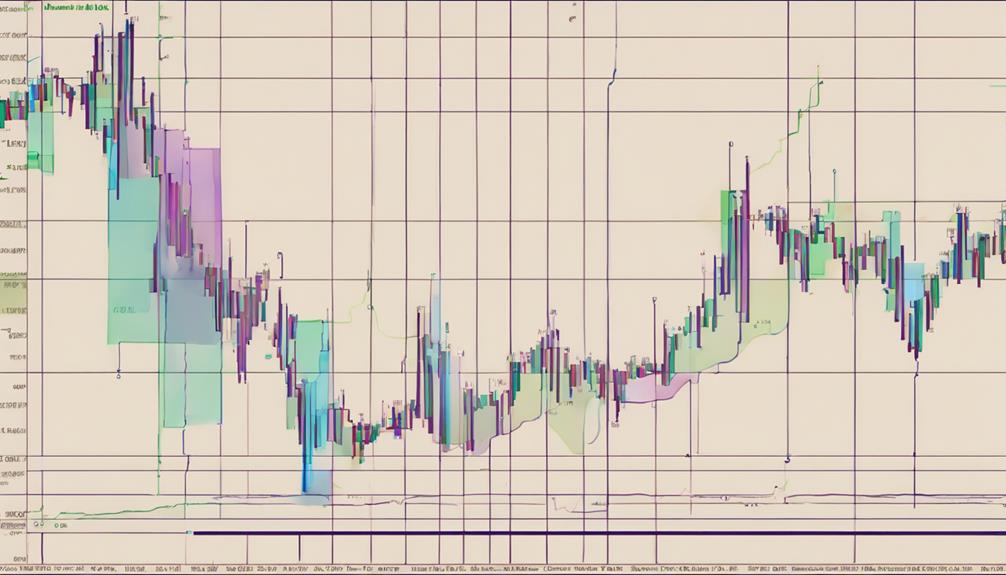

Understanding Fibonacci retracement levels is crucial for traders seeking to identify potential entry points in a market during price correction phases. These levels, such as 38.2%, 50%, and 61.8%, serve as key areas where price reversals may occur based on the Fibonacci sequence.

By incorporating Fibonacci retracement levels into your technical analysis, you gain a valuable tool for recognizing potential turning points in the market. Traders often look for confirmation from other technical indicators to strengthen the significance of these levels.

Utilizing Fibonacci retracement levels enables you to anticipate potential price reversals and make informed trading decisions. This technical tool provides a systematic approach to analyzing price movements and can enhance your overall trading strategy.

Identifying Key Support and Resistance Levels

Key support and resistance levels play a critical role in guiding traders' decision-making processes and influencing market dynamics. When it comes to Fibonacci retracement levels, they serve as key support and resistance areas that traders closely monitor for potential market movements. Here are three essential points to consider:

- Fibonacci numbers help identify crucial support and resistance levels.

- Utilizing Fibonacci analysis aids in determining key levels for trading strategies.

- Understanding key support and resistance levels is vital for effective risk management in Fibonacci Trading.

Applying Fibonacci Extensions for Target Projection

To project potential price targets during trend continuation, traders leverage Fibonacci extensions as key tools in their technical analysis arsenal. Common extension levels include 138.2%, 150%, and 161.8%. These levels are drawn from the lowest to the highest point of a trend for projection.

Traders use Fibonacci extensions to set profit-taking targets or anticipate possible reversal points. By utilizing Fibonacci extensions, traders can plan their trades more effectively by identifying where the price might reach next. Additionally, these extension levels are beneficial for managing trailing stops to secure profits in a trend.

Incorporating Fibonacci extensions into your trading strategy can provide valuable insights into potential price movements and help you make more informed decisions.

Implementing Trailing Stops With Fibonacci

Implementing Fibonacci in setting trailing stops can enhance profit protection by dynamically adjusting stop-loss levels as price movements progress favorably.

Utilizing the Fibonacci retracement tool can assist in determining optimal points for placing trailing stops to protect gains.

Traders can employ Fibonacci extension levels to set trailing stops at key price levels, aiming to maximize profits during favorable price action.

By actively monitoring the price movements and adjusting the stops accordingly, traders can effectively manage risk and lock in profits during trend continuations.

This strategic combination of Fibonacci retracement levels with trailing stops offers a systematic approach to safeguarding gains and capitalizing on market opportunities.

Integrating Fibonacci With Other Indicators

Integrating Fibonacci with other indicators can significantly enhance the precision of your trading decisions by providing additional confirmation and insights into market conditions. Combining Fibonacci retracement with moving averages can offer more clarity on entry and exit points.

Utilizing Fibonacci levels with RSI helps in pinpointing overbought or oversold conditions, guiding strategic moves. Integrating Fibonacci retracement alongside MACD strengthens the accuracy of trend reversal signals.

Seeking confluence between Fibonacci levels and support/resistance zones reinforces the validity of trading choices. Moreover, incorporating Fibonacci retracement with volume analysis can shed light on the strength of price movements at critical levels, aiding in making informed trading decisions.

What Are the 7 Steps to Mastering Fibonacci Retracement in Technical Analysis?

Fibonacci retracements extensions explained are vital in mastering technical analysis. The 7 steps include identifying the trend, choosing the high and low points, plotting the Fibonacci levels, waiting for a reversal confirmation, setting price targets, applying other tools for confirmation, and managing risk through stop-loss orders.

Frequently Asked Questions

How Do You Master Fibonacci Retracement?

To master Fibonacci retracement, you identify key levels like 38.2%, 50%, and 61.8% for potential entry points. Drawing levels from trend lows to highs pinpoints reversal zones. Confirm with other indicators for effectiveness. Recognize support/resistance for informed decisions.

What Is the Most Effective Fibonacci Retracement Level?

To master Fibonacci retracement, focus on the 38.2%, 50%, and 61.8% levels. Draw lines from trend lows to highs. Combine with other indicators for confirmation. This approach enhances your ability to foresee price shifts.

What Is the Golden Ratio of the Fibonacci Retracement?

The golden ratio in Fibonacci retracement is approximately 0.618. It serves as a key level for price retracement or extension in trading analysis. Traders seek confluence at this ratio for stronger trade signals, setting stop-loss and profit targets effectively.

Do Professional Traders Use Fibonacci Retracement?

Yes, professional traders use Fibonacci retracement. It's a crucial tool for identifying potential price reversal points. By integrating Fibonacci levels into their strategies, traders optimize entry and exit points, enhance risk management, and make more accurate trading decisions.

Conclusion

You have successfully mastered Fibonacci retracement techniques, equipping yourself with a powerful tool to make informed trading decisions. By combining Fibonacci levels with key support and resistance levels, applying extensions for target projection, implementing trailing stops, and integrating with other indicators, you have unlocked a treasure trove of possibilities in the world of trading.

Your newfound expertise shines like a beacon of light guiding you towards profitable trades.