Simplify the secrets of the Ichimoku Cloud Indicator in your trading journey. Unravel the intricacies of this powerful tool and discover how it can revolutionize your approach to market analysis.

Learn how to decode its signals, harness its potential, and elevate your trading acumen to new heights. Join us on a journey where clarity meets complexity, guiding you towards a path of profitable possibilities.

Deconstructing the Ichimoku Cloud Indicator

Deconstructing the Ichimoku Cloud Indicator allows you to unravel its five key components: Conversion Line, Base Line, Leading Span A, Leading Span B, and Lagging Span. These elements work together to project future support and resistance levels, aiding in identifying potential entry and exit points in the market.

The Conversion Line and Base Line offer insights into short-term and long-term trends, while the Lagging Span confirms the current trend by plotting the closing price 26 periods back.

Understanding Conversion and Base Lines

To comprehend the principles of the Ichimoku Cloud indicator fully, it's essential to grasp the roles and dynamics of the Conversion and Base Lines. Here are key points to consider:

- The Conversion Line represents a short-term moving average.

- The Base Line is a long-term moving average.

- These lines serve as dynamic support and resistance levels.

- Crossovers between the Conversion and Base Lines indicate changes in momentum and potential trend shifts.

Understanding how the Conversion and Base Lines interact is vital for accurately interpreting Ichimoku Cloud signals. By recognizing their significance in analyzing price movements, you can enhance your ability to identify trends and make informed trading decisions.

Deciphering the Ichimoku Cloud Signals

Deciphering Ichimoku Cloud signals involves analyzing five key components to determine trend direction and momentum accurately. The Conversion Line and Base Line crossovers offer insights into potential trend shifts and serve as early entry points.

The Leading Span A and Leading Span B help to identify support/resistance levels, confirming the trend direction. Additionally, the Lagging Span acts as a confirmation tool by plotting the current closing price 26 periods back.

Utilizing Ichimoku for Trade Analysis

Wondering how to effectively utilize the Ichimoku Cloud for trade analysis to enhance your trading strategies and decision-making process? Here are some key points to consider:

- Identifying Trends: The Ichimoku Cloud helps you determine the direction of the trend by analyzing the relationship between the Conversion Line and the Base Line.

- Support and Resistance: Utilize the Cloud boundaries as dynamic support and resistance levels to gauge potential price movements.

- Crossover Signals: Pay attention to crossovers between the Conversion Line and the Base Line as they can indicate changes in trend momentum.

- Precise Trading Signals: Utilize the Cloud formations to generate buy/sell signals and establish effective stop-loss and take-profit strategies for your trades.

Enhancing Trading Strategies With Ichimoku

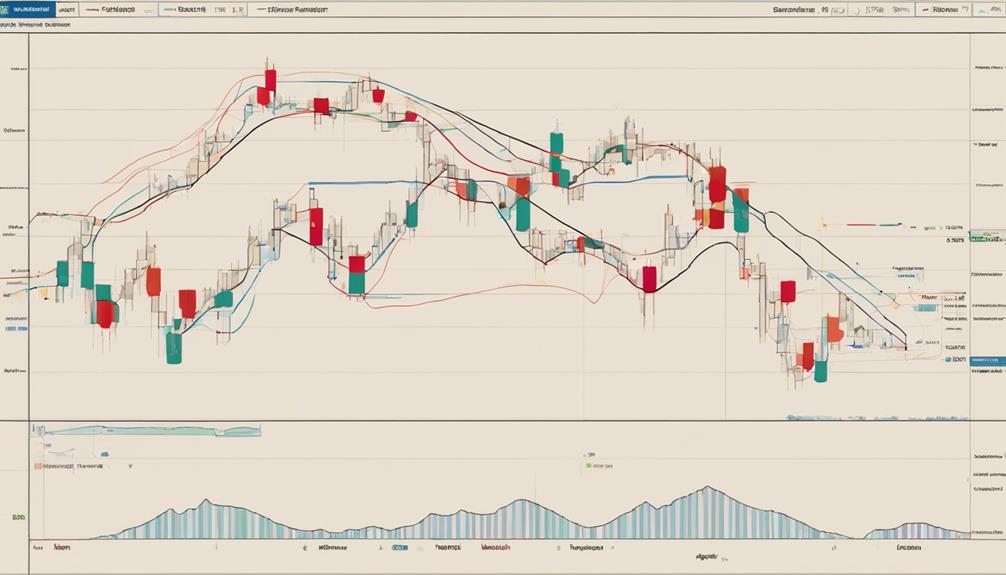

Curious about how to optimize your trading strategies with the Ichimoku Cloud indicator? Combining Ichimoku with RSI can enhance your trade signals by identifying potential reversals.

RSI divergences, when used in conjunction with Ichimoku, help pinpoint high-probability reversal points, especially when looking for trend reversals.

When price crosses the Conversion or Base lines following an RSI divergence, it may signal a trade exit opportunity. This confluence of Ichimoku and RSI not only aids in detecting reversals but also provides a robust trading approach.

Can you provide more detailed information on how to simplify the Ichimoku Cloud Indicator?

Looking to simplify the Ichimoku Cloud Indicator? Here are the best steps to follow. Firstly, familiarize yourself with the indicator’s components, such as the Tenkan-sen, Kijun-sen, Senkou Span A and B. Next, learn to identify buy and sell signals by assessing their relationships. Finally, streamline your analysis by adjusting the indicator’s parameters based on your trading style. Mastering these steps will help you simplify the Ichimoku Cloud Indicator effectively.

Frequently Asked Questions

What Is the Best Indicator for Ichimoku Cloud?

The best indicator for Ichimoku Cloud is the Tenkan-sen, or Conversion Line. It reflects short-term momentum and aids in spotting potential trend changes. Calculate it as the 9-period high and low average for insights into immediate price action.

What Is the Formula for Ichimoku Cloud Indicator?

To calculate the Ichimoku Cloud Indicator, average the 9-period high and low for the Conversion Line and 26-period high and low for the Base Line. Project midpoints 26 periods ahead for Leading Span A and B. Chikou Span plots the current price 26 periods back.

What Are the Drawbacks of Ichimoku?

When using Ichimoku, drawbacks include complexity causing confusion, mixed signals demanding experience, and overwhelming details for beginners. It can challenge your interpretation skills and effectiveness without sufficient experience in trading.

What Is 9 26 52 in Ichimoku?

Do you know what 9, 26, and 52 signify in Ichimoku? These key periods determine the Conversion Line, Base Line, and Cloud boundary, aiding in spotting short, medium, and long-term trends. Understanding them is crucial for accurate analysis.

Conclusion

As you navigate the markets with the Ichimoku Cloud indicator, remember that it's your guiding light in the stormy sea of trading. Just like how the clouds in the sky foretell the weather, the Ichimoku Cloud signals can forecast market trends and potential reversals.

By mastering this powerful tool and combining it with other indicators, you can steer your trading ship towards success amidst changing market conditions. Fair winds and following seas on your trading journey.