The Zig Zag indicator stands as a crucial tool in the arsenal of day traders, offering a refined lens through which to view market movements. Its ability to sift through market noise and unveil underlying trends provides traders with a clearer perspective on price action dynamics.

By pinpointing key reversal points and significant support and resistance levels, the Zig Zag indicator equips traders with valuable insights for making informed trading decisions. However, there is more to this indicator than meets the eye, as its integration into trading strategies can unlock a realm of untapped potential.

Importance of Zig Zag Indicator

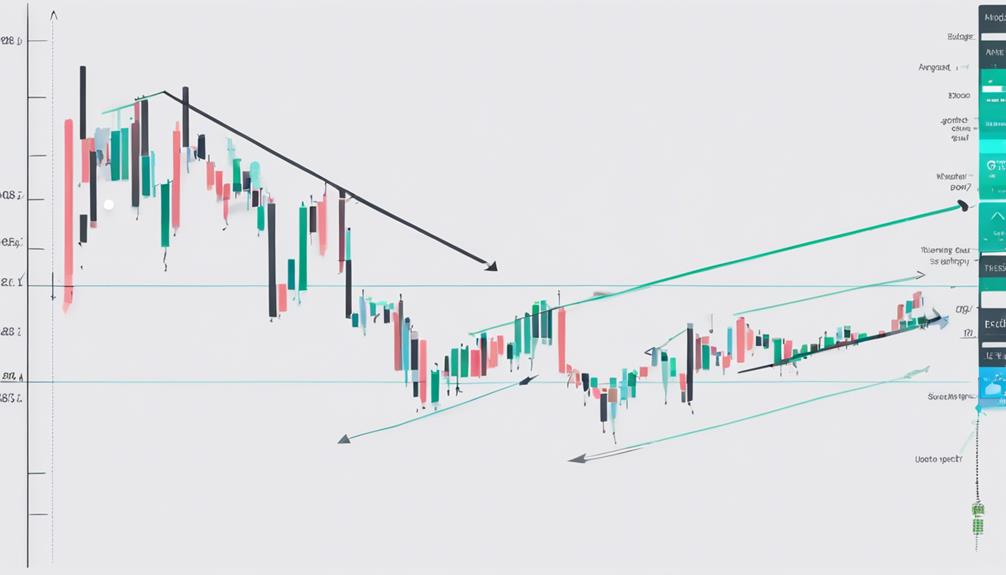

In the realm of day trading, the Zig Zag indicator emerges as a critical tool for discerning essential price movements amidst market fluctuations. This indicator is particularly valuable in identifying swing highs and swing lows, which are pivotal points for traders looking to enter or exit positions. By plotting Zig Zag lines based on price movements, day traders can effectively filter out noise and focus on significant price changes. This is especially helpful in the fast-paced world of financial trading, where timely decisions can make a substantial difference in investment outcomes.

Furthermore, the Zig Zag indicator aids traders in recognizing substantial swing highs or swing lows, guiding them towards potential trend reversals. In the context of Forex trading, where price volatility is common, the Zig Zag indicator can provide clarity amid the chaos, helping traders make informed decisions. Its ability to highlight lower lows and higher highs enables traders to gauge market sentiment and adjust their strategies accordingly. Overall, integrating the Zig Zag indicator into a trading toolkit can enhance decision-making processes and contribute to more successful trading outcomes.

Advantages in Day Trading

Harnessing the power of the Zig Zag indicator in day trading provides traders with a strategic edge by swiftly pinpointing crucial support and resistance levels. This technical tool aids in identifying swing highs and swing lows, allowing traders to make informed decisions on when to enter or exit trades. By filtering out minor price fluctuations, the Zig Zag indicator helps day traders focus on significant price movements, enhancing their ability to capture profitable opportunities.

Moreover, it plays a vital role in confirming momentum shifts and detecting potential trend reversals, enabling traders to act promptly. The Zig Zag line serves as a valuable guide for setting stop-loss orders and determining optimal points to buy or sell securities. With its ability to emphasize support and resistance prices, this indicator reduces noise and highlights crucial price action, improving the overall effectiveness of day trading strategies.

Enhancing Trading Strategies With Zig Zag

Utilizing the Zig Zag Indicator in trading strategies refines decision-making by emphasizing significant price movements and key market levels.

This tool effectively filters out noise and focuses on essential price fluctuations, enabling day traders to identify swing highs or lows, peaks, and trend reversals.

By incorporating the Zig Zag Indicator, traders can establish more precise entry and exit points, enhancing the timing of their trades.

Moreover, it assists in confirming signals generated by other technical indicators, leading to more accurate trading decisions.

Day traders rely on the Zig Zag Indicator to visualize market swings, capture profitable opportunities, and manage risk effectively.

This indicator is particularly valuable in day trading scenarios where quick responses to changing market conditions are crucial for success.

Maximizing Profit Potential

To enhance profitability in day trading, strategic implementation of the Zig Zag indicator facilitates precise identification of key market levels for maximizing potential gains. By filtering out noise and focusing on significant price fluctuations, day traders can effectively pinpoint support and resistance levels using the Zig Zag indicator.

This allows traders to capitalize on strong trends and optimize their profit potential by entering and exiting positions at opportune times. Moreover, the Zig Zag indicator aids in recognizing trend reversals promptly, enabling traders to adjust their strategies accordingly for enhanced profitability.

Incorporating this tool into day trading strategies not only improves decision-making processes but also enhances risk management practices, as traders can make more informed choices based on the indicator's signals.

Integrating Zig Zag for Success

Integrating the Zig Zag indicator into day trading strategies elevates traders' ability to identify key support and resistance levels with precision, optimizing decision-making processes and enhancing overall trading effectiveness.

Benefits of Integrating Zig Zag for Success:

- Pinpointing Peaks: The Zig Zag indicator helps in identifying peak price fluctuations, allowing traders to capitalize on profitable opportunities effectively.

- Enhanced Support and Resistance Levels: By incorporating Zig Zag, traders can better pinpoint support and resistance levels, aiding in decision-making and trend changes.

- Improving Trading Accuracy: Utilizing Zig Zag in day trading strategies reduces false signals, filters out market noise, and enhances overall trading accuracy, leading to more informed entry and exit points throughout the trading day.

What are the benefits of using the Zig Zag indicator in day trading?

The zig zag indicator importance trading lies in its ability to help traders identify trends and potential reversals in the market. By using this tool, day traders can make more informed decisions and better time their entry and exit points. This can ultimately lead to more profitable trades and reduced risk.

Is the Use of Zig Zag Indicator the Same for Day Trading and Regular Trading?

The zig zag indicator trading essentials can be used in both day trading and regular trading. It helps identify trend reversals and patterns, making it useful for short-term and long-term traders. However, day traders may utilize shorter time frames for quicker decision-making, while regular traders may rely on longer time frames for a broader perspective.

How Does the Zig Zag Indicator Compare to the Trix Indicator in Day Trading?

When it comes to day trading, understanding the differences between the Zig Zag indicator and the Trix indicator is an essential tutorial for novices. While both are used to identify trends and potential reversals in the market, they each have their unique calculation methods and strengths.

Frequently Asked Questions

What Is the Zigzag Indicator in Day Trading?

The Zig Zag indicator in day trading is a technical tool that connects swing highs and lows to identify trends and potential reversals accurately. Traders can customize settings to align with their strategies, aiding in pinpointing key price levels.

What Is the Best Combination of Indicators for Day Trading?

In day trading, combining the Relative Strength Index (RSI) with the Zig Zag indicator can pinpoint overbought or oversold conditions. This synergy provides valuable insights for entry or exit points, enhancing decision-making accuracy and strategy effectiveness.

What Is the Zigzag Trading Algorithm?

The Zigzag trading algorithm is a tool that filters market noise by connecting swing highs and lows on a price chart. Traders leverage it to identify trend reversals, confirm trend directions, and pinpoint entry or exit points.

What Is the Zigzag Line Strategy?

The Zigzag Line Strategy is a technical analysis tool that identifies price movements by connecting swing highs and lows. It aids in trend confirmation, support/resistance level identification, and entry/exit decisions, providing clarity amidst market volatility.

Conclusion

In conclusion, the Zig Zag indicator serves as a crucial tool in day trading, offering valuable insights into market trends and price movements.

By effectively filtering out noise and highlighting key levels of support and resistance, traders can make informed decisions and maximize profit potential.

Utilizing this indicator in conjunction with other technical analysis tools can significantly enhance trading strategies and overall success in the dynamic world of day trading.