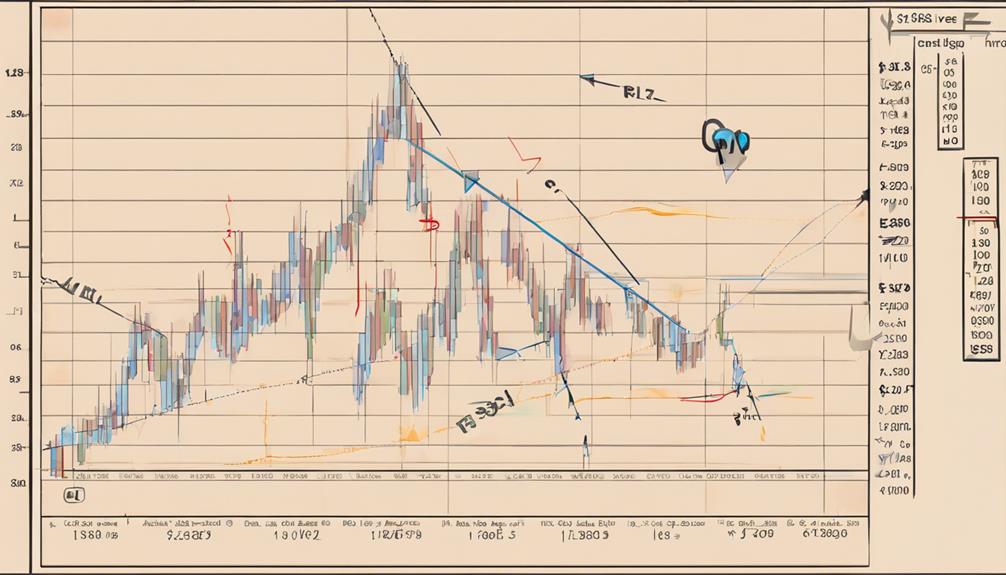

When trading with Fibonacci retracement levels, you may find it beneficial to consider the case where a stock price experiences a significant uptrend, followed by a retracement to the 50% Fibonacci level before continuing its upward trajectory.

Understanding how to interpret these retracement levels and apply them effectively can greatly enhance your trading strategies.

Stay tuned to discover the remaining four essential tips that can help you navigate the complexities of Fibonacci retracement trading with confidence and precision.

Importance of Fibonacci Retracement Levels

With Fibonacci retracement levels, traders gain a strategic advantage by pinpointing critical support and resistance zones essential for making informed trading decisions. These key levels, such as 23.6%, 38.2%, 50%, 61.8%, and 78.6%, play a significant role in predicting potential price movements within the market.

By understanding Fibonacci retracement levels, traders can improve their decision-making processes, setting precise stop-loss orders and profit targets based on these levels. Utilizing Fibonacci retracement levels effectively allows for better entry and exit points in trading positions, enhancing the overall trading experience.

Recognizing the importance of these levels can lead to more successful trades and better risk management strategies.

Identifying Key Fibonacci Levels

Identifying key Fibonacci levels is crucial for traders seeking to anticipate price movements and enhance their technical analysis strategies effectively. These key levels, such as 23.6%, 38.2%, 50%, 61.8%, and 78.6%, are derived from Fibonacci numbers and are instrumental in identifying support and resistance areas.

By using Fibonacci retracements, traders can predict potential price movements and adjust their trading strategies accordingly. The Fibonacci retracement tool simplifies the process of pinpointing these key levels for optimal entry and exit points.

Understanding and utilizing these key Fibonacci levels is essential for conducting effective technical analysis and making informed trading decisions based on market trends and candlestick patterns.

Utilizing Fibonacci Extensions Effectively

To effectively utilize Fibonacci extensions in your trading strategy, incorporate common extension levels like 127.2%, 161.8%, and 261.8% to project potential price targets beyond typical retracement levels.

When using Fibonacci extensions, consider the following:

- Set profit targets based on extension levels to maximize profits.

- Identify areas for potential trend continuation by analyzing Fibonacci extensions.

- Draw extensions from swing points in the price action to forecast possible price extensions.

- Utilize Fibonacci extensions to manage risk effectively in your trades.

- Incorporate Fibonacci extensions in conjunction with retracement levels for a comprehensive trading approach.

Setting Stop-Loss Orders With Fibonacci

Setting stop-loss orders strategically with Fibonacci retracement levels is a key aspect of effective risk management in trading. By using Fibonacci retracements, traders can define exit points, protect profits, and minimize losses.

Placing stop-loss orders just below key Fibonacci support levels ensures a structured approach to risk management. Adjusting these orders based on Fibonacci levels allows for adaptation to changing market conditions and capital protection.

Incorporating Fibonacci into stop-loss strategies enhances trade discipline, helping traders avoid emotional decision-making. This method not only safeguards against significant losses but also guides traders in maximizing potential gains by adhering to a well-defined risk management plan.

Combining Fibonacci With Other Indicators

When combining Fibonacci with other indicators, you can enhance the accuracy of trade signals and improve decision-making in your trading strategy. Consider the following:

- Using Fibonacci retracement with moving averages can confirm trend direction and potential reversal points.

- Combining Fibonacci levels with RSI or MACD indicators enhances trade confirmation and decision-making.

- Fibonacci retracement paired with Bollinger Bands helps identify volatility and potential price reversal areas.

- Utilizing Fibonacci levels alongside support and resistance zones strengthens trade setups and risk management.

- Incorporating Fibonacci retracement with trendlines provides additional confirmation for entry and exit points in trading.

What are the top tips for Fibonacci retracement trading?

1. Use the 61.8% level for optimal entry and exit points.

2. Combine Fibonacci retracement with other technical indicators for confirmation.

3. Set stop-loss orders to protect against potential reversals.

4. Identify the trend direction before applying Fibonacci retracement levels.

5. Avoid using Fibonacci retracement in isolation for trade decisions.

Frequently Asked Questions

What Is the Best Way to Use Fibonacci Retracement?

To use Fibonacci retracement effectively, identify potential support and resistance levels in the market. Utilize key Fibonacci levels like 23.6%, 38.2%, 50%, 61.8%, and 78.6%. Combine with other indicators for confirmation and adjust trading plans accordingly for optimal results.

What Is the Golden Ratio of the Fibonacci Retracement?

In Fibonacci retracement, the golden ratio, approximately 1.618 times the prior number, is crucial. Traders seek it for support/resistance levels. Price reactions at this ratio signal trend changes. Understanding it aids in predicting market movements.

What Are the Most Powerful Fibonacci Retracement Levels?

The most powerful Fibonacci retracement levels are 38.2%, 50%, and 61.8%. These levels hold significance in predicting price movements and are commonly used for making trading decisions based on their proven ability to influence trends.

How Do You Master Fibonacci Retracement?

To master Fibonacci retracement, visualize it as a roadmap guiding your trades. Practice drawing retracement levels, combine them with indicators for confirmation, set stop-loss orders strategically, and adapt strategies based on signals for trading success.

Conclusion

In conclusion, mastering Fibonacci retracement trading can greatly enhance your success in the financial markets.

Did you know that 61.8% is known as the 'golden ratio' and is considered one of the most significant Fibonacci levels?

By understanding and implementing these essential tips, you can effectively identify key levels, predict price movements, and make informed trading decisions.

Keep practicing and refining your skills to become a proficient Fibonacci trader.