When navigating the complexities of the financial markets, beginners often find themselves searching for reliable tools to assist in decision-making.

Amidst a sea of indicators, the Aroon Indicator stands out for its simplicity yet powerful insights.

By understanding why the Aroon Indicator is essential for novices, you'll uncover a valuable resource that can potentially transform your trading approach.

What Is the Aroon Indicator?

If you want to understand market trends better, the Aroon Indicator is a valuable tool for measuring the time between highs and lows. Developed by Tushar Chande in 1995, this technical analysis tool consists of two lines: Aroon Up and Aroon Down. Aroon Up measures the time since the last highest high, while Aroon Down tracks the time since the last lowest low.

Understanding Aroon Indicator Calculations

To comprehend the Aroon Indicator fully, understanding its calculations is essential for gauging market trends effectively. The Aroon Up is determined by calculating (Number of periods – Number of periods since the Highest High) / Number of periods * 100%, while the Aroon Down is calculated as (Number of periods – Number of periods since the Lowest Low) / Number of periods * 100%.

Typically calculated over a default period of 14, the Aroon Indicator offers a numerical representation of the time since the last highest high and lowest low. Traders can adjust the period settings to 25-30 for long-term trend assessments based on their trading preferences, providing valuable insights for trend analysis and aligning with individual trading styles.

Interpreting Aroon Indicator Signals

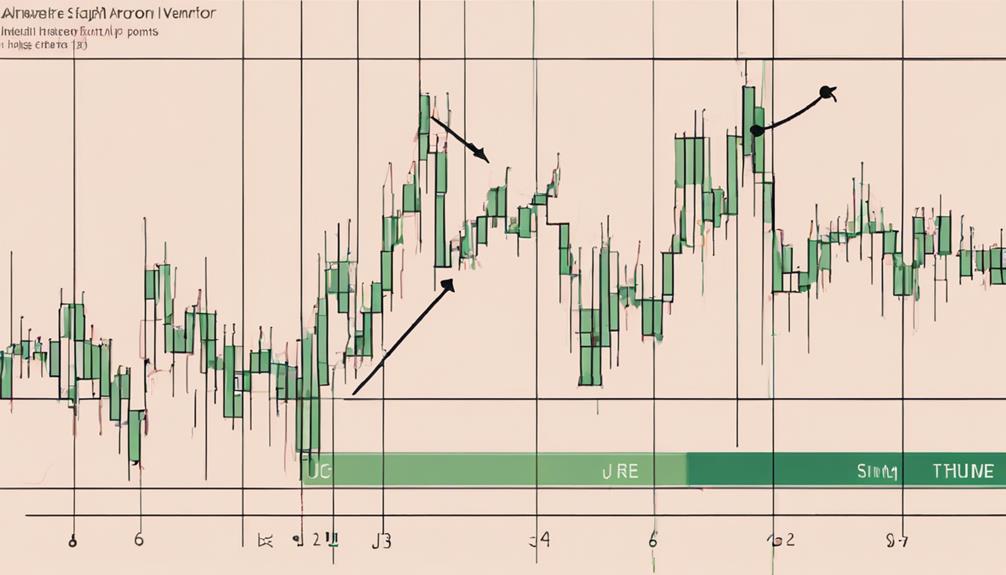

When interpreting Aroon Indicator signals, it's crucial to identify key patterns that signal potential market movements. Aroon Up surpassing Aroon Down indicates bullish behavior, suggesting buying opportunities.

Conversely, if Aroon Down crosses above Aroon Up, it signals bearish behavior, indicating potential selling opportunities. Keep an eye on crossovers between the Aroon Up and Aroon Down lines as they can indicate potential trend changes, helping you determine entry or exit points.

A reading above 50 on the Aroon Indicator suggests strong trends, while values approaching zero may signify weak trends or consolidation. Understanding these signals empowers beginners to discern trend direction, strength, and potential market opportunities for informed decision-making.

Practical Application of Aroon Indicator

Utilizing the Aroon Indicator in your analysis can provide valuable insights into trend changes and strength in asset prices, aiding in strategic decision-making for beginners.

When applying the Aroon Indicator, consider the following:

- Identify bullish and bearish behavior: The indicator helps you recognize whether an asset is exhibiting bullish (upward trend) or bearish (downward trend) behavior.

- Use crossovers as signals: Aroon Indicator crossovers can signal potential trend changes, guiding you on entry and exit points.

- Analyze consolidation periods: Understanding consolidation periods through the Aroon Indicator can assist in managing trades effectively during market trends.

Aroon Indicator Vs. Other Technical Indicators

The Aroon Indicator distinguishes itself from other technical indicators by focusing on the time factor between price highs and lows, providing a unique perspective on trend analysis. Unlike indicators such as RSI that emphasize price momentum, the Aroon Indicator assesses trend strength through the time analysis of price highs and lows using its Aroon Up and Aroon Down lines.

This contrasts with indicators like MACD, which rely on moving averages. Moreover, the Aroon Indicator prioritizes trend duration, unlike the Stochastic Oscillator that highlights overbought and oversold conditions. For beginners, understanding trend direction can be simplified with the Aroon Indicator's emphasis on time analysis, setting it apart from volume-based indicators such as OBV.

How Can Beginners Benefit from Using the Aroon Indicator?

Beginners in trading can benefit from using the aroon indicator. The aroon indicator usage revealed can help identify trends and potential reversals, allowing new traders to make better decisions. By understanding how to use this tool effectively, beginners can gain confidence and improve their trading strategies.

Frequently Asked Questions

What Is the Best Strategy for Aroon?

For the best Aroon strategy, focus on identifying trend changes through Aroon Up and Down crossovers. Utilize Aroon signals like Aroon-Up crossing above Aroon-Down for bullish entries. Combine Aroon with other indicators for enhanced confirmation of trend direction.

How Accurate Is the Aroon Indicator?

The Aroon Indicator is highly accurate, providing precise signals for trend changes. Its Aroon Up and Aroon Down values indicate trend strength and direction effectively. Utilize readings above 50 for strong trend identification.

What Is the Difference Between MACD and Aroon?

In comparing MACD and Aroon, note Aroon focuses on time between highs/lows for trend strength, while MACD uses moving averages for momentum. Aroon's Up/Down lines signal bullish/bearish behavior, unlike MACD's signal line crossovers for buy/sell indications.

What Is the Difference Between RSI and Aroon Indicator?

Do you wonder about the difference between RSI and the Aroon Indicator? RSI focuses on price momentum for overbought/oversold signals, while Aroon emphasizes time between highs and lows for trend strength indications. Understand these distinctions for effective trading strategies.

Conclusion

In conclusion, the Aroon Indicator is like a compass guiding beginners through the winding paths of the financial markets, helping them navigate trends and potential reversals with ease.

By incorporating this powerful tool into their technical analysis, beginners can gain valuable insights and make more informed trading decisions.

So, don't let the market's twists and turns intimidate you – let the Aroon Indicator be your guiding light to success.