In the realm of financial markets, the significance of candlestick patterns for risk management cannot be understated. These patterns serve as a fundamental tool for traders seeking to navigate the complexities of market dynamics with prudence and foresight.

By deciphering the subtle language of candlestick formations, traders can unveil hidden insights that hold the key to successful risk mitigation strategies. The intricate interplay of bullish and bearish patterns unveils a compelling narrative that guides traders towards informed decisions aimed at safeguarding their investments and capitalizing on market opportunities.

Importance of Candlestick Patterns

Candlestick patterns play a crucial role in financial markets by offering traders valuable visual insights into potential trend reversals and market sentiment. By identifying patterns like the Bullish Harami pattern, traders can confirm the potential for changes in market direction. This insight is instrumental in helping traders make informed decisions. Understanding these patterns is essential for effective risk management strategies.

Integrating candlestick analysis with other indicators further enhances risk assessment by providing a more comprehensive view of market dynamics. By incorporating candlestick patterns into their analysis, traders can improve their ability to anticipate market movements and adjust their strategies accordingly, ultimately leading to more effective risk management practices.

Risk Management Strategies

What are some essential strategies that traders can employ to effectively manage risks in financial markets? Risk management strategies play a crucial role in navigating the complexities of trading. Here are some key approaches to consider:

- Setting stop-loss orders: Limit potential losses by placing stop-loss orders to automatically sell an asset if it reaches a certain price point.

- Implementing hedging techniques: Protect investments from unexpected market movements by using hedging strategies like options or futures contracts.

- Avoiding emotional decision-making: Stick to a well-defined investment strategy and avoid making impulsive decisions based on emotions to ensure a disciplined approach to risk management.

Candlestick Patterns in Analysis

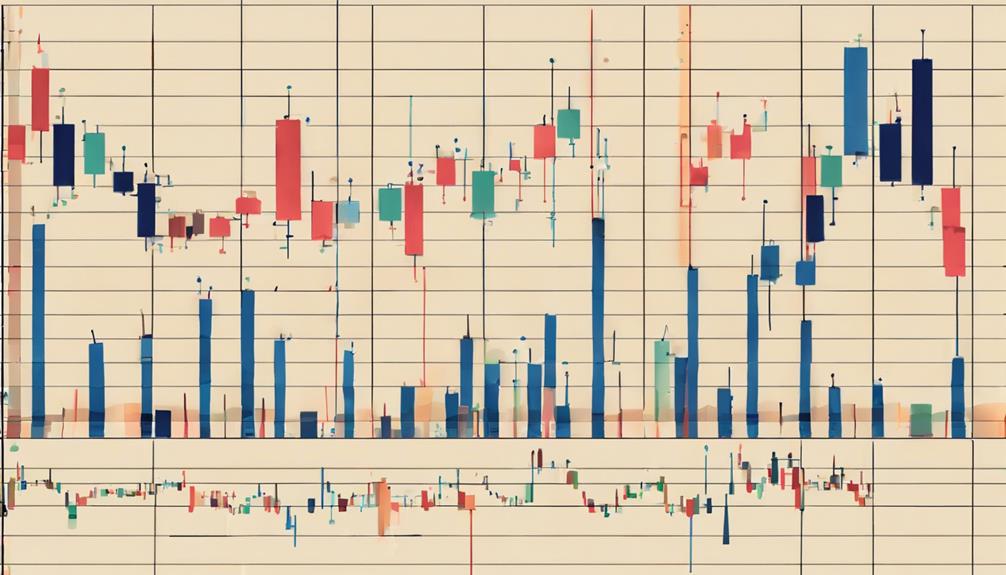

Utilizing visual cues derived from candlestick patterns is instrumental in conducting thorough market analysis for informed decision-making in financial trading. Candlestick patterns offer insights into market sentiment, potential price movements, key reversal points, and trend continuations.

By analyzing these patterns, traders can enhance their risk management strategies and make well-informed decisions. Recognizing the significance of candlestick patterns in interpreting market sentiment allows for a more precise assessment of risks and opportunities.

This analytical approach to decision-making based on candlestick signals enables traders to navigate the markets with a greater understanding of potential outcomes, ultimately improving their overall risk management practices. Incorporating candlestick patterns in analysis is crucial for traders seeking to optimize their decision-making processes and enhance their risk management capabilities.

Enhancing Risk Assessment

In the realm of financial trading, a keen understanding of candlestick patterns not only facilitates comprehensive market analysis but also plays a pivotal role in enhancing risk assessment strategies.

Key Points:

1) Candlestick patterns provide visual cues for assessing market sentiment and potential risks.

2) Understanding these patterns helps in identifying trend reversals and key reversal signals.

3) Utilizing candlestick patterns enables traders to implement effective risk management strategies, including setting stop-loss orders to minimize potential losses.

Practical Applications in Risk Management

Candlestick patterns play a crucial role in practical risk management applications within the realm of financial trading. These patterns offer insights into potential market reversals, aiding traders in setting stop-loss orders at strategic levels to mitigate risks effectively.

By identifying bullish or bearish patterns, traders can adjust their risk management strategies accordingly, aligning with market sentiment shifts. This knowledge enables informed decision-making to safeguard investments.

Utilizing candlestick patterns optimizes profit potential and minimizes losses by facilitating timely entry and exit points. Incorporating these visual cues into risk management strategies enhances the ability to manage risks proactively and react to market dynamics efficiently.

How Can Understanding Candlestick Patterns Help with Risk Management in Stock Trading?

Understanding candlestick patterns is one of the essential tips for stock trading. By recognizing these patterns, traders can anticipate potential market movements and make more informed decisions. This helps in managing risks by identifying entry and exit points, setting stop-loss orders, and maximizing potential profits.

Frequently Asked Questions

Why Are Candlestick Patterns Important?

Candlestick patterns are essential due to their ability to provide visual cues for identifying potential trend reversals, interpreting market sentiment, and aiding in decision-making based on price action. Understanding these patterns enhances risk management by pinpointing entry and exit points.

What Is the Significance of Candlestick Chart?

Candlestick charts offer a visual representation of price movements, displaying key data points like opening, closing, high, and low prices. They provide valuable insights into market sentiment and potential trend reversals, aiding traders in making informed decisions.

What Does the Candlestick Pattern Indicate?

Candlestick patterns indicate market sentiment, reflecting investor psychology and potential price movements. They offer valuable insights into bullish, bearish, or indecisive conditions, aiding traders in decision-making. Understanding these patterns enhances risk assessment and mitigation strategies effectively.

What Are the Advantages of Candlestick Charts?

Candlestick charts offer traders a visual representation of price movements, aiding in trend identification and pattern recognition. They provide insights into market sentiment and potential reversals, helping traders anticipate movements and make informed decisions.

Conclusion

In conclusion, candlestick patterns play a crucial role in risk management by providing valuable insights into market sentiment and potential price movements.

While some may argue that relying solely on candlestick patterns can be risky, when used in conjunction with other risk management strategies, they can greatly enhance decision-making processes and improve overall trading outcomes.

It is essential for traders to understand and utilize candlestick patterns effectively to mitigate risks and optimize their trading strategies.