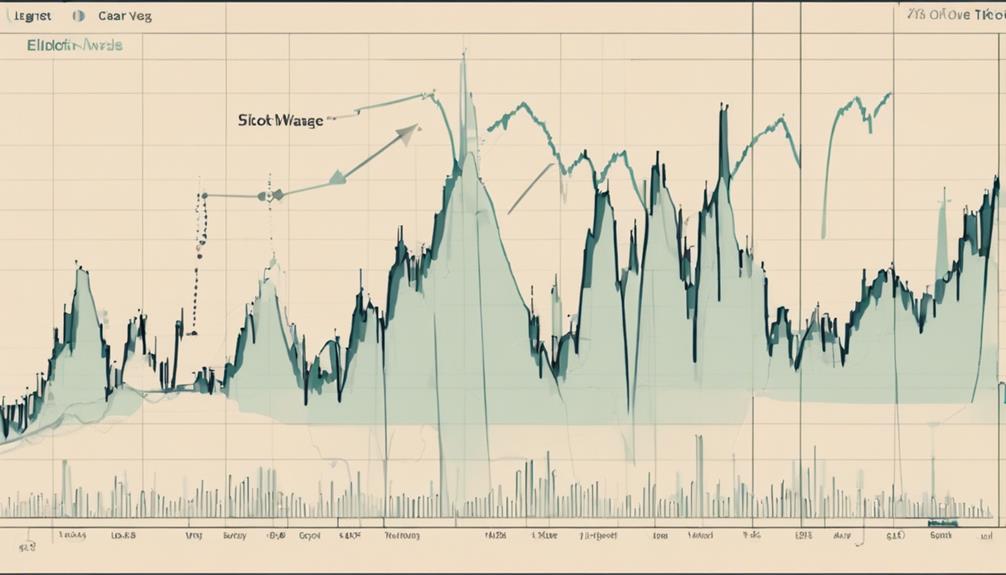

Elliott Wave Theory serves as a fundamental tool for navigating the intricate landscape of stocks. Its ability to decipher repetitive patterns in market movements offers investors a structured approach to understanding and predicting stock behavior.

By integrating Fibonacci analysis, this theory equips traders with a methodical framework for making informed decisions based on anticipated market trends.

As market participants seek to enhance their strategies and gain an edge in the stock market, the significance of Elliott Wave Theory becomes increasingly apparent.

Benefits of Applying Elliott Wave Theory

Applying the Elliott Wave Theory to stock market analysis offers traders a systematic approach to identifying potential market turning points through the recognition of repetitive wave patterns. The theory, developed by Ralph Nelson Elliott in the 1930s, suggests that market prices unfold in specific patterns, known as waves, which can be analyzed to forecast future price movements. By understanding the structure of Elliott Waves, traders gain valuable insights into the market's psychology and can anticipate trend reversals with more confidence.

One of the key advantages of Elliott Wave Theory is its incorporation of Fibonacci ratios, which are widely used in technical analysis to determine key levels of support and resistance. These ratios help traders identify potential price targets and define risk parameters for their trades. Additionally, by distinguishing between impulse waves that move in the direction of the trend and corrective waves that move against the trend, traders can make more informed decisions on when to enter or exit positions. Overall, the systematic approach offered by Elliott Wave Theory enhances traders' ability to navigate the complexities of the stock market and capitalize on profitable opportunities.

Market Analysis Advantages

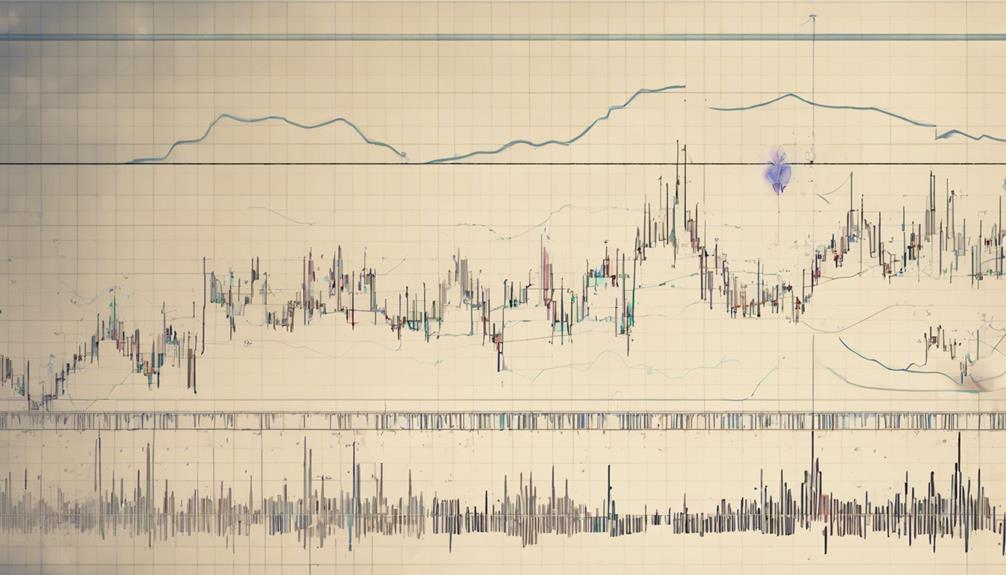

The utilization of Elliott Wave Theory in market analysis provides traders with a strategic advantage in identifying potential entry and exit points based on observable wave patterns.

- Structured Analysis: Elliott Wave Theory offers a systematic approach to understanding financial markets, aiding in the prediction of trend reversals.

- Pattern Recognition: Traders can leverage wave patterns to anticipate major trends and corrections in stock prices.

- Sentiment Analysis: The theory enhances market analysis by recognizing repetitive wave patterns influenced by investor sentiment.

- Utilizing Fibonacci Ratios: Traders can apply Fibonacci Ratios within Elliott Wave Theory to determine potential support and resistance levels.

- Informed Decision-Making: By incorporating Elliott Wave Theory into their technical analysis, investors can align their strategies with predicted market movements, leading to more informed decision-making processes.

This analytical tool equips traders with a deeper understanding of market dynamics, allowing for more precise market analysis and potentially improving trading outcomes.

Insights Into Stock Trends

Insights into stock trends can be gained through the application of Elliott Wave Theory, which enables the identification of repetitive and predictable wave patterns. By understanding the concept of five-wave impulse waves followed by corrective waves, investors can potentially predict stock price movements with more accuracy.

Elliott Wave Theory emphasizes the significance of wave degrees and wave characteristics in conducting thorough financial analysis. Utilizing Fibonacci retracement levels in conjunction with Elliott Wave Theory allows traders to pinpoint crucial support and resistance levels in stock prices, aiding in informed trading decisions.

This theory offers a structured framework for interpreting market behavior through wave patterns, providing valuable insights into the dynamics of stock price movements. By recognizing motive waves and corrective waves within the context of Elliott Wave Theory, investors can enhance their technical analysis and make more informed decisions when navigating the complexities of the stock market.

Informed Trading Decisions

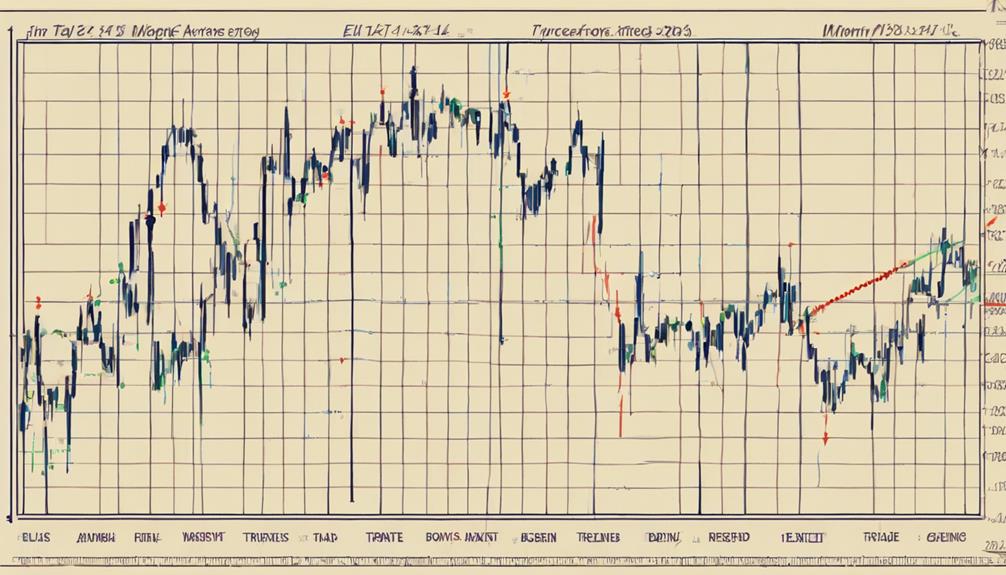

Given the foundational understanding of Elliott Wave Theory and its application in analyzing stock trends, the focus now shifts towards the strategic aspect of making informed trading decisions based on wave patterns. When traders delve into the depths of the Elliott Wave principle, they can harness its power to navigate the markets with precision. Here are five key points to consider in making informed trading decisions:

- Recognizing the repetitive nature of three waves in corrections within a five-wave sequence in a bull market.

- Utilizing Fibonacci numbers to identify potential support and resistance levels in stock prices.

- Distinguishing between impulse waves that drive the main trend and corrective waves that counter it.

- Analyzing market swings to predict future market movements based on collective human behavior.

- Implementing Elliott Wave Theory in chart reading to anticipate trend reversals and enhance trading decisions.

Enhancing Trading Success

Enhancing trading success through the strategic application of Elliott Wave Theory involves meticulous analysis of repetitive wave patterns and their implications on stock price movements. Developed by Ralph Nelson Elliott in the 1930s and further popularized by Robert Prechter through New Classics Library, Elliott Wave Theory identifies distinct patterns in market data.

These patterns, known as Elliott waves, consist of waves A and C moving in the direction of the larger trend, with Wave B typically a corrective wave composed of three sub-waves. Understanding the length of each wave and the relationships between them is crucial for traders aiming to predict potential price movements accurately.

What Are the Benefits of Using Elliott Wave Theory in Stock Trading?

Elliott wave analysis is an essential trading tool for stock traders. It helps identify market trends and potential reversal points, aiding in making more informed trading decisions. By understanding wave patterns, traders can capitalize on price movements and better manage risk, ultimately improving trading performance.

Frequently Asked Questions

What Is the Elliot Wave Theory in Investment Management?

Elliott Wave Theory in investment management is a technical tool that analyzes repetitive wave patterns to predict future stock price movements. It aids in identifying trends, corrections, and reversals, enabling strategic decision-making for portfolio managers.

What Is the Application of Elliott Wave Theory?

The application of Elliott Wave Theory lies in its ability to identify wave patterns in stock prices, aiding traders in forecasting future movements. By analyzing impulse and corrective waves, traders can make informed decisions on market entries and exits.

Is the Elliott Wave Nonsense?

The question of whether the Elliott Wave Theory is nonsense sparks debate. Critics highlight its subjective nature, lack of empirical evidence, and difficulty in consistent application. While some find value in its predictive potential, skepticism persists.

How Accurate Is the Elliott Wave Trading?

Evaluating the accuracy of Elliott Wave trading involves considering wave identification, market dynamics, and trader proficiency. Results vary among traders, with some achieving success and others facing challenges. Combining wave analysis with technical indicators can enhance trading outcomes.

Conclusion

In conclusion, Elliott Wave Theory serves as a valuable tool for investors in analyzing stock market behavior and making informed trading decisions.

By identifying repetitive patterns and utilizing Fibonacci numbers for analysis, investors can gain insights into market trends and predict future movements with greater accuracy.

This theory enhances trading success by providing a framework for understanding market psychology and navigating the complexities of the stock market, making it essential for those looking to make strategic investment choices.