Mastering the MACD indicator can be a meaningful milestone in your trading journey. Understanding its intricacies and applications is crucial for making informed decisions in the market.

Unveiling the mysteries behind MACD's calculations and interpretations can empower you to navigate the complexities of trading with confidence. Explore how this versatile tool can be your ally in spotting potential trends and optimizing entry and exit points.

Take the first step towards unraveling the MACD's potential and unlocking a new realm of trading possibilities.

Understanding MACD Indicator Basics

To grasp the fundamentals of the MACD indicator, begin by understanding how it combines two exponential moving averages (EMAs) to reveal trend direction and shifts in momentum.

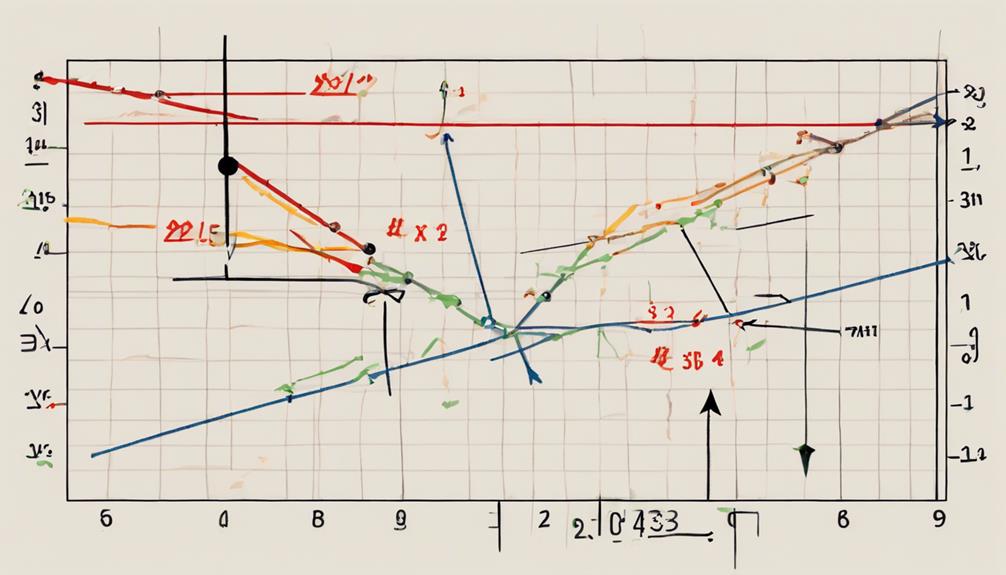

The MACD, short for Moving Average Convergence/Divergence, includes the MACD line, signal line, and histogram for a comprehensive view.

The MACD line is derived by subtracting the 26-period EMA from the 12-period EMA.

Traders utilize the MACD histogram to pinpoint potential buy/sell signals and identify overbought/oversold conditions in the market.

By comprehending the basics of the MACD indicator, individuals in the trading sphere can make more informed decisions based on the strength and direction of the prevailing trend.

This technical tool is pivotal for analyzing market momentum efficiently.

MACD Formula and Calculation

How is the MACD indicator formula calculated to provide insights into market momentum and trend direction efficiently?

The Moving Average Convergence Divergence (MACD) formula involves subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA, creating the MACD line. To further refine signals, a 9-day EMA of the MACD line is computed to generate the signal line. This method of utilizing EMAs assists in identifying potential trend changes and market momentum shifts.

Interpreting MACD Crossovers and Divergences

Interpreting MACD crossovers and divergences can provide valuable insights into potential changes in market trend direction and momentum.

A bullish crossover occurs when the MACD line rises above the signal line, suggesting a possible uptrend, while a bearish crossover happens when the MACD line falls below the signal line, indicating a potential downtrend.

Divergence in MACD compares price movement with MACD movement, highlighting potential trend reversals. Positive divergence, seen when price makes lower lows while MACD makes higher lows, suggests a potential bullish reversal.

Understanding these signals can help you anticipate and react to changes in market direction, whether it's towards an uptrend or a downtrend.

Practical Examples of MACD Application

When applying the MACD indicator in real trading scenarios, traders often seek practical examples to enhance their understanding of its application in analyzing market trends and potential entry or exit points.

Traders use the MACD indicator to identify bullish crossovers, where the MACD line crosses above the signal line, indicating a potential uptrend. Conversely, bearish signals occur when the MACD line crosses below the signal line, suggesting a possible downtrend.

Histogram narrowing signifies potential crossovers, while widening trends indicate strong momentum in the current trend. Positive divergences in MACD can signal upcoming trend reversals to the upside, while negative divergences indicate potential reversals to the downside.

Understanding these examples can help traders make informed decisions based on MACD analysis.

Tips for Using MACD Effectively

To effectively utilize the MACD indicator in your trading strategies, understanding its key principles and signals is essential.

The MACD line, derived from the difference between two moving averages, indicates momentum and potential trend changes. Keep an eye on the MACD line crossing above or below the signal line as this signals buying or selling opportunities.

The MACD histogram visually represents the gap between the MACD line and the signal line, offering a clear view of divergence.

Enhance your trading strategies by combining MACD with other indicators for confirmation.

Before trading with real money, practice using MACD on historical data to develop proficiency in interpreting its signals accurately.

What Are Some Tips for Newbies to Effectively Use the MACD Indicator?

When it comes to mastering the usage guide for MACD indicator, newbies should start by understanding the basics of how it works. It’s important to learn about the different signals it provides and how to use them effectively. Additionally, practicing with historical data can help newbies gain confidence in their ability to interpret MACD signals.

Frequently Asked Questions

How Do You Use MACD for Beginners?

To use MACD as a beginner, watch for crossovers between the MACD line and signal line for buy/sell signals. Visualize market momentum strength with the histogram. Time entry/exit points by understanding exponential moving averages' relationship. Practice with historical data for confidence.

What Is the Best MACD Indicator Strategy?

To maximize your trading success with MACD, stick to default settings of 12, 26, and 9 periods. Utilize crossovers with the signal line for buy or sell signals. Enhance accuracy by combining MACD with indicators like RSI.

What Are the Basic Settings for Macd?

To set up MACD, use a 12-period EMA for short-term moves, a 26-period EMA for long-term trends, and a 9-period EMA for signal smoothing. Customize these settings based on your strategy for effective market analysis.

What Are the 5-Minute MACD Settings?

For your 5-minute MACD, use default settings of 12, 26, 9 for EMA periods. These settings suit short-term trading on a 5-minute chart, helping you spot momentum changes and decide on entry/exit points quickly. Adjust for strategy and market conditions.

Conclusion

As you navigate the turbulent seas of trading, remember that the MACD indicator is your compass, guiding you towards profitable opportunities.

Just as sailors trust their instruments to steer them safely to shore, rely on the MACD to navigate the markets with precision and confidence.

By mastering this powerful tool, you can chart a course towards success, avoiding pitfalls and staying on course towards your financial goals.

Fair winds and following seas in your trading journey.