Mastering Gann Fan angles is critical for traders seeking precise market analysis. Understanding key time and price relationships aids in trend identification and anticipating reversals. Correct placement of Gann Fan lines allows for accurate support and resistance level pinpointing. Analyzing price movements with Gann Fan provides strategic entry and exit points, enhancing decision-making. Traders can use Gann Fan to estimate future price targets effectively. Interpreting price movements through Gann Fan angles offers insights into market dynamics. Avoid common mistakes like cluttering charts and guarantee reliability by following specific rules. Mastery of Gann Fan angles elevates trading strategies for success. Explore deeper insights on Gann Fan techniques.

Gann Fan Angles Overview

In the domain of technical analysis, the Gann Fan angles provide traders with a powerful framework for understanding the intricate interplay between time and price dynamics in the financial markets. Gann angles, a key component of Gann Theory, are drawn from significant price highs and lows to form trendlines that project into the future. These angles are vital in identifying potential price levels where trend reversals may occur.

The 45-degree angle, considered the most important, suggests a strong market trend when prices remain above this angle and a potential reversal when prices fall below it. By applying Gann Fan angles, traders can anticipate critical price levels where trends might change direction, enabling them to make informed trading decisions. Equal spacing between these angles is essential for accurate projections and aligning with the principles of Gann Theory.

Additionally, combining Gann Fan angles with other technical tools like trend lines and moving averages can further enhance the precision and reliability of market analysis for traders.

Understanding Gann Theory Principles

Understanding Gann Theory Principles is essential for traders seeking to master market analysis techniques.

Gann Theory explores the fundamental relationships between price and time in financial markets, offering a unique perspective on trend forecasting.

Gann Theory Basics

What fundamental principles underpin the mathematical and geometric concepts of Gann Theory, as developed by W.D. Gann for examining price movements in financial markets?

Gann Theory is rooted in the use of Gann angles, where the primary angle is set at 45 degrees to analyze trends and forecast potential support and resistance levels. These angles are vital in constructing the Gann Fan indicator, a tool that helps traders identify key price points and potential trend changes.

Price and Time Relationships

Utilizing fundamental mathematical and geometric principles, Gann Theory explores the intricate interplay between price movements and time relationships to provide traders with a structured framework for analyzing market trends and forecasting potential support and resistance levels.

In Gann Theory, the 45-degree angle plays a vital role in representing a key time-to-price relationship for trend analysis. The Gann Fan Indicator, derived from Gann's theory, assists traders in accurately identifying support and resistance levels.

Understanding Gann Theory principles is essential for mastering Gann fan angles and predicting price reversals effectively. By establishing key diagonal support and resistance levels, Gann fan angles offer valuable insights into future price movements, aiding traders in making informed decisions based on price and time relationships.

Application in Trading

The application of Gann Theory principles in trading provides traders with a structured framework rooted in mathematical and geometric concepts to analyze price movements in financial markets effectively. Gann Fan angles play an important role in identifying key support and resistance levels accurately, aiding traders in making informed decisions.

By understanding Gann's 45-degree angle, traders can determine market trends, with prices above signaling a bull market and below indicating a bear market. Gann fan angles offer valuable insights into future price movements and trend strength, enabling traders to anticipate potential market shifts.

Incorporating Gann Theory principles in trading enhances strategic decision-making and improves market analysis skills, empowering traders to navigate financial markets with confidence and precision.

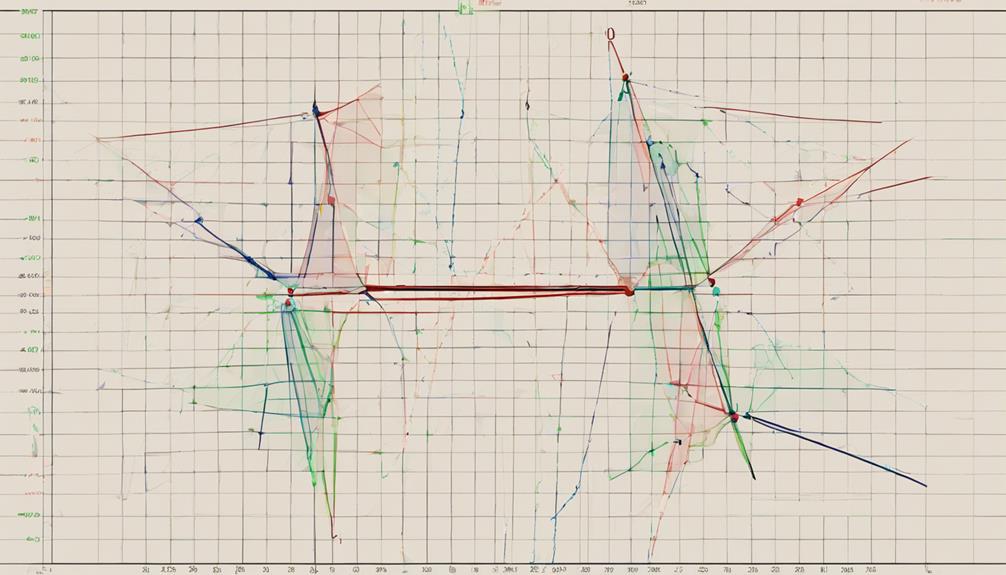

Drawing Gann Fan Lines Correctly

Drawing Gann Fan lines correctly is essential for traders seeking to identify key support and resistance levels with precision. When drawing these lines, traders should keep in mind the following key points:

- Gann Fan lines are drawn from significant price points to pinpoint potential support and resistance levels accurately.

- Correctly drawing Gann Fan lines involves utilizing the 45-degree angle as a reference point for analyzing market trends effectively.

- Understanding the geometric relationships between price and time is vital for accurately placing Gann Fan lines on a chart.

- Gann Fan lines should be extended to intersect recent price action to validate their significance in current market conditions.

Identifying Support and Resistance Levels

By analyzing the intersecting points of Gann Fan angles with price movements, traders can effectively pinpoint key support and resistance levels in the market. Gann Fan angles are instrumental in identifying these levels as they provide a visual representation of potential areas where price might reverse or consolidate.

The 45-degree angle, a critical component of Gann Fan analysis, helps determine major support or resistance levels that could have a substantial impact on price action. Traders leverage these angles to anticipate how price movements might react when they reach specific levels, aiding in making informed trading decisions.

Accurate placement of Gann Fan angles is paramount as it enhances the ability to predict potential price bounces or breakouts with more precision. Understanding how these angles interact with price movements allows traders to establish strategic entry and exit points based on the support and resistance levels identified through Gann Fan analysis.

Analyzing Price Movements With Gann Fan

Utilizing Gann Fan angles enables traders to methodically analyze price movements through precise geometric relationships, aiding in strategic decision-making within the market.

When analyzing price movements with Gann Fan, traders can benefit from the following key points:

- Support and Resistance Levels: Gann Fan angles provide valuable support and resistance levels, helping traders identify ideal entry and exit points in the market.

- Future Price Targets: By effectively utilizing Gann Fan angles, traders can estimate future price targets more accurately, assisting in decision-making for potential profit-taking or stop-loss placement.

- Geometric Relationships: Understanding the significance of the 45-degree angle in Gann Fan is essential for trend analysis, as it indicates the balance between time and price movement.

- Market Trend Assessment: Gann Fan angles enhance the ability to assess the strength and direction of market trends accurately, enabling traders to make informed trading decisions based on a thorough analysis.

Applying Gann Fan for Informed Decisions

Applying Gann Fan principles in market analysis equips traders with a systematic approach to making well-informed trading decisions based on geometric relationships and price movement forecasts. Gann Fan angles play an important role in this process by helping traders identify key support and resistance levels with precision. These angles, derived from geometric principles, offer insights into potential price movements and trend dynamics.

Among these angles, the 45-degree angle holds particular significance as it signifies equilibrium between time and price, indicating stability in the market. Traders can leverage Gann Fan angles not only to assess the strength of a trend but also to anticipate potential trend reversals. By mastering these angles, traders gain a deeper understanding of market dynamics, enabling them to make more informed decisions in their trading strategies.

Ultimately, the application of Gann Fan angles empowers traders to navigate the markets with enhanced precision and confidence.

Mastering Gann Fan Indicator Techniques

The mastery of Gann Fan Indicator techniques involves understanding the basics of the tool, applying Gann angles accurately, and interpreting resulting price movements.

By grasping these points, traders can effectively utilize the Gann Fan to identify key support and resistance levels, predict price movements, and make informed decisions based on the analysis.

Through a combination of technical skills and strategic application, traders can enhance their ability to navigate the complexities of the financial markets with precision and confidence.

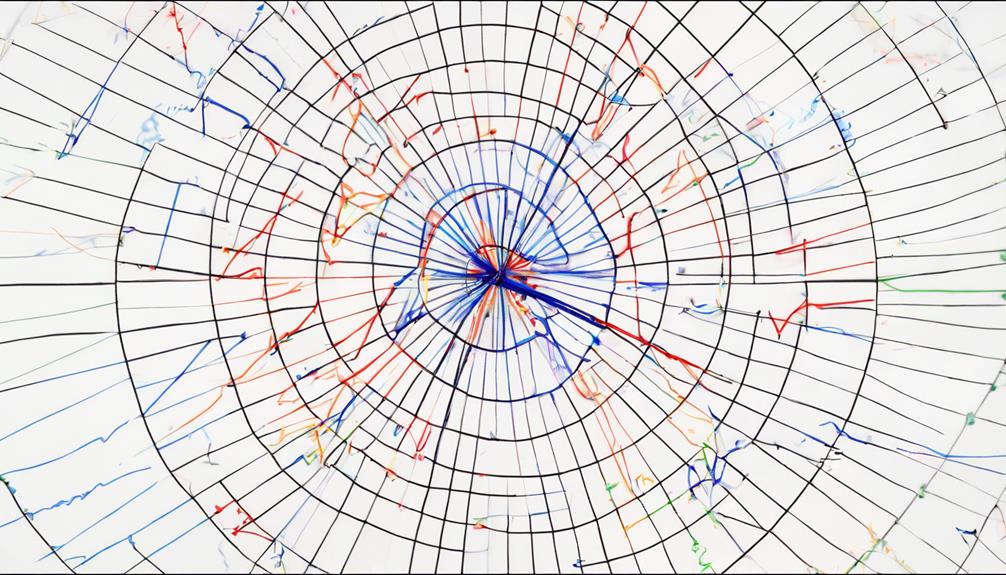

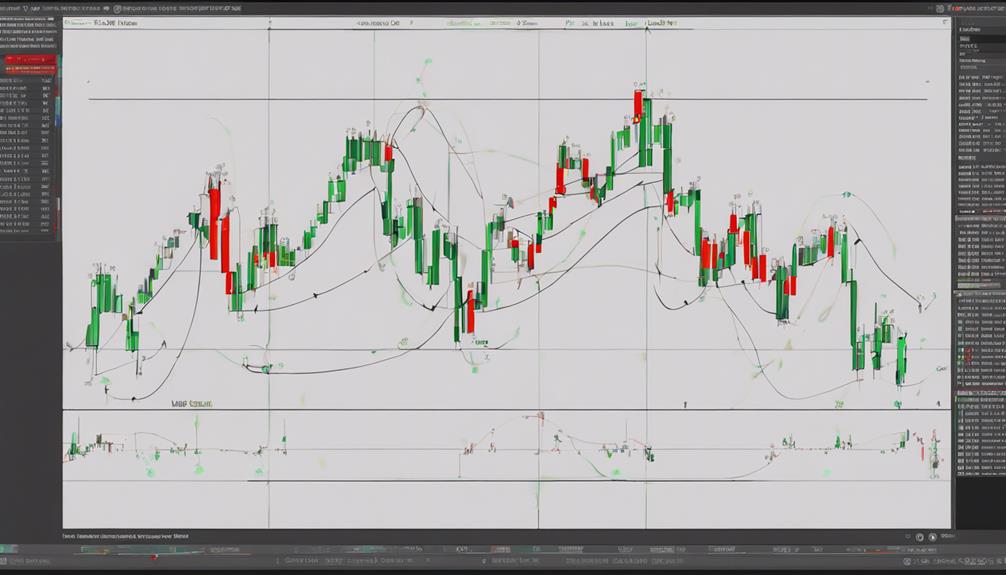

Gann Fan Basics

Understanding the foundational principles of the Gann Fan indicator is essential for traders seeking to master its application in technical analysis.

The Gann Fan basics include:

- Gann Fan consists of nine diagonal lines fanning out from a reference point.

- The primary angle in Gann Fan is set at 45 degrees, representing key time-to-price relationships.

- It helps traders identify important support and resistance levels for making trading decisions.

- Traders can use Gann Fan to analyze the strength of price movements and estimate potential price targets.

Applying Gann Angles

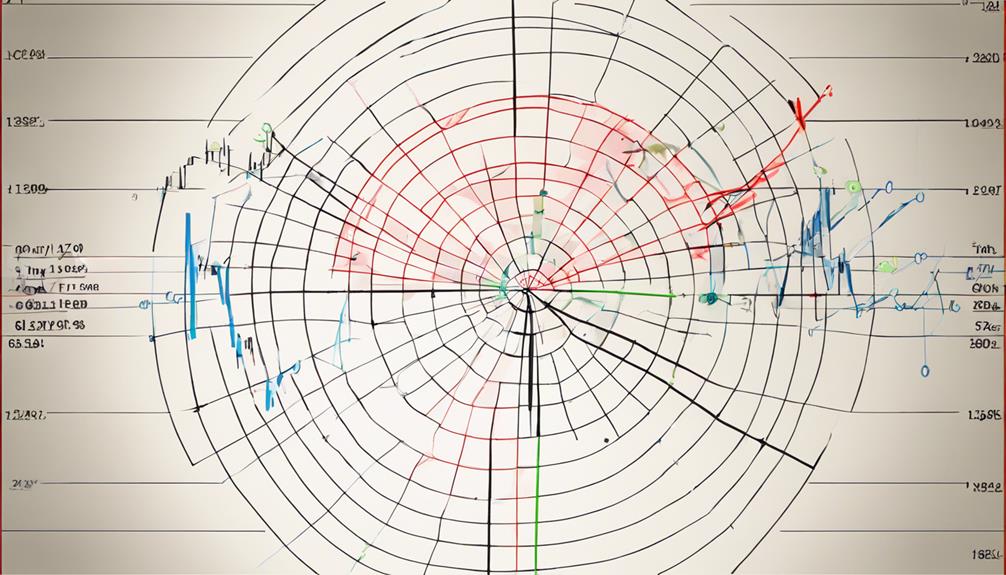

Drawing precise Gann angles on price charts provides traders with a strategic advantage in anticipating potential price movements and making informed trading decisions. Gann angles, derived from the geometric relationship between time and price movements, offer valuable insights into market trends.

The 45-degree angle, among the 9 Gann angles available, holds particular importance for trend analysis. Utilizing the Gann fan indicator, traders can pinpoint essential support and resistance levels by accurately plotting these angles on charts.

When combined with other technical analysis tools, such as moving averages or Fibonacci retracements, Gann angles enhance traders' ability to identify optimal entry and exit points. This integration of Gann angles with established technical indicators strengthens traders' overall analysis and decision-making process.

Interpreting Price Movements

Utilizing the Gann Fan Indicator techniques effectively involves dissecting price movements through a meticulous analysis of the various angles provided, with a keen focus on the pivotal 45-degree angle for insightful market interpretation. When interpreting price movements using Gann Fan angles, traders should consider the following:

- Prices above the 1/1 line on the Gann Fan indicate a bullish market.

- Prices below the 1/1 line suggest a bearish trend.

- Gann Fan angles offer insights into future price movements based on geometric principles.

- Accurate predictions with Gann Fan require equal time and price intervals for proper analysis.

Understanding these angles is essential for precise market trend analysis and decision-making, enabling traders to make informed choices based on the indications provided by the Gann Fan indicator.

Enhancing Technical Analysis Skills

Enhancing technical analysis skills is paramount for traders seeking to navigate the complexities of financial markets with confidence and precision. Gann fan angles, derived from specific geometric principles, play an essential role in identifying key support and resistance levels.

The 45-degree angle within the Gann fan is particularly vital as it helps traders predict price movements accurately. By incorporating Gann fan angles into their technical analysis toolkit, traders can better assess trend strength and determine potential price targets with precision.

Understanding how to interpret these angles can provide valuable insights into market dynamics and enhance decision-making processes. Additionally, combining Gann fan angles with other technical tools can lead to a more thorough analysis of market conditions, empowering traders to make informed decisions and improve their trading strategies effectively.

Mastering the interpretation of Gann fan angles can significantly enhance a trader's ability to analyze price movements and navigate the financial markets successfully.

Implementing Gann Fan in Trading Strategies

Implementing Gann Fan angles in trading strategies allows traders to strategically analyze and anticipate price movements by identifying key support and resistance levels.

By drawing diagonal lines at specific angles, traders can gain valuable insights into the strength of a trend and make well-informed decisions regarding entry and exit points.

Utilizing Gann Fan angles effectively enhances technical analysis skills and empowers traders to navigate the markets with precision and confidence.

Gann Fan Basics

Drawing diagonal lines with the Gann Fan tool from significant price points is a fundamental step in identifying potential support and resistance levels in trading strategies. Traders can implement Gann Fan angles to identify key levels using the 45-degree angle as a reference point for market analysis. Here are some key points to take into account when using Gann Fan in trading strategies:

- Utilize Gann Fan angles to pinpoint potential support and resistance levels.

- Understand the geometric relationships between time and price for forecasting price movements.

- Combine Gann Fan with other technical tools like trend lines and moving averages for thorough analysis.

- Practice drawing accurate lines and interpreting their significance for mastering Gann Fan angles in market trends and reversals.

Trading With Angles

Utilizing Gann Fan angles in trading strategies enhances precision in identifying key support and resistance levels based on geometric principles for accurate trend analysis and decision-making in financial markets. These angles play a crucial role in pinpointing potential trend reversals, guiding traders to make informed decisions.

By recognizing the importance of support and resistance lines within the framework of Gann Fan angles, traders can anticipate price movements more effectively. The 45-degree angle, a critical component of Gann Fan, helps determine whether the market is exhibiting bullish or bearish tendencies, aiding in market trend interpretation.

Integrating Gann Fan angles with other technical indicators amplifies the strength of trading strategies, offering traders a detailed approach to market analysis and trading execution.

Gann Fan Angle Strategies

The strategic application of Gann Fan angles plays an essential role in enhancing traders' ability to anticipate market movements and optimize trading outcomes. Traders can utilize Gann Fan angle strategies to make informed decisions based on key support and resistance levels provided by these angles.

Here are some effective strategies for incorporating Gann Fan angles into trading:

- Identifying Trend Reversals: Gann Fan angles can help traders predict potential trend changes accurately, enabling them to adjust their positions accordingly.

- Determining Entry and Exit Points: The angles in Gann Fan provide valuable guidance in identifying excellent entry and exit points for trades, increasing the probability of success.

- Utilizing the 45-Degree Angle: Understanding the significance of the 45-degree angle in Gann Fan is pivotal as it signifies a balance between time and price, aiding in making well-rounded trading decisions.

- Gaining a Competitive Edge: Mastering Gann Fan angles empowers traders with a strategic advantage in analyzing market trends, leading to more precise trading strategies and improved outcomes.

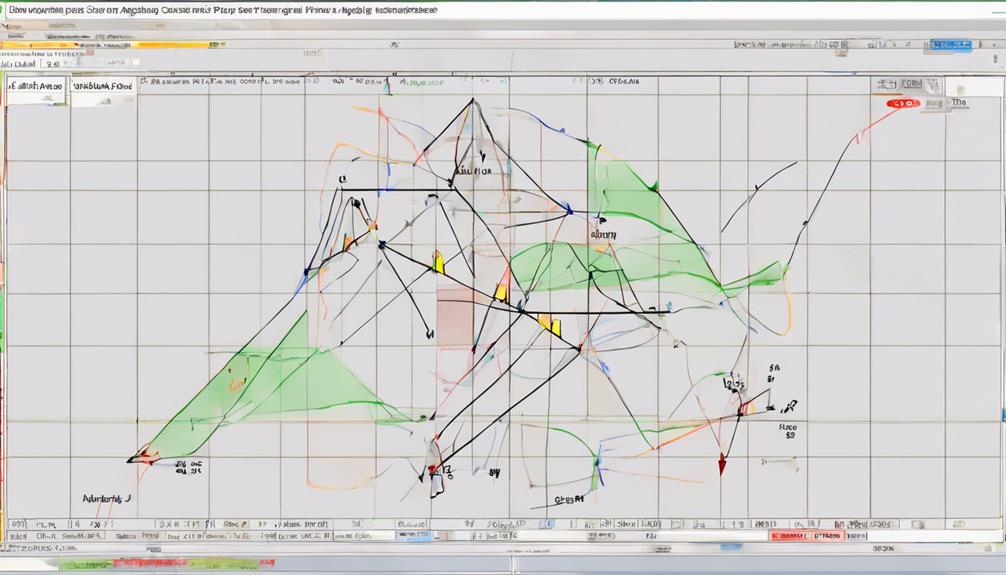

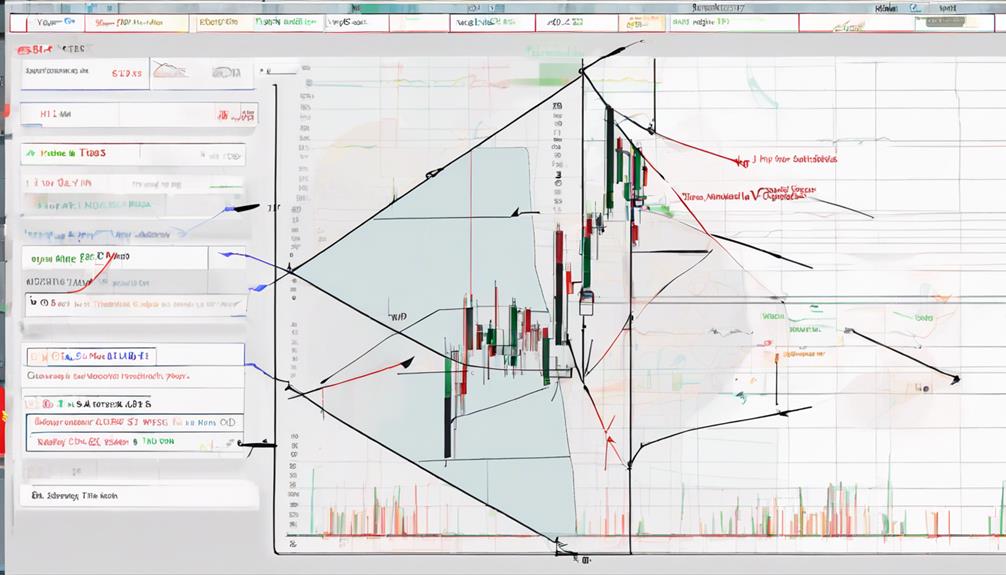

Long Trade Rules With Gann Fan

Anticipating market movements with precision, traders engaging in long trades with Gann Fan meticulously analyze price behavior above the 1/1 line at a 45-degree angle for bullish signals.

When implementing long trade rules with Gann Fan, it is essential to identify the starting point of the trend and draw the Gann Fan lines accordingly to anticipate potential price movements.

Traders should utilize Gann Fan angles not only to set profit targets but also to effectively manage risk in long trades.

Combining Gann Fan analysis with support and resistance levels can further confirm entry points and validate the direction of the trend.

It is vital to implement protective stop-loss orders based on Gann Fan angles to safeguard profits and minimize losses in long trades.

Setting Stop Loss and Take Profit Levels

To effectively manage risk and secure potential profits in trading scenarios, setting precise stop loss and take profit levels is a strategic imperative for traders. When using the Gann Fan tool, it is essential to implement proper risk management strategies. Here are some key points to ponder:

- Setting stop loss levels: Limit potential losses by exiting a trade at a predetermined price point, safeguarding against adverse market movements.

- Determining ideal placement: Use technical analysis and assess market conditions to place stop losses at levels that align with the Gann Fan angles and support/resistance zones.

- Establishing take profit levels: Lock in profits by setting specific price targets to capitalize on favorable price movements.

- Calculating risk-reward ratios: Evaluate the potential reward against the risk involved to make sure that the stop loss and take profit levels are effectively aligned with the trade's objectives.

Validating Breakouts With Gann Fan

Validating breakouts with the Gann Fan tool involves leveraging its angles to confirm significant price movements and trend shifts accurately, aiding traders in making informed decisions. By understanding how to interpret Gann Fan angles, traders can effectively validate breakouts and anticipate potential market movements. Utilizing Gann Fan angles in conjunction with other technical tools can enhance the confirmation of breakouts, providing traders with a systematic approach to analyzing price action.

To illustrate the concept further, the table below demonstrates how Gann Fan angles can assist in validating breakouts:

| Aspect | Description |

|---|---|

| Support Levels | Gann Fan angles help identify key support levels, validating breakouts when prices hold above these levels. |

| Resistance Levels | Gann Fan angles indicate important resistance levels, confirming breakouts when prices surpass these levels. |

| Trend Reversal Points | Gann Fan angles can signal potential trend shifts, aiding traders in validating breakouts and adjusting their strategies accordingly. |

Common Gann Fan Mistakes to Avoid

When utilizing Gann fan angles, traders should steer clear of using incorrect time and price intervals to guarantee the accuracy of their predictions.

It is vital to avoid cluttering the Gann fan chart with excessive angles, as this can lead to confusion and misinterpretations.

Additionally, neglecting the significance of the 45-degree angle and failing to combine Gann fan angles with other technical analysis tools can impede a thorough market assessment.

Pitfalls to Watch

Are traders aware of the potential pitfalls associated with common Gann Fan mistakes, and how can these errors impact their trading strategies? When utilizing Gann Fan angles, it is important to avoid certain missteps to guarantee accuracy and effectiveness in trading decisions.

Here are some common pitfalls to watch out for:

- Avoid drawing Gann fan angles arbitrarily; follow specific rules and calculations for precise placement.

- Be cautious of using incorrect time and price intervals, as it can lead to inaccurate predictions with Gann fan angles.

- Watch out for overcrowding the chart with too many Gann fan lines, as it can make analysis confusing and less effective.

- Steer clear of ignoring the 45-degree angle, as it is a key reference point for identifying market trends and potential reversals.

Key Errors to Avoid

In exploring the domain of Gann Fan analysis, traders must carefully steer clear of common errors that could greatly impact the accuracy and effectiveness of their trading strategies. When working with Gann Fan angles, it is important to avoid using incorrect time and price intervals, as this can lead to inaccurate predictions.

Additionally, overlooking the significance of the 45-degree angle in Gann Fan analysis may result in missing key market trends. Traders should refrain from drawing Gann Fan angles without adhering to the specific rules and calculations involved, as precision is essential for accurate analysis.

Neglecting the importance of Gann Fan support and resistance levels can also hinder the interpretation of market movements. Misinterpreting Gann Fan angles and their implications on future price movements should be avoided to enhance trading strategies.

Gann Fan Reliability in Trading

Gann Fan angles exhibit a high degree of reliability in trading due to their precise identification of critical support and resistance levels. Traders heavily rely on these angles for their ability to predict future price movements accurately. Here are some reasons why Gann Fan angles are considered reliable in trading:

- Accurate Identification: Gann Fan angles excel in pinpointing key support and resistance levels, providing traders with valuable insights into potential market turning points.

- Geometric Principles: These angles are rooted in geometric principles, offering a unique and structured approach to analyzing market dynamics.

- Price Movement Prediction: Traders use Gann Fan angles to forecast future price movements with a high degree of precision and confidence, aiding in strategic decision-making.

- Trend Analysis: Gann Fan angles help traders assess trend strength and potential reversals, enabling them to adapt their trading strategies accordingly.

Frequently Asked Questions

What Are the Most Important Gann Angles?

The most vital Gann angles, especially in the context of Gann fan techniques, applying Gann angles, and Gann fan strategies, include the 45-degree angle.

This angle is pivotal for identifying robust support and resistance levels and signifies a balanced market condition.

Traders commonly rely on the 45-degree angle for trend analysis and price projection, making it a key reference point for market participants seeking to make informed trading decisions.

How to Use Gann Fan in Trading?

When utilizing Gann Fan in trading, traders can employ this technical analysis tool to develop robust trading strategies by identifying key support and resistance levels.

By analyzing price movements and time relationships, Gann Fan assists in forecasting potential price targets and determining trend strength accurately.

Integrating Gann Fan with other technical tools like trend lines and moving averages enhances traders' ability to make informed decisions, enabling a thorough approach to analyzing market trends effectively.

What Is the Golden Ratio of Gann?

The Golden Ratio of Gann is often associated with Fibonacci ratios. It denotes a 45-degree angle pivotal in Gann analysis. This angle signifies a balanced 1:1 relationship between time cycles and price levels, aiding in the identification of vital support and resistance zones.

Traders rely on this angle to forecast price movements and potential trend reversals. Understanding and integrating the 45-degree angle enhances the precision of Gann fan analysis, enriching trading strategies with valuable insights.

What Is the Gann Rule of 4?

The Gann Rule of 4 is a foundational principle in Gann analysis that emphasizes the interplay between price and time. This rule posits that one unit of price corresponds to one unit of time, enabling traders to pinpoint potential reversal zones.

Conclusion

To sum up, mastering Gann fan angles is a valuable skill for traders seeking to identify key support and resistance levels and make informed decisions based on price movements. By understanding Gann theory principles, drawing fan lines accurately, and avoiding common mistakes, traders can enhance the reliability of their trading strategies.

Remember, just as a compass guides a traveler through unknown territory, the Gann fan can help navigate the complex world of financial markets with precision and confidence.