When it comes to trading, they say, 'The trend is your friend.' But how do you identify and capitalize on those trends effectively?

Understanding moving averages can be a game-changer in your trading journey. By mastering the practical applications and strategies of moving averages, you can gain insights into the market trends, improve your entry and exit points, and enhance your overall trading performance.

So, are you ready to unlock the potential of moving averages and take your trading skills to the next level?

Choosing the Right Moving Average

When selecting the appropriate moving average for your trading strategy, consider your preference for Simple Moving Averages (SMA) or Exponential Moving Averages (EMA) based on your trading style and sensitivity to recent price movements.

SMAs are commonly used for longer-term trends, providing a smoother representation of price action. On the other hand, EMAs, giving more weight to recent price data, are often favored for shorter-term trends or quick signals, especially in volatile markets or when trading a specific stock.

Experimenting with different lengths of moving averages can help in identifying trend reversals and optimizing your trading decisions. The choice between SMA and EMA, along with selecting the appropriate length, significantly impacts the accuracy of trend identification and signal generation in your trading endeavors.

Setting Up Moving Averages

Consider the charting platform or trading software you'll utilize to plot the moving averages, ensuring it offers the necessary functionality for your analysis.

Select the time frame for the moving average calculation, like a 50-day moving average for a 50-day period.

Choose between a Simple Moving Average (SMA) or an Exponential Moving Average (EMA) based on your trading strategy.

Plot the moving average on the price chart using the chosen settings and parameters.

Make adjustments to the moving average settings as required, such as modifying the length or data source, to align with your analysis needs.

This setup will provide insight into recent price trends, potential support and resistance levels, and assist in determining stop-loss levels effectively.

Interpreting Moving Average Crossovers

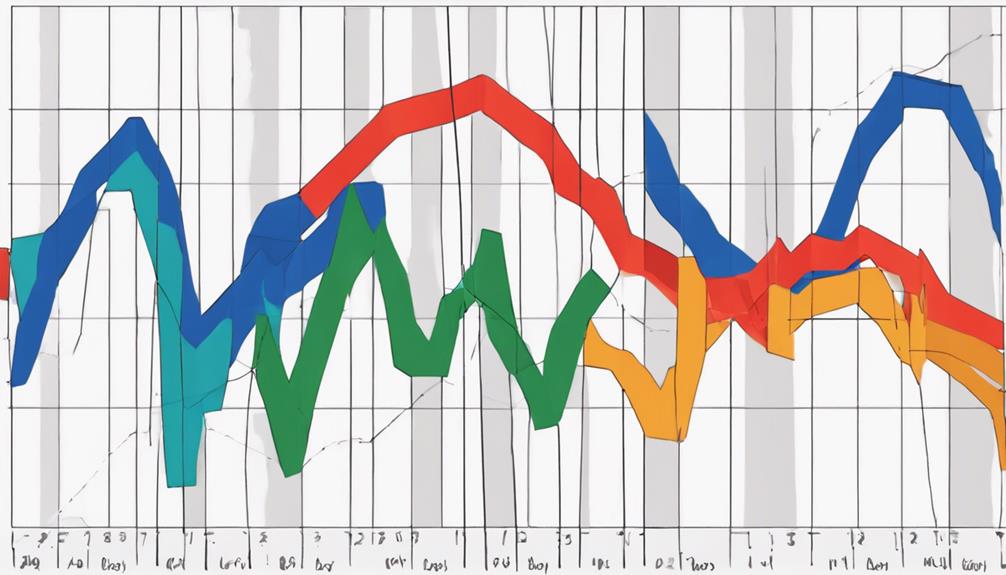

Interpret moving average crossovers as key signals for potential shifts in market trends, aiding traders in decision-making processes and strategy adjustments. These crossovers involve the short-term moving average crossing above or below the long-term moving average.

A bullish crossover, where the short-term moving average moves above the long-term moving average, can indicate an uptrend and potentially generate buy signals. Conversely, a bearish crossover, with the short-term moving average crossing below the long-term moving average, may suggest a downtrend and signal potential sell opportunities.

Traders frequently rely on these moving average crossovers to confirm changes in market direction, allowing them to adjust their trading strategies accordingly. Understanding the implications of these crossovers is crucial for informed decision-making in trading scenarios.

Using Moving Averages for Trend Identification

To effectively identify trends using moving averages, analyze price positions relative to the average line to determine uptrends or downtrends. When considering moving averages for trend identification, keep in mind the following key points:

- Long-term investors often rely on simple moving averages like the 200-day SMA for trend analysis.

- The golden crossover, where the 50-day SMA crosses above the 200-day SMA, signals a potential upward trend reversal.

- Moving averages can act as dynamic support and resistance levels, aiding in trend identification.

- Implementing a trailing stop loss strategy based on moving averages can assist in managing risk and securing profits during trending market conditions.

Using moving averages strategically can provide valuable insights for trend identification and decision-making for traders and investors alike.

How Can I Apply Moving Averages in Practical Case Studies?

When utilizing practical moving averages case studies, it is crucial to understand their application. By analyzing real-life scenarios, you can observe how moving averages can help identify trends, predict future movements, and make informed decisions. These case studies provide valuable insights into how to effectively apply moving averages in various situations.

Implementing Moving Averages in Trading Strategies

When incorporating moving averages into trading strategies, selecting the appropriate length and type based on your trading style and goals is crucial. The length of the moving average determines its responsiveness to recent time periods; shorter moving averages react quicker to price changes, while longer moving averages provide a smoother trend indication.

Use moving averages to identify potential entry and exit points in the market by observing crossovers or price interactions with the moving average line. Ensure that the moving average aligns with your trading timeframe, adjusting the number of data points accordingly.

Can Following a Step-by-Step Guide Help Improve the Application of Moving Averages?

Yes, following a moving averages tutorial can definitely help in improving the application of moving averages. By learning the step-by-step process of using moving averages effectively, individuals can gain a better understanding of how to interpret the data and make informed decisions based on the trends.

Frequently Asked Questions

How Do You Use Moving Average Effectively?

To use moving averages effectively, determine your trading style and objectives to choose between SMA or EMA. Consider market volatility and your time horizon to find the optimal MA length. Combine MAs for reliable signals and adjust strategies for changing market conditions.

What Are the Practical Applications of Moving Average?

Looking to enhance your trading strategy? Moving averages provide dynamic support/resistance levels, identify retracement zones for potential reversals, and help manage risks with trailing stop losses. How can you leverage these tools effectively?

What Is the 5 8 13 21 EMA Strategy?

The 5 8 13 21 EMA strategy uses specific Exponential Moving Averages like 5, 8, 13, and 21 to identify trends and entry/exit points. Combining shorter and longer EMAs, traders seek timely buy/sell signals for effective market analysis.

How Do You Apply a Simple Moving Average?

To apply a simple moving average, sum up closing prices over a set period and divide by the number of periods. Choose a timeframe based on your strategy. Plot it on a chart for trend analysis.

Conclusion

In conclusion, mastering the art of applying moving averages is like having a compass in the unpredictable sea of trading. With the right tools and strategies, you can navigate through price trends with precision and confidence.

By understanding the nuances of different moving averages and incorporating them into your trading arsenal, you can uncover hidden opportunities and make informed decisions that pave the way to success in the markets.

Dive into the world of moving averages and chart your course to profitability.