Exploring the intricate realm of Gann Theory unveils a realm of strategic insights that can significantly impact trading outcomes.

By honing in on five pivotal tips, traders can navigate this complex landscape with a sharper edge.

From decoding Gann angles to leveraging intricate tools like fans and squares, each tip holds the promise of unlocking a deeper understanding of market movements.

As the market ebbs and flows, these essential guidelines serve as a compass, guiding traders towards more informed decisions.

Understanding Gann Theory Basics

To grasp the foundational principles of Gann Theory, one must delve into the geometric constructs and mathematical angles that underpin its predictive capabilities in financial markets. Gann Theory, developed by the legendary trader W.D. Gann, revolves around the concept of geometric angles and their relationship with time and price. These angles play a crucial role in identifying potential support and resistance levels within the market, aiding traders in determining entry and exit points for their positions.

By applying Gann Angles, such as the 1×1 angle, traders can visualize the trend dynamics and anticipate significant price movements based on the geometric relationships present in the market.

Moreover, Gann Theory emphasizes the cyclical nature of price movements and the importance of understanding market trends over time. By incorporating geometric principles into trading strategies, investors can gain a deeper insight into the underlying forces driving market fluctuations, leading to more informed decision-making processes.

Applying Gann Angles Effectively

The application of Gann angles in technical analysis serves as a pivotal tool for traders seeking to gauge trend strength and identify key support and resistance levels within financial markets.

Gann angles are drawn from significant price points, with the 1×1 angle being the most crucial, representing a 45-degree slope in Gann theory.

Various Gann angles like 2×1, 1×2, and 3×1 offer insights into bullish or bearish market conditions, aiding in predicting trend changes.

These angles can also be plotted as Gann fans to confirm trends and assess trend strength accurately.

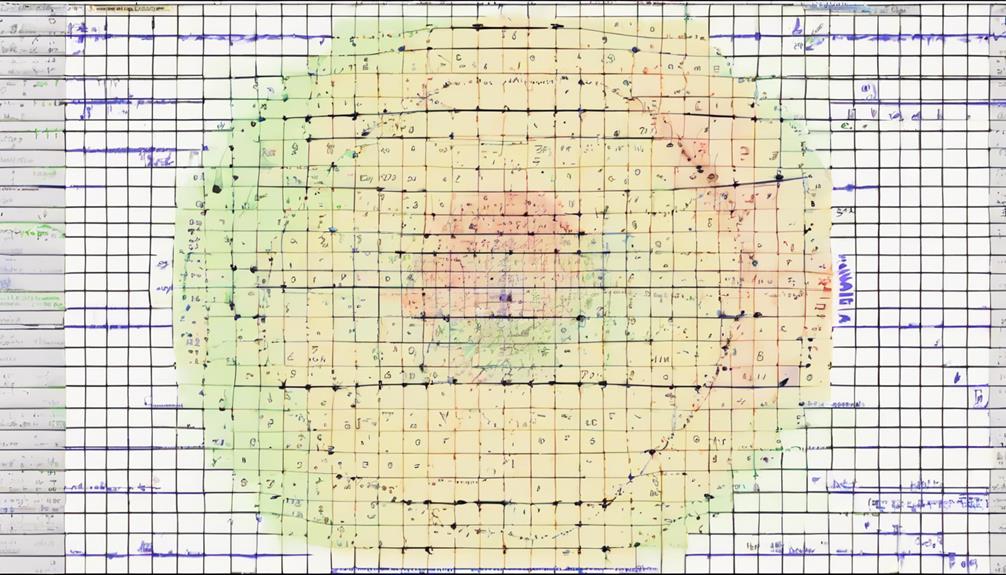

Utilizing Gann Square of Nine

Utilizing the Gann Square of Nine grid provides traders with a structured method to pinpoint key price levels and anticipate market turning points efficiently. The Gann Square is a powerful tool within Gann Theory that aids in price analysis and forecasting by identifying crucial support and resistance levels. Here are five essential tips for effectively utilizing the Gann Square of Nine:

- Spiral Pattern: The numbers in the Gann Square of Nine follow a spiral pattern, assisting traders in identifying the sequence of key price levels.

- Cardinal Points: The cardinal points on the square, which are 90 degrees apart, play a significant role in price analysis and determining potential turning points.

- Key Price Levels: Traders can use the Gann Square to forecast key price levels where the market is likely to make important decisions.

- Turning Points: By analyzing the structure of the Gann Square, traders can anticipate potential market turning points more accurately.

- Market Decision-Making: The Gann Square provides a visual representation of important levels, aiding traders in making informed market decisions based on historical price movements.

Mastering Time and Price Squaring

Mastering the alignment of time and price is a critical aspect of Gann Theory, essential for identifying potential reversal points in market movements. Gann emphasized the importance of squaring time and price to achieve harmonic market movements. The Gann Square of Nine is a valuable tool in this process, providing a visual representation of time and price relationships that aid in establishing decision-making levels.

By geometrically squaring time and price, traders can better forecast market reversals. Through the utilization of Gann Square of Nine and Gann Angles, specific future points can be pinpointed to anticipate potential trend changes accurately. This technique enhances the precision of analyzing market movements and assists traders in making informed decisions based on the alignment of time and price.

Mastering time and price squaring is key to unlocking the predictive power of Gann Theory and gaining insights into future market dynamics.

Leveraging Gann Fans for Analysis

When considering market trend analysis through Gann Theory, leveraging Gann Fans provides traders with a comprehensive toolset for identifying key support and resistance levels.

Gann Fans consist of 9 angles, including the 1×1, 2×1, and 1×2 angles, crucial for trend analysis. These angles play a vital role in pinpointing significant pivot points and forecasting potential price movements.

Traders rely on Gann Fans to confirm trends and detect potential trend changes in the market, making them an essential tool for technical analysis. The 45-degree angle within Gann Fans holds particular importance as it indicates trend strength and potential market momentum.

What Are the Key Tips for Applying Gann Theory Successfully?

Applying Gann theory effectively involves mastering the use of geometric angles, time cycles, and price patterns to analyze market movements. A key tip for success is to thoroughly understand the principles of Gann theory and practice applying them consistently in different market conditions.

Frequently Asked Questions

What Are the Basics of Gann?

The basics of Gann Theory encompass understanding natural geometric shapes and angles, utilizing Gann Angles for predicting price movements with high accuracy, and studying trend lines to forecast market trends and reversals effectively.

What Is the 9 5 Gann Rule?

The 9 5 Gann Rule, a fundamental principle of Gann Theory, highlights market timing intervals at 9 and 5 days. This rule, rooted in natural time cycles, aids traders in predicting market reversals. Understanding it enhances decision-making in timing markets.

What Is the Gann's Rule of Four?

Gann's Rule of Four divides price and time into four equal parts, emphasizing symmetry in market movements. It aids traders in identifying key levels and potential reversals, offering insights into trends and price movements for accurate predictions.

What Are the Important Angles of Gann?

Gann Theory highlights critical angles like 1×1, 1×2, 1×4, and 2×1 for analyzing market trends. The 1×1 angle, akin to a compass guiding a ship, signifies market equilibrium. Understanding these angles is vital for informed trading decisions.

Conclusion

In conclusion, mastering the principles of Gann Theory and effectively applying its tools and techniques can greatly enhance trading success.

As the adage goes, 'knowledge is power,' and understanding the intricacies of Gann Theory can provide traders with the necessary insight to make informed decisions in the market.

By incorporating Gann angles, squares, fans, and time-price analysis, traders can confidently navigate the complexities of the financial markets and improve their trading outcomes.