You've grasped the basics of Advance Decline Line Analysis, but have you truly unlocked its full potential? Imagine being able to anticipate market shifts with precision and confidence, all by following a straightforward five-step guide.

From understanding the fundamentals to interpreting intricate patterns, this method could be the key to elevating your trading game. Stick around to uncover how this guide can revolutionize your approach to market analysis and decision-making.

Understanding Advance Decline Line

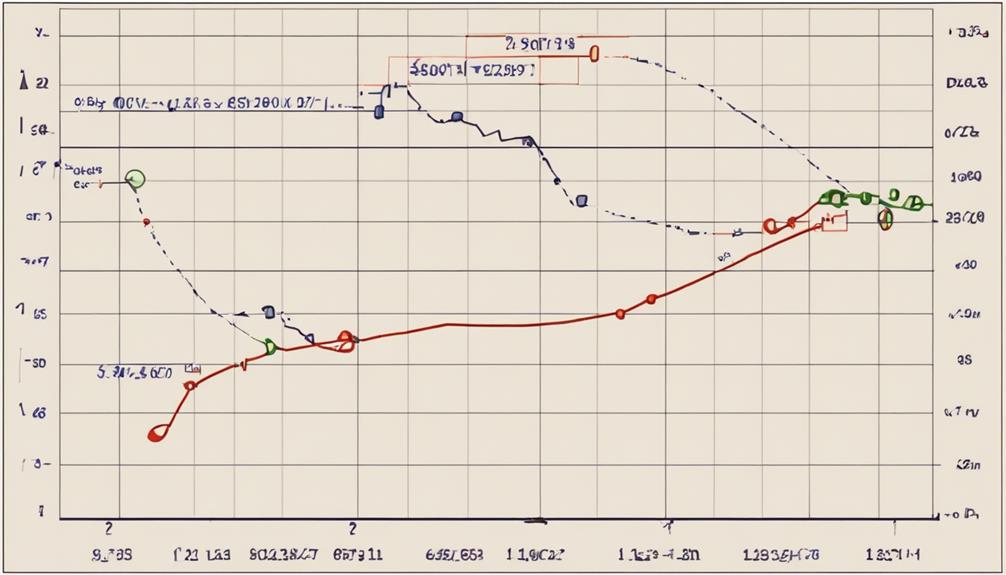

When analyzing the stock market, understanding the Advance-Decline Line (A/D Line) is crucial for evaluating market breadth and individual stock participation. The A/D Line serves as a valuable tool in assessing market sentiment, confirming price trends, and pinpointing potential reversals.

By examining the A/D Line, traders can gauge the strength of trends and make well-informed trading decisions. Moreover, this indicator helps in identifying divergences between the A/D Line and price movements, providing insight into potential market shifts.

The A/D Line's role as a cumulative indicator of market breadth showcases the collective performance of stocks, offering a comprehensive view of participation levels across various securities. Mastering the intricacies of the A/D Line can significantly enhance your market analysis skills.

Calculating ADL

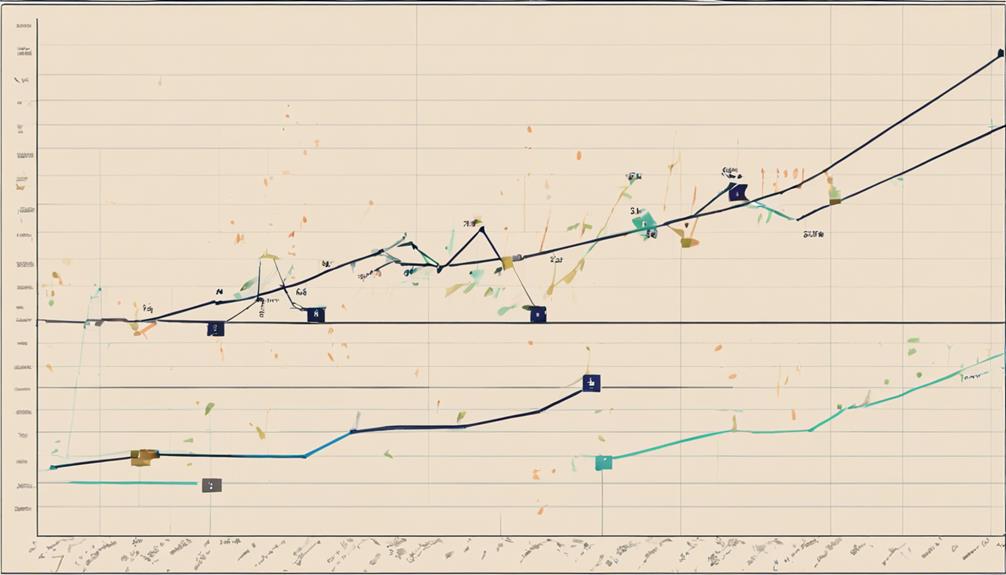

To calculate the Advance-Decline Line (ADL), subtract the number of declining stocks from the number of advancing stocks on a daily basis. This calculation helps traders gauge market breadth and sentiment. Here's a breakdown to guide you through calculating ADL:

- ADL values are cumulative, reflecting net advancing and declining stocks over time.

- The formula for ADL is ADL = Prior ADL + Net Advances, where Net Advances = Advancing Stocks – Declining Stocks.

- ADL calculations provide insights into trends and overall market participation.

- Daily updates of ADL values can signal potential trend reversals and market shifts.

Understanding how to calculate ADL is crucial for utilizing this indicator effectively in analyzing stock market trends.

Interpreting ADL Patterns

Analyzing ADL patterns provides valuable insights into market breadth and the level of participation among individual stocks, aiding in confirming the strength of prevailing market trends. The AD Line, a key stock market indicator, helps assess market sentiment and potential trend reversals.

Divergence in ADL patterns, where the AD Line moves opposite to the market index, can indicate shifts in market breadth. Bullish divergence, where the AD Line trends upward while the index trends downward, suggests optimism in the markets.

Understanding these technical aspects is essential for interpreting ADL patterns accurately. By recognizing these patterns and their implications for individual stocks, investors can gain a better understanding of market dynamics and make more informed decisions regarding trend changes and market sentiment.

Leveraging ADL in Trading

Leveraging the Advance-Decline Line (ADL) in trading enhances your ability to assess market breadth and confirm trends accurately. When incorporating ADL into your trading strategy, consider the following:

- Use ADL to gauge market sentiment and identify potential reversals.

- Combine ADL with other technical indicators for more precise trend analysis.

- Gain insights into market internals by understanding individual stock participation through ADL analysis.

- Strengthen your trade decisions and overall market analysis by leveraging ADL effectively.

Is the Five-Step Guide to Advance Decline Line Analysis Sufficient for Comprehensive Understanding of the Topic?

The Five-Step Guide to Advance Decline Line Analysis provides a solid foundation for understanding advanced decline line decoding. However, for a more comprehensive understanding, additional research and practical application may be necessary to fully grasp the nuances of this topic.

Can a Comprehensive Guide Help Improve Advance Decline Line Analysis?

Yes, a comprehensive guide on advanced decline line decoding can significantly help improve one’s analysis. By understanding the intricacies of this tool, investors can make more informed decisions. A comprehensive guide can provide valuable insights and strategies to effectively interpret and utilize the advanced decline line.

ADL Best Practices

When implementing ADL best practices, ensure you focus on confirming trend strength and potential reversals effectively.

The Advance Decline Line (ADL) is a valuable technical indicator used to assess market breadth and sentiment. It shows the cumulative value of the difference between advancing and declining stocks each day.

By analyzing the ADL chart, traders can identify potential trend reversals and confirm the strength of existing trends. The ADL tells traders whether a large or small number of stocks are participating in a market move, providing insights into market sentiment and participation trends.

To maximize the utility of ADL, combine its analysis with other techniques for a comprehensive understanding of market dynamics.

Frequently Asked Questions

What Is the Advance Decline Line Strategy?

The advance decline line strategy tracks net advancing and declining stocks, offering insights into market breadth and sentiment. It helps forecast market direction, confirm trends, and identify potential reversals. Analyzing it empowers you to make informed decisions for market participation.

How Do You Calculate the Advance Decline Line?

To calculate the Advance Decline Line, subtract declining stocks from advancing ones daily. The net advances, showing the difference, are pivotal in determining A/D Line values. It's a cumulative indicator reflecting market breadth and sentiment.

What Is Advance Decline Line Chart?

The Advance-Decline Line chart tracks individual stock participation in market movements. It helps predict market stock performance by comparing advancing and declining stocks. Investors, stockbrokers, and financial experts rely on it for trend analysis.

What Is the 3 5 7 Rule in Trading?

To understand the 3 5 7 rule in trading, combine moving averages of 3, 5, and 7 days. This method reveals short-term trends and potential market shifts. By smoothing price data over different periods, you gain valuable insights for informed trading decisions.

Conclusion

You have now mastered the Five-Step Guide to Advance Decline Line Analysis. Did you know that historically, a rising ADL has preceded market rallies, while a declining ADL has preceded market declines?

By incorporating ADL analysis into your trading strategy, you can gain a competitive edge in predicting market trends and making informed decisions.

Keep practicing and refining your skills to achieve even greater success in the world of trading.