In the realm of trading strategies, harnessing the power of indicators like Chaikin Money Flow can provide valuable insights into market dynamics. By exploring three effective ways to trade with this indicator, traders can unlock potential opportunities for informed decision-making.

Whether through the Zero Line Cross Strategy, Trend Line Strategy, or Divergence Strategy, each method offers a unique perspective on market sentiment and price action. Understanding how these approaches can be integrated into trading routines can be a game-changer for those seeking to navigate the complexities of financial markets.

Zero Line Cross Strategy

Utilizing the Zero Line Cross Strategy with Chaikin Money Flow (CMF) offers traders a clear and objective method to interpret market dynamics and make informed trading decisions based on shifts in buying and selling pressures.

When CMF crosses above the zero line, indicating buying pressure, traders may consider potential uptrends. Conversely, if CMF crosses below zero, signaling selling pressure, a downtrend might be anticipated. Significant crosses at the zero line are often sought by traders to confirm trend changes and determine entry or exit points.

The Zero Line Cross Strategy with CMF proves valuable in identifying shifts in market sentiment, assisting traders in navigating market fluctuations and making strategic trading decisions based on concrete data rather than emotional impulses.

Trend Line Strategy

Have you considered how trend lines can enhance your trading strategy with Chaikin Money Flow (CMF)? When combining trend lines with CMF, traders gain valuable insights for making informed trading decisions. Here are some key points to consider when using the trend line strategy with CMF:

- Trend lines help identify trend confirmation and potential trend reversals.

- CMF can validate the direction of the trend line, providing entry/exit points.

- The combination of CMF and trend lines offers visual cues for buying or selling opportunities.

- Utilizing trend lines with CMF enhances the accuracy of trend analysis, aiding in spotting profitable trades.

Divergence Strategy

When incorporating the Divergence Strategy with Chaikin Money Flow (CMF), traders can leverage price and indicator movements to identify potential trend reversals. Bullish divergence, characterized by price making lower lows while CMF forms higher lows, suggests increasing buying pressure and a possible upward price movement.

On the other hand, bearish divergence, where price forms higher highs while CMF shows lower highs, indicates rising selling pressure and a potential downturn in price. By recognizing these divergences, traders can gain early indications of changes in pressure dynamics within the market, allowing them to anticipate trend reversals before they fully materialize.

This strategy provides traders with a valuable tool to make informed decisions based on the relationship between price movements and CMF readings.

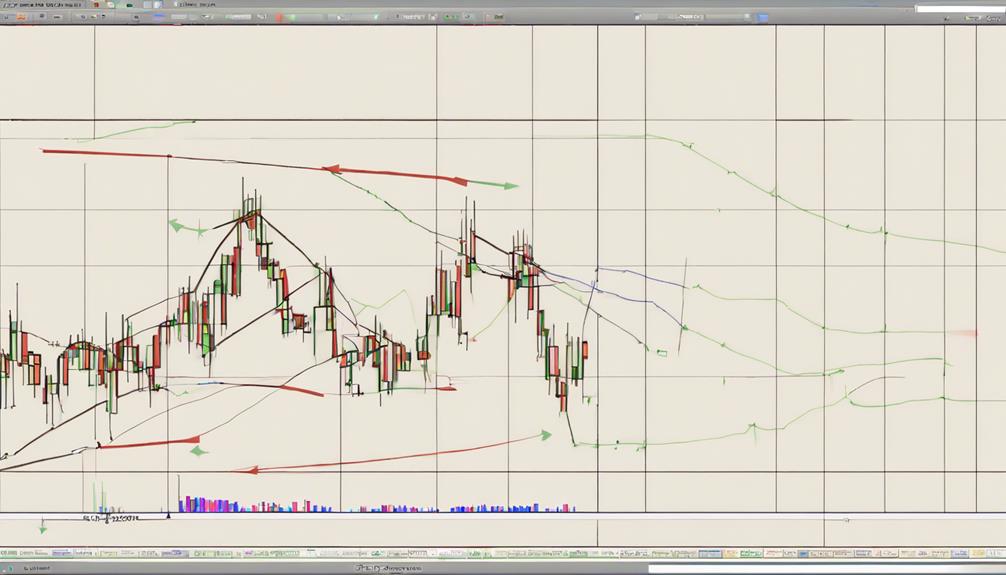

Charting Example for CMF

Effectively incorporating Chaikin Money Flow (CMF) into charting involves plotting the indicator below the price chart to analyze buying and selling pressure dynamics in the market. When utilizing CMF for charting, traders observe the following key points:

- CMF values above zero signify buying pressure, while values below zero indicate selling pressure.

- Traders use CMF to confirm trends by seeking consistent movement above or below zero.

- Understanding CMF charting aids in making well-informed buy or sell decisions based on money flow.

- The CMF charting example illustrates how the indicator complements price action for effective trend analysis.

Trading Techniques With CMF

Incorporating trading techniques with Chaikin Money Flow (CMF) involves leveraging its ability to identify buying and selling pressure dynamics to make informed decisions in the market. Traders can employ various strategies like zero line crosses, analyzing indicator moves, and interpreting bullish and bearish signals to determine entry and exit points.

Utilizing CMF in conjunction with trend lines and volume-weighted averages can enhance the accuracy of trading decisions. Monitoring CMF periods for readings above or below zero can indicate trend strength and potential reversals, aiding in strategic decision-making.

Divergence between CMF and price movements can also serve as a valuable tool for identifying trend reversals and implementing effective trading strategies based on technical analysis of Chaikin Money Flow.

Frequently Asked Questions

What Is the Best Setting for Chaikin Money Flow?

The optimal setting for Chaikin Money Flow (CMF) varies based on individual trading preferences and market conditions. Traders should experiment with different periods to align with their strategy and risk tolerance, adjusting for sensitivity and trend smoothness.

How to Trade With Chaikin?

Trading with Chaikin Money Flow involves analyzing price-volume relationship for trend confirmation. Look for bullish/bearish crosses at zero line for signals. Combine CMF with indicators like moving averages for improved trend identification. Divergence from price signals potential reversals.

Is Chaikin Money Flow a Good Indicator?

Chaikin Money Flow is a valuable indicator, offering insights into market buying and selling pressure. Traders find it beneficial for trend analysis and confirming price movements. When used alongside other indicators, it enhances the understanding of market conditions.

What Is the CMF Strategy in Trading?

The CMF strategy in trading involves utilizing the Chaikin Money Flow indicator to gauge buying and selling pressure in a stock. Traders rely on CMF values above or below zero to identify trends and potential reversals.

Conclusion

In conclusion, integrating the Chaikin Money Flow indicator into trading strategies offers valuable insights into market trends and potential reversals. By utilizing the Zero Line Cross, Trend Line, and Divergence strategies, traders can make informed decisions based on buying and selling pressure.

Charting examples demonstrate the indicator's effectiveness in confirming trends. With these techniques, traders can enhance their trading decisions and maximize profits, painting a clearer picture of market dynamics.