Utilizing candlestick patterns in options trading strategies offers traders a nuanced approach to market analysis that goes beyond mere price movements. These visual representations of price action can serve as valuable indicators of potential market shifts, guiding traders towards more informed decision-making processes.

By understanding how specific candlestick formations correlate with market behavior, traders can gain a competitive edge in navigating the complexities of options trading. The integration of candlestick patterns into options strategies opens up a realm of possibilities for traders seeking to optimize their performance and capitalize on market opportunities.

Identifying Key Candlestick Patterns

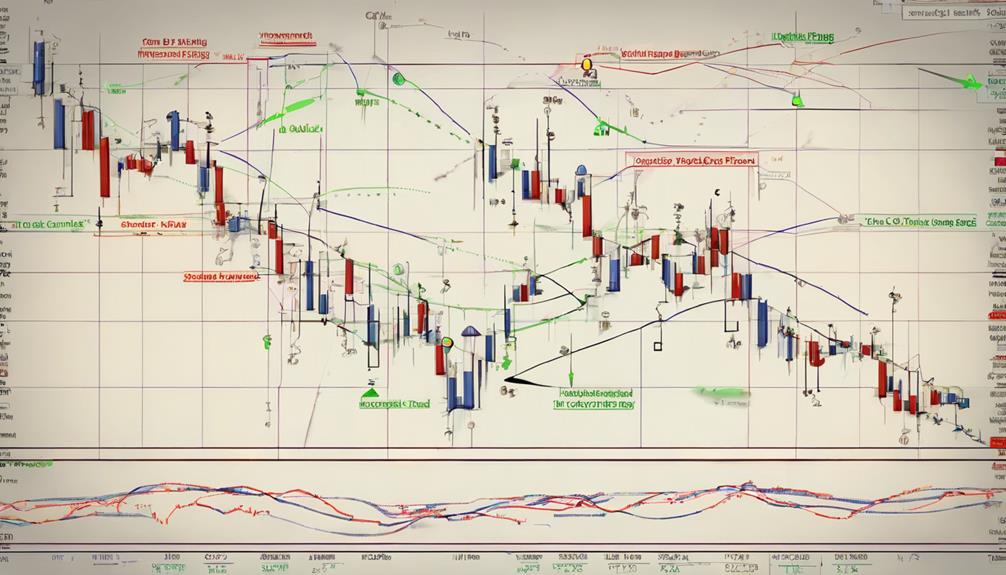

To proficiently navigate the complexities of options trading, mastering the skill of identifying key candlestick patterns is imperative for traders seeking to make informed decisions and optimize their strategies. Candlestick patterns such as Doji and Hammer play a crucial role in signaling potential price reversals and entry points for options trades.

Understanding the significance of these patterns is paramount as they provide valuable insights into market sentiment, aiding in making accurate predictions. By combining candlestick patterns with technical indicators, traders can enhance the effectiveness of their options trading strategies, enabling them to react swiftly to changing market conditions.

These patterns serve as visual tools that assist traders in interpreting price movements and making strategic decisions in the dynamic world of options trading.

Leveraging Candlestick Patterns for Options

Candlestick patterns serve as invaluable tools for options traders, enabling them to leverage market insights and enhance decision-making processes. By recognizing bullish and bearish patterns, traders can determine potential entry and exit points while gauging market sentiment. Specific patterns like engulfing patterns or hammers can offer indications of impending price movements in options trading.

Combining these patterns with options strategies not only aids in predicting price shifts but also contributes to refining risk management techniques. The incorporation of candlestick patterns into options trading enhances the accuracy of forecasting price movements and optimizing trade outcomes. Understanding the significance of these patterns can provide traders with a competitive edge in navigating the complexities of the options market.

Integrating Candlesticks Into Options Trading

By incorporating candlestick patterns into options trading, traders can enhance their decision-making processes and optimize trade outcomes through improved analysis of potential price movements and risk management strategies. Understanding these patterns can help options traders identify potential price reversals, time entry and exit points effectively, and recognize opportunities for options strategies such as bullish engulfing or doji.

Integrating candlestick analysis with options trading strategies can significantly improve decision-making and risk management practices. By utilizing specific candlestick patterns, options traders can enhance their overall trading strategies, leading to more optimized trading outcomes. This integration allows for a more data-driven and analytical approach to trading, increasing the likelihood of success in the options market.

Advanced Strategies With Candlestick Patterns

Enhancing advanced options trading strategies can be achieved through the strategic integration of candlestick patterns for improved entry and exit points. Specific patterns like the Morning Star or Three White Soldiers can assist in identifying trend reversals or continuation patterns within options trading.

Advanced strategies such as iron condors and straddles benefit from incorporating candlestick analysis to enhance risk management and profitability. By combining candlestick patterns with options Greeks analysis, traders can refine their strategies further.

Understanding how these patterns influence options pricing and volatility provides traders with a competitive advantage in crafting effective trading strategies. The synergy between candlestick patterns and advanced options strategies offers valuable insights into market sentiment and potential price movements, guiding traders towards more informed decision-making.

Enhancing Options Trading With Candlesticks

The incorporation of candlestick patterns into options trading strategies provides traders with a valuable tool for identifying opportune entry and exit points. Understanding these patterns enhances decision-making by pinpointing optimal times to enter or exit trades.

By integrating candlestick analysis with options trading strategies, traders can effectively manage risk and enhance profitability. Candlestick patterns offer insights into market sentiment and potential price movements, crucial for successful options trading.

Utilizing these patterns helps traders identify trends, potential reversals, and key levels, enabling strategic decision-making. Incorporating candlestick patterns into options trading strategies not only aids in spotting lucrative opportunities but also in navigating the complexities of the market with a data-driven approach.

How Can Candlestick Patterns Help in Binary Options Trading?

Understanding essential binary options candlestick analysis is crucial in binary options trading. Candlestick patterns can give valuable insights into market trends and potential price movements. By analyzing these patterns, traders can make more informed decisions and increase their chances of success in binary options trading.

Frequently Asked Questions

Which Candlestick Pattern Is Most Reliable for Option Trading?

The Bullish Engulfing pattern stands out as a highly reliable choice for option trading. Its strong reversal signal following a downtrend signals a win for buyers, offering valuable long position opportunities in the market.

Do Professional Traders Use Candlestick Patterns?

Professional traders extensively rely on candlestick patterns to discern market sentiment and gauge momentum. These visual cues play a crucial role in their technical analysis, aiding in decision-making for optimal entry and exit points.

What Is the Best Time Frame for Candlestick Patterns for Options Trading?

The best time frame for candlestick patterns in options trading is typically the 1-hour or 4-hour chart. These time frames offer a balance between reliable signals and manageable noise, catering to traders' need for accuracy and efficiency.

How Do You Read Candles for Options Trading?

Reading candles in options trading involves analyzing patterns like Doji, Hammer, and Engulfing to gauge market sentiment and predict price movements. Understanding these formations aids in identifying entry and exit points, support and resistance levels, and managing risks effectively.

Conclusion

In conclusion, incorporating candlestick patterns into options trading strategies can provide valuable insights into market trends and potential price movements. By leveraging these visual representations of price action, traders can make informed decisions and optimize their trading strategies.

Just as a skilled artist uses a palette of colors to create a masterpiece, traders can use candlestick patterns as a tool to navigate the complexities of the options market with precision and finesse.