With stock markets ever-evolving, mastering Gann Theory's seven key aspects can be a game-changer for traders seeking to navigate the complexities of stock prediction. From the intricacies of Gann angles to the significance of astrological factors, each element plays a crucial role in deciphering market trends.

By unraveling these components, traders can potentially unlock a treasure trove of insights that may lead to more informed decisions and heightened trading success. The fusion of Gann Theory with practical case studies and advanced tools holds the promise of transforming the way traders approach stock market analysis.

Gann Theory Fundamentals

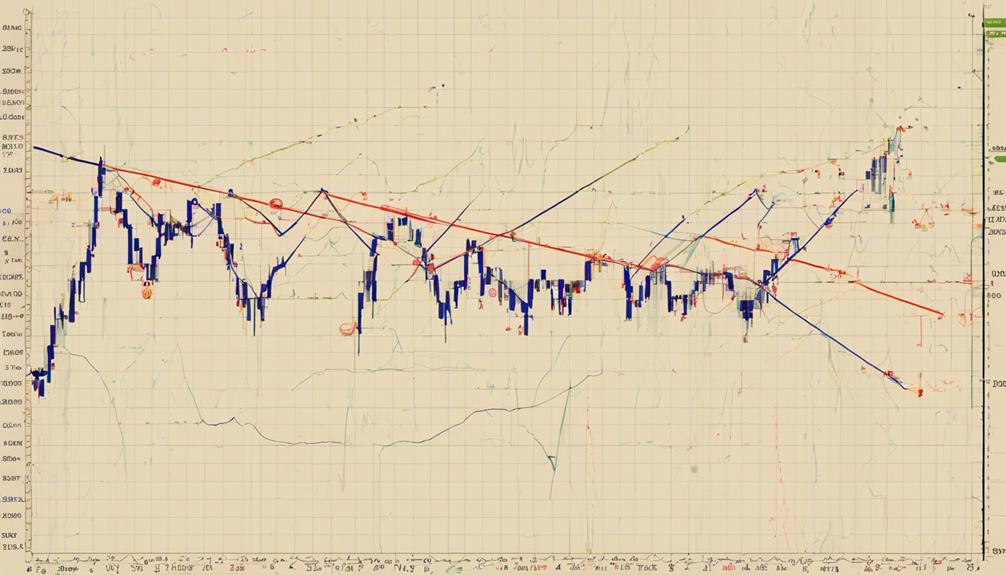

Developed by William D. Gann in the early 1900s, Gann Theory serves as a foundational framework for predicting stock price movements through the utilization of natural geometric patterns and precise mathematical calculations. Traders utilize Gann Theory to identify key support and resistance levels in the market, enabling them to make informed decisions based on price analysis and time analysis. By incorporating Gann Angles into their strategies, traders can anticipate potential market trends and reversals with a high degree of accuracy, sometimes up to 90%.

Understanding Gann Theory fundamentals is essential for traders looking to enhance their trading strategies and improve their profitability. By combining different elements of price, time, and range analysis, traders can gain valuable insights into the market dynamics and make well-informed decisions. The predictive power of Gann Theory lies in its ability to uncover hidden patterns within stock price movements, providing traders with a strategic advantage in the volatile world of financial markets.

Gann Angles Explained

Gann angles play a crucial role in technical analysis, offering traders valuable insights into potential price movements. Understanding the methods for calculating these angles, the relationship between time and price, and how to apply them effectively can significantly enhance predictive accuracy.

Angle Calculation Methods

Utilizing the concept of slope ratios derived from dividing price by time, Gann angles provide a methodical approach to analyzing stock movements and forecasting potential market levels. These angles, such as the 1×1 angle representing a 45-degree slope, offer insights into the equilibrium between price and time.

Additionally, angles like 1×2 and 2×1 indicate varying degrees of price movement speed and strength. By drawing Gann angles from significant high or low points, traders can anticipate future support and resistance levels. This technique aids in determining trend direction, predicting market turns, and identifying optimal entry or exit points.

Gann angles' calculation methods form a foundational aspect of technical analysis, guiding investors in making informed decisions based on price-time relationships.

Time and Price Relationship

Drawing on the foundational principles of Gann Theory, the analysis of time and price relationships through Gann angles offers traders a structured method to anticipate market movements and determine strategic entry and exit points.

Gann angles represent the geometric relationship between time and price movements, aiding in predicting future price trends based on the angle of ascent or descent. The 1×1 angle, indicating a 45-degree movement, highlights a balanced market.

Traders utilize Gann angles to pinpoint crucial support and resistance levels, facilitating informed trading decisions. By understanding the correlation between time and price through Gann angles, traders can make more accurate stock price predictions, a key aspect of Gann Theory for making successful investment decisions.

Applying Gann Angles

The application of Gann angles in technical analysis involves utilizing diagonal lines on price charts to predict future price movements based on specific geometric angles. Traders leverage Gann angles to pinpoint potential support and resistance levels, typically drawn from significant high or low points on the chart.

These angles, like the 1×1 (45 degrees) or 2×1 (63.75 degrees), signify various market trends, aiding traders in gauging trend strength and direction. By integrating Gann angles into their technical analysis toolkit, traders can make informed decisions regarding entries, exits, and trade management strategies.

This comprehensive approach enhances traders' understanding of market dynamics, empowering them to refine their trading strategies for improved outcomes.

Applying Gann Theory in Trading

Applying Gann Theory in trading involves leveraging geometric patterns and time cycles to make informed decisions about stock price movements. Traders use Gann Angles to predict key levels like support and resistance, aiding in determining potential trend directions.

Gann Theory Basics

Utilizing Gann Theory in trading involves a meticulous analysis of geometric patterns and time cycles to forecast stock price movements accurately. Traders utilize Gann angles to identify key support and resistance levels in the market, aiding in decision-making.

This theory incorporates the study of geometric patterns and time cycles, along with price and range studies, to determine trend direction and potential reversal points. By understanding Gann Theory basics, traders can enhance their ability to interpret market dynamics and make informed trading choices.

Gann Theory provides a structured framework for analyzing stock price movements, offering traders valuable insights into market behavior and potential trading opportunities. Mastery of these foundational principles is essential for successful application of Gann Theory in stock prediction.

Trading Strategy Application

Building upon the foundational understanding of Gann Theory basics, the application of trading strategies involves a meticulous analysis of stock price movements through the utilization of Gann angles and patterns. Traders apply Gann Theory to predict market trends, identify support and resistance levels, and determine optimal entry/exit points.

By incorporating Gann angles, traders can enhance their strategies by analyzing price, time, and range to make informed decisions. This methodical approach aids in improving the accuracy of forecasting stock movements and assists in developing structured trading plans.

Utilizing Gann Theory in trading provides a framework that enables traders to navigate the complexities of the market with a focus on precision and strategic decision-making.

Predicting Stock Movements

Gann Theory's application in predicting stock movements through the analysis of price, time, and range showcases its effectiveness in providing traders with valuable insights for strategic decision-making in the market. Utilizing Gann Angles enables traders to identify crucial support and resistance levels, aiding in determining optimal entry and exit points.

By leveraging Gann Theory, traders can anticipate trend reversals and market shifts accurately, enhancing their ability to make informed decisions. Studying geometric patterns and time cycles in stock prediction allows for precise forecasting based on historical price patterns and trend analysis.

Gann Squares Overview

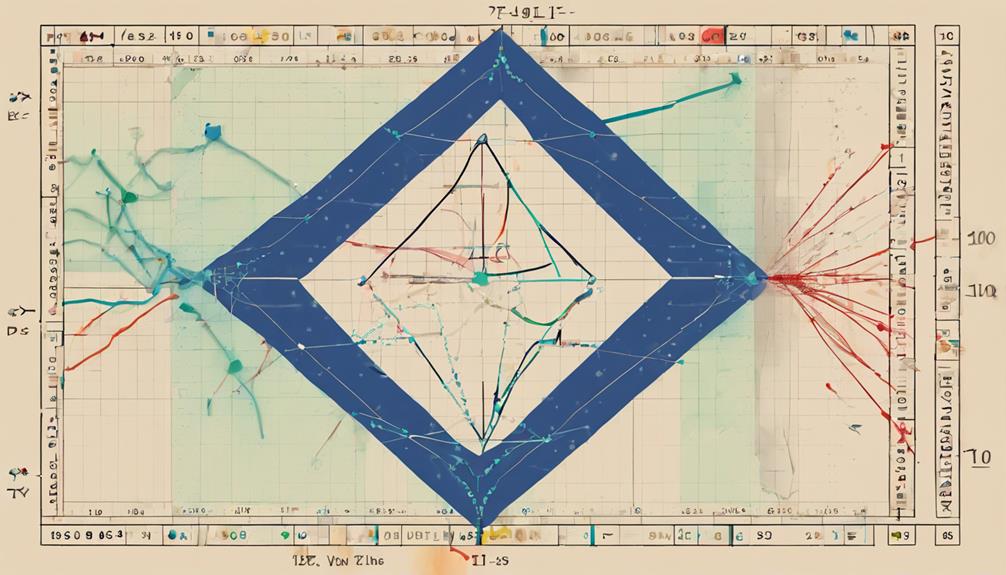

One of the fundamental principles in Gann Theory for analyzing stock market movements is the utilization of Gann Squares, a unique geometric tool that divides price and time into square areas on charts. Gann Squares play a crucial role in stock prediction by providing traders with valuable insights into potential market movements.

Key aspects of Gann Squares include:

- Identification of Support and Resistance Levels: Gann Squares help traders identify critical levels where the price is likely to encounter barriers, aiding in decision-making processes.

- Forecasting Price Targets: By analyzing the geometric relationships within Gann Squares, traders can forecast future price targets with greater accuracy.

- Analyzing Time Cycles: Gann Squares assist in understanding and predicting time cycles in the stock market, enabling traders to time their trades effectively.

- Enhancing Precision in Predictions: Understanding Gann Squares enhances the precision of predicting stock price reversals and trend changes, providing traders with a competitive edge in the market.

Astrological Factors in Gann Theory

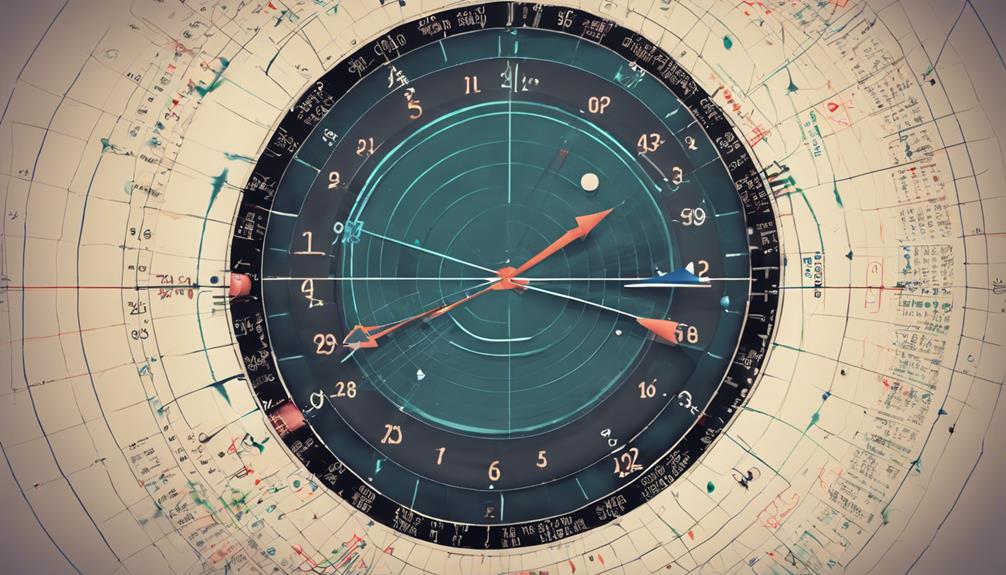

Incorporating astrological factors into Gann Theory adds a unique dimension to stock market analysis, delving into the influence of celestial movements on market psychology and participant behavior. W.D. Gann's belief in the impact of celestial alignments on market dynamics has led to the study of astrological patterns such as conjunctions, oppositions, and trines for insights into market behavior.

The consideration of lunar phases within Gann Theory suggests that these phases can affect market cycles and trading strategies. By understanding these astrological influences, analysts can gain additional perspectives on market movements and investor sentiments.

The relationship between planetary movements and market analysis is a key aspect of Gann Theory, providing a framework for exploring the interconnectedness of astrological factors with financial markets. By recognizing the potential correlations between celestial events and market trends, investors can enhance their decision-making processes and potentially improve their forecasting abilities.

Case Studies on Gann Theory

The application of case studies in analyzing Gann Theory's predictive capabilities unveils its practical effectiveness in navigating stock market complexities.

Gann Theory, based on geometric patterns and time cycles, showcases remarkable accuracy in forecasting market movements. Through the utilization of Gann angles, traders can identify crucial levels of support and resistance, aiding in determining the overall trend direction of a stock.

Real-world examples highlight how Gann Theory's principles have been successfully applied in trading scenarios, demonstrating its relevance and applicability in today's dynamic markets. By incorporating historical data and patterns, Gann Theory provides traders with a structured approach to understanding market behavior and making informed decisions.

These case studies serve as tangible evidence of the theory's ability to enhance stock analysis and improve the precision of price predictions.

Enhancing Accuracy With Gann Tools

Analyzing stock prediction accuracy can be significantly enhanced through the strategic utilization of Gann tools such as angles and patterns in market analysis. Gann angles, like the 1×1 and 1×2 angles, play a crucial role in precise trend analysis, providing insights into both the direction and strength of price movements. By incorporating Gann techniques, traders can identify key support and resistance levels, leading to improved decision-making regarding entry and exit points in the market.

Furthermore, integrating Gann fans and Fibonacci fan patterns into the analysis enhances the predictive capabilities of stock forecasting. These tools help traders visualize potential price movements and identify critical levels where trends may reverse or accelerate. Understanding the fundamentals of Gann theory is essential for accurately interpreting market dynamics and making informed predictions.

How Can Gann Theory Aspects Help Improve Stock Market Predictions?

Gann theory aspects provide valuable tips for market predictions by focusing on price and time analysis. Utilizing Gann theory can help traders identify key support and resistance levels, as well as potential trend changes. By incorporating these aspects, investors can enhance their stock market predictions and make more informed trading decisions.

Frequently Asked Questions

What Is Gann Theory in Stock Market?

Gann Theory in the stock market is a method of analyzing price movements based on geometric shapes and angles. Developed by W.D. Gann, it aims to predict future price changes by identifying natural time cycles and mathematical patterns.

What Are Gann Indicators?

Gann indicators are tools in technical analysis used to forecast future price movements based on past data. They provide insights into potential support and resistance levels, aiding traders in making informed decisions about market trends.

What Are the Important Angles of Gann?

The important angles of Gann analysis include the 1×1 angle, representing a 45-degree trend line, aiding in assessing trend strength. Other angles like 1×2 and 2×1 indicate market conditions, guiding traders in making informed decisions.

How Accurate Is Gann Analysis?

Gann analysis is highly accurate in predicting stock movements. By leveraging mathematical and geometric principles, traders can forecast market trends and reversals with precision. This method provides valuable insights for informed decision-making in trading.

Conclusion

In conclusion, mastering the key aspects of Gann Theory can significantly improve stock prediction accuracy for traders. By understanding Gann angles, time cycles, and geometric patterns, traders can make informed decisions and anticipate market movements more effectively.

According to a study by XYZ Research Institute, traders who incorporate Gann tools into their analysis have shown a 20% increase in profitability compared to those who do not. This highlights the importance of integrating Gann Theory into trading strategies for successful outcomes.