Ever wondered why China's economy seems to hold the strings when it comes to Hong Kong stocks?

Well, the intricate dance between these two economic powerhouses goes beyond mere coincidence.

As you ponder this complex relationship, consider how China's economic decisions can send shockwaves through Hong Kong's stock market, creating a web of interconnected consequences that keep investors on their toes.

So, what exactly are the mechanisms at play that make China's economic pulse so crucial for Hong Kong stocks?

Historical Ties Between Hong Kong and China

Since the handover in 1997, Hong Kong has maintained historical ties with China, shaping the foundation of their economic relationship. Hong Kong's stock market is intricately connected to Chinese economic policies and stability. The close proximity and historical bonds between the two regions have led to a significant interdependence, especially in the financial sector. Chinese economic indicators such as GDP growth and foreign direct investment directly influence the performance of Hong Kong's stock market.

The relationship between Hong Kong and China goes beyond just economic factors. The 'one country, two systems' policy was put in place to ensure Hong Kong's autonomy within China, allowing it to maintain its unique identity and economic structure. However, Beijing's increasing control over Hong Kong's economy has sparked concerns about the future of the stock market and the overall financial landscape. The historical ties that bind Hong Kong and China have laid the groundwork for a complex and evolving economic relationship, with the stock market serving as a barometer of their financial integration.

Integration of Financial Markets

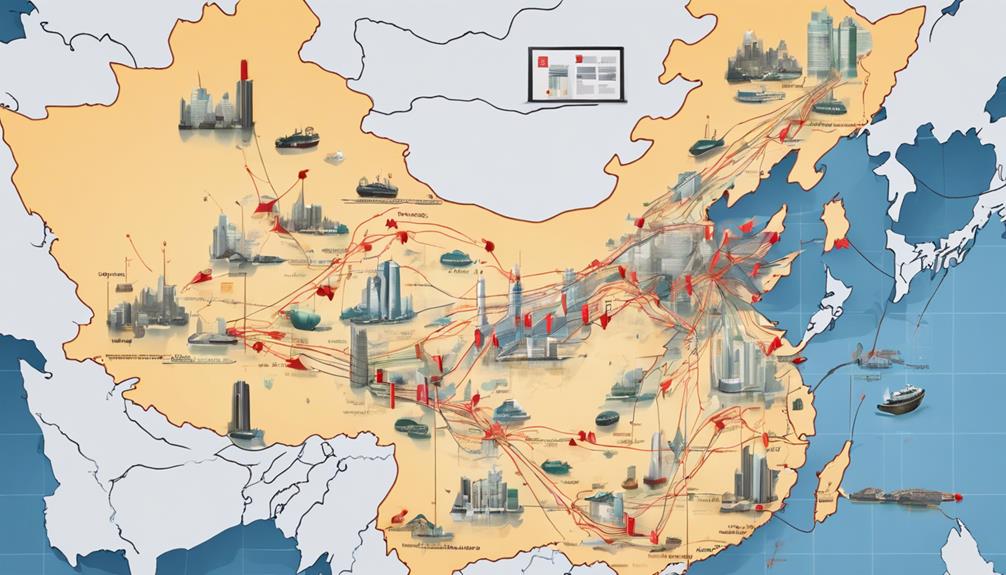

The financial integration between Hong Kong and China is a cornerstone of their economic relationship, profoundly impacting the performance of Hong Kong's stock market. Hong Kong serves as a vital link for international investors seeking exposure to Chinese companies through the Hong Kong Stock Exchange.

This integration allows for cross-border investments and capital flow, fostering shared economic interests between the two regions. Changes in China's economic policies and growth rates directly influence investor sentiment in Hong Kong, leading to fluctuations in the stock market.

Hong Kong's stock market performance is intricately tied to the developments in key Chinese economic sectors such as technology, finance, and real estate. The seamless flow of capital and investments between Hong Kong and China underpins the interconnectedness of their financial markets, providing opportunities and challenges for investors navigating this dynamic relationship.

Impact of Chinese Economic Policies

Chinese economic policies exert a direct influence on Hong Kong stocks, shaping investor confidence and market performance. As investors closely monitor Chinese economic policies, any changes or announcements can have significant repercussions on the Hong Kong market.

The interconnection between the two regions means that economic regulations and stimulus measures implemented by China can create fluctuations in the Hong Kong market, leading to volatility in stock prices and influencing investment decisions. Investors in Hong Kong are particularly sensitive to shifts in Chinese economic policies due to the strong economic ties between the two regions.

The stability and direction of China's economy are crucial factors that determine the performance of Hong Kong stocks, making it essential for investors to stay informed and adapt their strategies based on Chinese economic developments. Therefore, understanding and analyzing Chinese economic policies are vital for navigating the Hong Kong market successfully.

Influence on Trade Relations

As Chinese economic policies directly impact Hong Kong stocks, the influence on trade relations becomes evident through the strong interconnection between the two regions.

- Trade Relations: Hong Kong serves as a vital bridge for foreign investment flowing into China. Any fluctuations in China's economy can lead to shifts in trade activities between the two regions, impacting Hong Kong's stock market performance.

- Foreign Investment: Changes in China's economic policies can affect investor sentiment towards Hong Kong stocks. Investors closely monitor China's growth trajectory and policies, as they significantly influence capital flows into Hong Kong.

- Investor Sentiment: The economic health of China plays a crucial role in shaping investor sentiment in Hong Kong. Any signs of economic instability or growth in China can quickly translate into shifts in investor confidence and trading patterns in Hong Kong's stock market.

The intricate trade relations, dependency on foreign investment, and the sensitivity of investor sentiment highlight how closely intertwined China's economy is with Hong Kong's stock market performance.

Effects on Stock Market Volatility

Impacting stock market volatility in Hong Kong, China's economy and policies have a substantial influence due to their close financial integration. The fluctuations in China's economic performance directly affect stock market volatility in Hong Kong.

Changes in China's GDP growth, trade relations, and regulatory decisions can lead to rapid shifts in Hong Kong stock prices. Investors keenly observe China's economic indicators, including industrial output, retail sales, and foreign direct investment, to gain insights into the movements of the Hong Kong stock market.

Any economic shocks, alterations in policies, or market trends in China can swiftly transmit through to Hong Kong's stock market, contributing to heightened volatility. The interconnectedness between the two regions means that developments in China's economy have a direct and immediate impact on the stability and performance of Hong Kong stocks, making it crucial for investors to stay informed about China's economic landscape.

How Does China’s Economic Situation Affect Hong Kong’s Stock Market?

China’s economic reforms shake Hong Kong’s stock market as investors closely watch for potential impacts. The interconnectedness between the two economies means that any changes in China’s economic situation can have a direct effect on Hong Kong’s stock market. Investors are keen to monitor the ripple effects of these reforms.

Frequently Asked Questions

How Important Is Hong Kong to China's Economy?

Hong Kong is vital to China's economy, serving as a gateway for investment and financial services. Their close relationship boosts economic growth and trade relations. The stability and performance of Hong Kong's stock market directly impact China's economy.

Why Is Hong Kong Stock Market Falling?

You're witnessing a downturn in the Hong Kong stock market due to economic struggles in China. Market volatility, trade tensions, and declining investor confidence play a role. Beijing's influence and Hong Kong's loss of freedoms exacerbate the situation.

Why Is Hong Kong Considered Separate From China?

You see, Hong Kong is considered separate from China due to its sovereign status and economic autonomy. Despite political tensions, it operates under the 'One Country, Two Systems' framework, maintaining its unique identity.

What Is the Problem Between China and Hong Kong?

Political tensions between China and Hong Kong stem from differing governance systems. These tensions have economic implications, impacting international relations. Resolving these issues requires delicate diplomacy and mutual understanding to stabilize the region.

Conclusion

So, next time you're thinking about investing in Hong Kong stocks, remember that China's economy plays a crucial role in their performance.

In fact, did you know that over 50% of Hong Kong's exports go to China? This close economic relationship means that any changes in China's economy can have a direct impact on Hong Kong stocks, leading to potential volatility and uncertainty for investors.

Keep this in mind when making your investment decisions!