Mastering Gann Theory Basics is essential for beginners to understand William D. Gann's foundational principles and the complex methodology of forecasting stock prices using price, time, and geometry integration. Gann Angles are key tools in technical analysis, aiding in predicting price movements, trend reversals, and market trends. Applying Gann Theory involves practical techniques like using Gann angles, pivot levels, and Gann time study models. Trading strategies based on Gann Theory focus on price analysis, trend prediction, and support/resistance levels. Understanding Gann's rules and concepts is paramount for interpreting market trends and making informed trading decisions. This foundation sets the stage for deeper insights into mastering Gann Theory.

Gann Theory Basics

The foundational principles of Gann Theory encompass a unique methodology developed by William D. Gann in the early 1900s, aimed at forecasting stock price movements through the application of geometric shapes and temporal analysis.

Gann Theory integrates price, time, and geometry to track price movements, predict future movements, and identify support and resistance levels in the market.

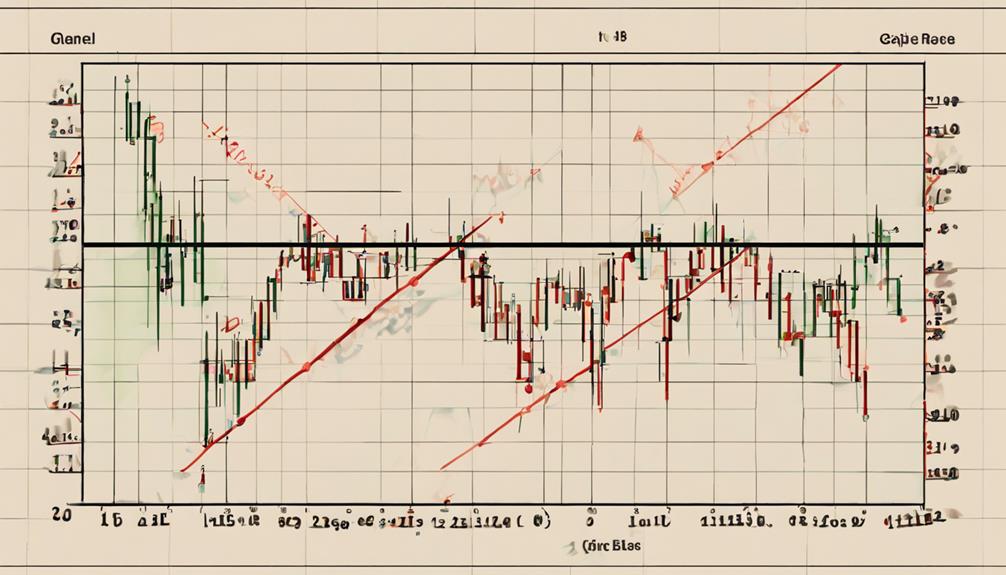

Gann Trading Strategy, a key component of Gann Theory, relies on time cycles, geometric market design, and price factors to locate support and resistance lines for asset trading. This strategy involves drawing Gann angles at different degrees to study patterns for predicting asset movements accurately.

By understanding the significance of Gann angles in stock market analysis, traders can make informed decisions based on the principles laid out by Gann.

Gann's innovative approach to stock price analysis has stood the test of time, offering traders a unique perspective on market movements through the lens of geometry and time.

Gann Angles Explained

In the domain of technical analysis, Gann angles serve as indispensable tools for predicting price movements in financial markets based on geometric principles and temporal analysis. Gann angles, such as the 1×1, 1×2, or 2×1 angles, play a significant role in price prediction by providing unique support and resistance levels on price charts.

These angles are instrumental in determining trend reversals and potential breakout points in the market. By analyzing different Gann angles, traders can gauge the strength of market trends and movements, enabling them to make accurate forecasts and strategic trading decisions.

Understanding the nuances of Gann angles is vital for traders looking to enhance their ability to anticipate market movements and make informed trading choices. By incorporating Gann angles into their technical analysis toolkit, traders can gain valuable insights into market dynamics and improve their overall trading strategies.

Gann Theory Application

Utilizing Gann theory in practical applications allows traders to employ thorough and detailed analysis techniques to enhance their predictive capabilities in financial markets.

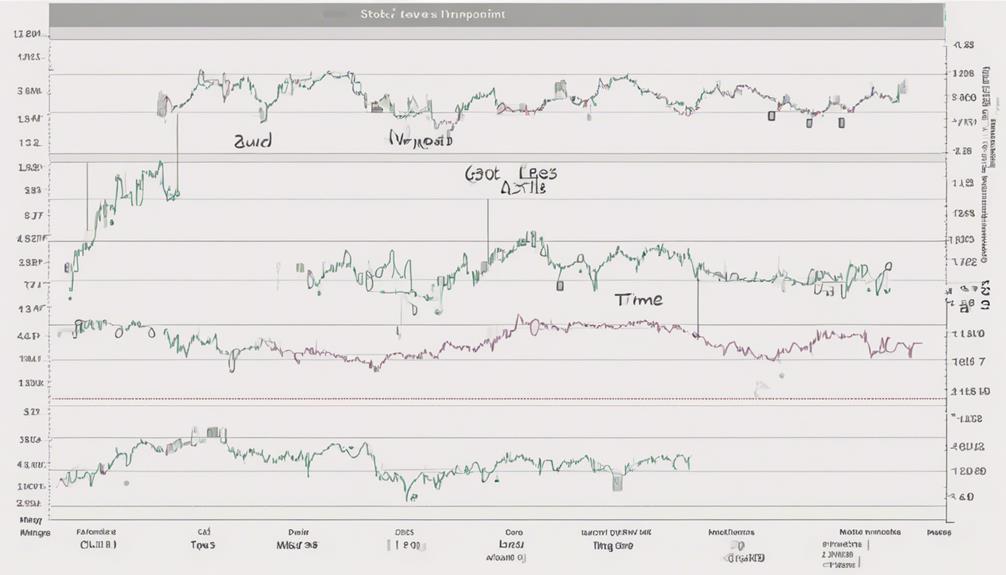

Gann angles help traders track price movements and predict future changes accurately by analyzing the patterns and angles of an asset. Pivot levels derived from Gann theory provide insights into future price movements based on geometric shapes and time relationships.

The Gann time study model aids in forecasting stock value reversals with high accuracy, enabling traders to anticipate market trends effectively. By integrating Gann Theory into their trading strategies, investors can identify dynamic support and resistance levels, optimizing their entry and exit points.

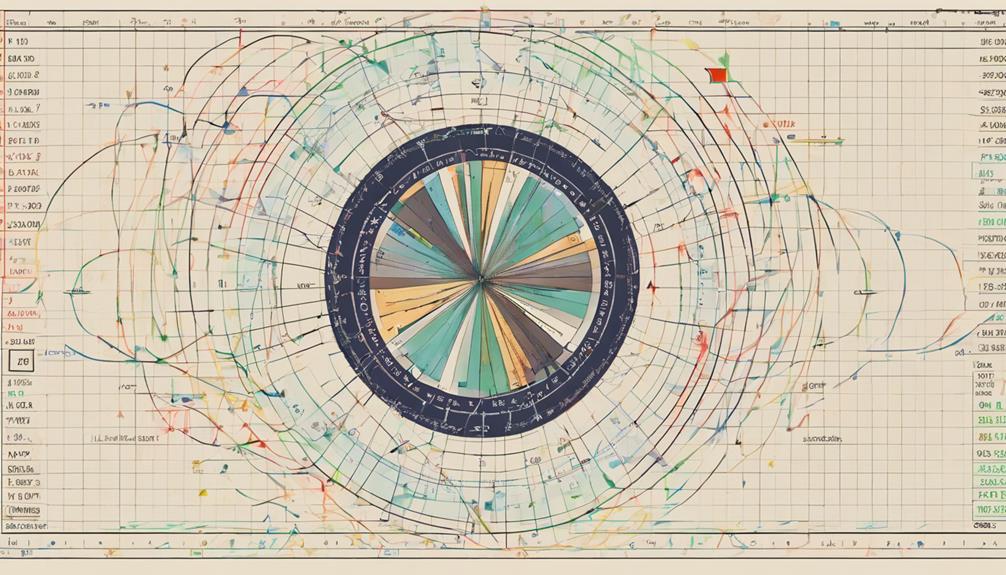

Additionally, Gann Squares are utilized to analyze price and time relationships, offering a comprehensive framework for market analysis. Incorporating astrological factors further enhances the predictive power of Gann Theory, providing traders with a holistic approach to decision-making in the stock market.

Gann Trading Strategies

Employing a systematic approach blending price analysis, time elements, and geometric principles, Gann Trading Strategies offer a thorough framework for market analysis and decision-making. These strategies utilize tools like Gann Angles to predict market trends based on geometric angles and patterns.

Support and resistance levels play an important role in determining strategic entry and exit points for traders using Gann Trading Strategies. Gann Squares are employed to divide price and time, aiding in forecasting key market levels. By combining Gann tools with technical analysis, traders can enhance their decision-making process and improve forecasting accuracy.

Understanding market trends and identifying potential entry and exit points are essential aspects of implementing Gann Trading Strategies effectively. This approach provides traders with a detailed method to analyze markets and make informed decisions based on a blend of price action, time elements, and geometric principles.

Gann Rule of Four

The Gann Rule of Four encapsulates the fundamental aspects of price, time, range, and pattern in market analysis.

Traders rely on these key points to gain a thorough understanding of price movements and market dynamics.

Gann's Mathematical Principles

Applying Gann's Rule of Four involves a meticulous examination of price, time, range, and pattern elements to enhance market forecasting precision. Gann's mathematical principles offer a structured approach to forecasting market movements by emphasizing the significance of thorough analysis.

Price, reflecting the asset's value, time denoting market trends, range indicating volatility, and patterns representing chart formations, are vital components in making informed market predictions. By integrating these factors into their analysis, traders can gain a deeper understanding of market dynamics and improve the accuracy of their forecasts.

Gann's approach provides a systematic framework that aids in deciphering market behaviors and making strategic decisions based on a thorough evaluation of the interconnected price, time, range, and pattern studies.

Application in Trading

Utilizing the Gann Rule of Four in trading involves a thorough analysis of price, time, pattern, and trend factors to effectively forecast market movements with strategic precision. Traders apply this rule to identify key support and resistance levels, which are essential for determining ideal entry and exit points in the market.

By incorporating price patterns, time cycles, and geometric patterns, traders can anticipate potential trend reversals and price movements accurately. This strategic approach enables traders to make informed decisions based on a thorough understanding of market dynamics.

The Gann Rule of Four serves as a valuable tool for traders seeking to enhance their trading skills and improve their ability to interpret and predict market behavior with greater consistency and accuracy.

Understanding Price Movements

Analyzing price movements according to the Gann Rule of Four provides traders with a systematic approach to forecasting future market trends based on distinct directional patterns.

The Gann Rule of Four, a fundamental aspect of Gann's trading Theory, categorizes price movements into four main directions: up, down, sideways, or trendless.

Understanding these price movements is vital for anticipating market trends and making informed decisions. By applying the Rule of Four, traders can identify the current price action pattern, which serves as a roadmap for their decision-making process.

Mastery of this concept is essential for interpreting market trends accurately and effectively navigating the complexities of price movements in the financial markets.

Gann 9 5 Rule

The Gann 9 5 Rule, a fundamental principle within Gann Theory, delineates the occurrence of market movements in precise 9 unit price swings and 5 unit time swings. This rule plays an essential role in helping traders identify potential price and time cycles in the market. By understanding the Gann 9 5 Rule, traders can better predict future price movements based on the concept of symmetry in market movements and time intervals. Below is a table illustrating how the Gann 9 5 Rule works:

| Unit | Price Swings | Time Swings |

|---|---|---|

| 1 | Up | Start |

| 2 | Down | |

| 3 | Up | |

| 4 | Down | |

| 5 | Up | End |

This table showcases the alternating pattern of price swings and time swings as per the Gann 9 5 Rule, providing traders with a structured approach to analyzing market movements.

Gann 50 Percent Rule

The Gann 50 Percent Rule plays a critical role in technical analysis by indicating potential areas of support and resistance based on price retracements. Traders leverage this rule to forecast market movements and strategically plan their trades, highlighting key entry and exit points.

Understanding the application and significance of the 50% retracement level enhances a trader's ability to interpret market trends and make informed trading decisions.

Gann Rule Application

Utilizing the Gann 50 Percent Rule in technical analysis is paramount for identifying potential trend reversals based on price retracements. This rule allows traders to pinpoint key support and resistance areas where price could potentially reverse its direction.

By recognizing the significance of the 50% retracement level, traders can anticipate market trends and make well-informed trading decisions. The Gann 50 Percent Rule serves as a valuable tool in technical analysis, providing insights into potential price movements and aiding in the interpretation of market behavior.

Understanding how to apply this rule effectively is essential for mastering Gann Theory and enhancing one's ability to analyze and forecast market dynamics accurately.

Understanding 50 Percent

Understanding the significance of the Gann 50 Percent Rule is vital for effective technical analysis and identifying potential market reversals based on price retracements. This rule indicates that a retracement should typically be around 50% of the prior move, aligning with a common Fibonacci retracement level.

Traders closely monitor price reactions and look for potential reversals around this key 50% level, which can act as both support and resistance. Recognizing the Gann 50 Percent Rule aids in pinpointing important entry and exit points in the market, offering valuable insights for making informed trading decisions.

Gann Theory FAQs

Within the domain of Gann Theory, adept application of pattern studies and angle analysis is essential for anticipating future price movements. Gann Theory FAQs often address the importance of drawing Gann angles at various angles to aid in price prediction.

Understanding the significance of Gann theory in analyzing asset patterns and angles is vital for traders and investors. These FAQs cover the utilization of pattern studies within Gann theory application to predict future price movements accurately. Additionally, they emphasize the significance of backtesting trading strategies based on Gann theory and setting appropriate stop-loss levels to manage risks effectively.

Gann theory not only provides insights into asset patterns but also offers a structured approach to analyzing angles for informed decision-making in stock market analysis. By delving into these FAQs, beginners can gain a better understanding of how to apply Gann Theory principles effectively in their trading practices.

Gann Theory Conclusion

To sum up, all-encompassing Gann Theory encapsulates the culmination of geometric analysis and time-based forecasting for traders and investors alike. Understanding Gann Theory is crucial for making informed trading decisions based on market cycles, price levels, and investor behavior.

By utilizing Gann tools such as angles and geometric shapes, traders can identify strong support and resistance levels that aid in predicting future price movements. Gann Theory emphasizes the importance of integrating price and time factors to analyze market behavior accurately.

Traders who master Gann Theory can develop robust trading strategies that combine market geometry with time cycles for precise entry and exit points. By backtesting strategies and incorporating stop-loss orders, traders can mitigate risks and enhance the effectiveness of their trading approaches.

Ultimately, Gann Theory offers a comprehensive framework for understanding market dynamics and making well-informed trading decisions based on a combination of geometric analysis and time-based forecasting.

Frequently Asked Questions

How to Learn Gann Theory?

To learn Gann Theory effectively, aspiring traders should focus on practical application. They can utilize learning resources like online courses and books, engage with a supportive community for guidance, and practice chart analysis for trend identification. Understanding various timeframes, mastering price forecasting techniques, and prioritizing risk management strategies are essential elements.

Emphasizing hands-on experience, utilizing educational materials, seeking community support, and honing analytical skills are key components in mastering Gann Theory.

How Accurate Is the Gann Theory?

Historically, Gann Theory has demonstrated a remarkable level of accuracy in predicting price movements, attributed to its mathematical precision.

This theory's modern applications are seen in various trading strategies, where its forecasting techniques are utilized for precise market predictions.

Real-world examples showcase the theory's ability to forecast price movements accurately, making it an essential tool for traders seeking informed decision-making with high accuracy.

What Is the Gann's Rule of Four?

The Gann's Rule of Four is a key component of Gann's methodology, used in trading strategies for price forecasting, trend identification, and support resistance levels.

By dividing price swings into four equal parts, traders can analyze time frames more effectively, understand market psychology, and implement risk management strategies.

This rule is essential for deciphering market dynamics and anticipating potential price movements with greater precision.

What Is the Golden Ratio of Gann?

The Golden Ratio of Gann, derived from Fibonacci applications, plays a pivotal role in price forecasting and market cycles. This ratio, often expressed as 1:1.618, is integral in identifying support and resistance levels influencing trading decisions.

Traders leverage this ratio for time analysis, support resistance identification, trend analysis, and recognizing chart patterns. Understanding the Golden Ratio of Gann is paramount for developing effective trading strategies based on geometric principles and mathematical relationships.

Conclusion

To sum up, mastering Gann Theory basics is like solving a intricate puzzle, each piece fitting together to reveal a clear picture of market movements.

With Gann Angles, trading strategies, and rules to guide the way, investors can navigate the turbulent waters of the financial markets with confidence.

Through diligent study and application, Gann Theory offers a framework for understanding market behavior and making informed decisions.

Embrace the principles of Gann Theory, and tap into the potential for success in trading.