Understanding the intricacies of pivot points can significantly impact one's stock trading strategies. By incorporating these top 3 pivot point tips, traders can enhance their analytical skills and potentially improve their decision-making processes.

From key calculation techniques to advanced strategies, mastering pivot points could offer a competitive edge in navigating the complexities of the stock market. Stay tuned to unravel the essence of these pivotal insights and elevate your trading game.

Key Pivot Point Calculation Techniques

When delving into the realm of stock analysis, mastering key pivot point calculation techniques is essential for making informed trading decisions. Pivot points are crucial levels used in trading to determine potential support and resistance areas.

By calculating pivot points based on the previous day's high, low, and closing prices, traders can identify key price levels for the current trading day. The central pivot point serves as a reference point, calculated by averaging the high, low, and close values.

Support levels are below the central pivot, indicating where the price might find buying interest, while resistance levels are above the central pivot, showing where selling pressure may arise. Different methods such as Standard, Fibonacci, and Woodie's are employed to calculate pivot points, each offering unique insights into potential price movements.

Understanding these pivot point calculation techniques is fundamental to developing effective trading strategies grounded in technical analysis.

Implementing Pivot Points in Analysis

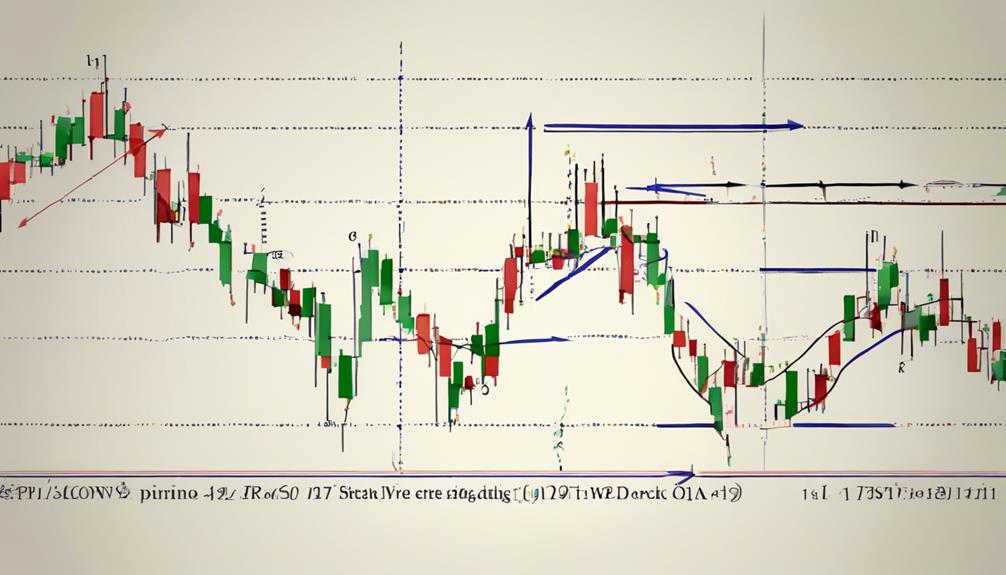

Utilizing pivot points in stock analysis provides traders with valuable reference levels that aid in identifying potential price movements and making strategic trading decisions.

Pivot points, derived from the previous day's high, low, and closing prices, act as critical support and resistance levels. They serve as key technical analysis indicators, assisting traders in determining entry and exit points.

One common pivot point trading strategy is the pivot point bounce strategy, where traders anticipate a price reversal at these predefined levels. By incorporating pivot points into analysis, traders can effectively identify potential reversals and execute trades with precision.

The benefits of using pivot points extend to risk management, as these levels help set stop-loss orders and profit targets. Additionally, traders often combine pivot points with other technical indicators to enhance the accuracy of their analysis and decision-making process, particularly when looking for pivot point breakouts in the market.

Advanced Strategies for Pivot Points

Incorporating advanced pivot point strategies enhances traders' ability to identify stronger support and resistance levels for making informed trading decisions. To maximize the effectiveness of pivot points, traders can consider the following advanced strategies:

- Utilizing Pivot Point Confluence Zones: Combining pivot points with other technical tools to identify areas where multiple levels align can provide added confirmation of potential price movements.

- Implementing Pivot Point Breakouts with Volume Confirmation: By waiting for a breakout above or below a pivot point level accompanied by increased volume, traders can reduce the likelihood of false signals and improve the accuracy of their trades.

- Integrating Multiple Time Frame Analysis: Examining pivot points across different timeframes can offer a comprehensive view of the market dynamics, helping traders identify significant levels and potential reversals more effectively.

What Are the Top 3 Pivot Point Tips for Mastering Stock Analysis?

When it comes to mastering stock analysis, understanding the importance of pivot points in trading essentials is crucial. Three top tips for utilizing pivot points effectively include identifying key support and resistance levels, using pivot points in conjunction with other technical indicators, and adjusting strategies based on market volatility and conditions.

Frequently Asked Questions

How Do You Master Pivot Points?

Mastering pivot points involves understanding key levels derived from previous price data, calculating them accurately with various formulas, identifying support and resistance levels, incorporating other technical indicators, and implementing strategies like bounce and breakout trades for informed trading decisions.

What Are the Most Effective Pivot Points?

The most effective pivot points for trading are Standard, Fibonacci, and Camarilla types. Standard pivot points use high, low, and close prices. Fibonacci points are based on ratios offering unique levels. Camarilla points provide precise support and resistance levels. Understanding these is crucial for success.

Do Professional Traders Use Pivot Points?

Professional traders extensively utilize pivot points as crucial components of their trading strategies. These points aid in identifying key support and resistance levels, facilitating informed decisions on entry and exit points based on historical price data and market conditions.

What Is the Best Setting for Pivot Point Indicator?

The best setting for a Pivot Point indicator involves utilizing the previous day's high, low, and closing prices. This calculation generates key levels like the central pivot point, support, and resistance levels, aiding traders in making informed trading decisions based on market dynamics.

Conclusion

In conclusion, mastering the use of pivot points in stock analysis is essential for informed decision-making in trading.

Like a compass guiding a traveler through unknown terrain, pivot points provide direction and clarity in navigating the complexities of the stock market.

By incorporating these key techniques and strategies into their trading plans, investors can enhance their analytical skills and increase their chances of success in the ever-changing world of stocks.