In the realm of financial markets, the ROC indicator stands as a valuable tool for traders seeking to enhance their decision-making processes. Understanding when to deploy this indicator effectively can significantly impact trading outcomes.

By carefully analyzing market conditions and applying the principles outlined in this guide, traders can gain a competitive edge in navigating the complexities of price movements. The ROC indicator's versatility offers a multifaceted approach to interpreting market dynamics, allowing traders to capitalize on opportunities that might otherwise go unnoticed.

Whether you are a seasoned trader or just starting, mastering the art of utilizing the ROC indicator could be the key to unlocking your trading potential.

Identifying Trend Reversals

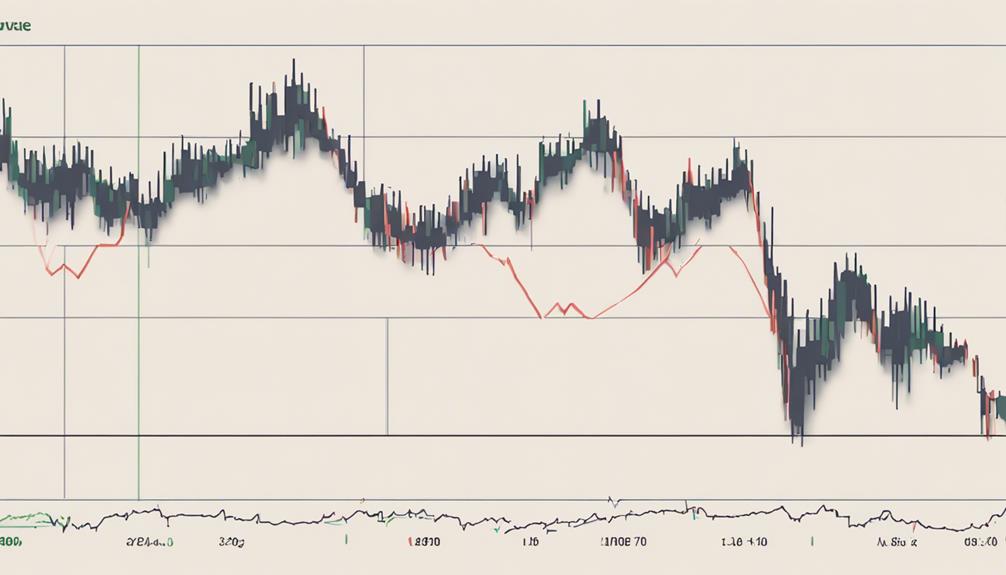

Utilizing the ROC indicator for identifying trend reversals necessitates a keen observation of divergences between price movements and the Rate of Change indicator to anticipate potential shifts in market momentum.

By closely monitoring the relationship between price action and ROC, traders can pinpoint instances where price establishes a new high or low, but ROC fails to validate these movements. Such divergence between price and ROC serves as a warning sign for potential trend reversals, hinting at a weakening or strengthening of momentum before it becomes evident in price trends.

The accuracy of trend reversal predictions can be heightened by combining ROC with other technical indicators, amplifying the reliability of signals. Therefore, a comprehensive analysis of ROC divergence patterns is crucial for traders aiming to effectively utilize this indicator in trend reversal analysis.

Through a systematic approach of evaluating these divergences, traders can enhance their ability to forecast market shifts and make informed trading decisions with greater precision.

Timing Entry and Exit Points

When considering market entry and exit points, the ROC indicator serves as a valuable tool for identifying momentum shifts and making well-timed trading decisions. Here are some key points to keep in mind when utilizing the Rate of Change (ROC) as a momentum indicator for optimal trade timing:

- Look for rising ROC above zero for entry signals in uptrends.

- Falling ROC below zero can signal potential exit points in downtrends.

- ROC crossovers can indicate trend reversals and optimal trade timing.

- Combine ROC with other indicators for confirmation and precision in entry/exit decisions.

Confirming Price Momentum

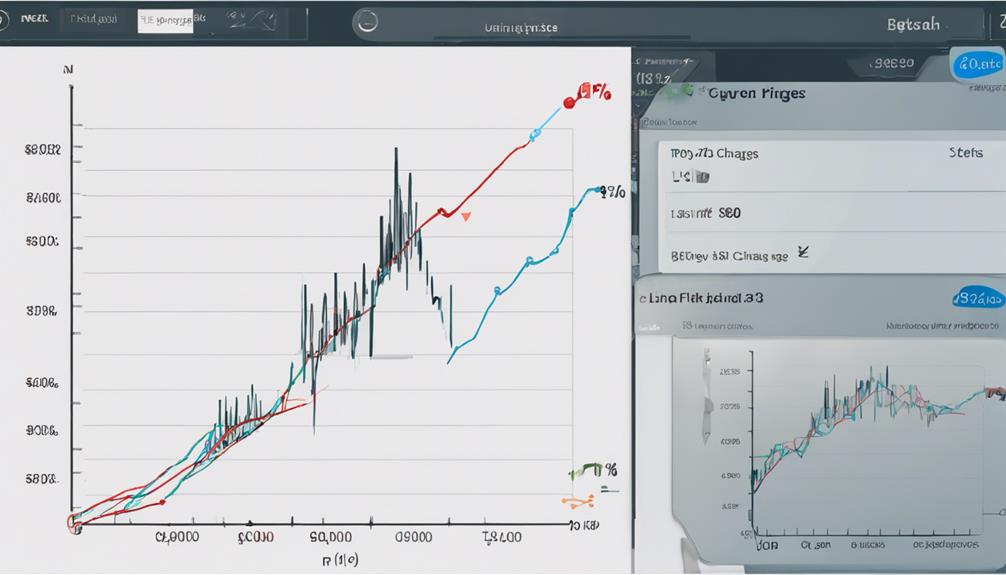

Confirming price momentum is essential in making informed trading decisions, and the ROC indicator plays a crucial role in measuring the percentage change in price over a specific period. Traders rely on the Rate of Change (ROC) to assess the technical aspect of price movements and identify overbought and oversold zones in the market.

By utilizing this momentum oscillator, traders can spot divergences between price and momentum, providing valuable insights into potential trend reversals. ROC enables traders to confirm the strength of an ongoing trend before making crucial trading decisions.

Analyzing ROC values helps traders gauge the acceleration or deceleration of price movements, aiding in timely trade entries and exits. This technical tool is instrumental in determining the momentum behind price changes and can serve as a reliable indicator for traders seeking to validate trends and make strategic trading choices based on confirmed price momentum.

Comparing Price Changes

Analyzing the percentage change in price through the ROC indicator provides valuable insights into the comparative speed and momentum of price changes within a security. When comparing price changes using the ROC indicator, traders can gain a deeper understanding of market dynamics and potential trading opportunities.

Here are some key points to consider:

- ROC moves into positive territory when there are price increases and into negative territory for price decreases.

- Traders utilize ROC to confirm price moves and validate the strength of trends.

- Divergences between price action and ROC can signal potential reversals or shifts in momentum.

- ROC helps traders identify overbought or oversold conditions, providing opportunities to enter or exit positions strategically.

Monitoring Market Volatility

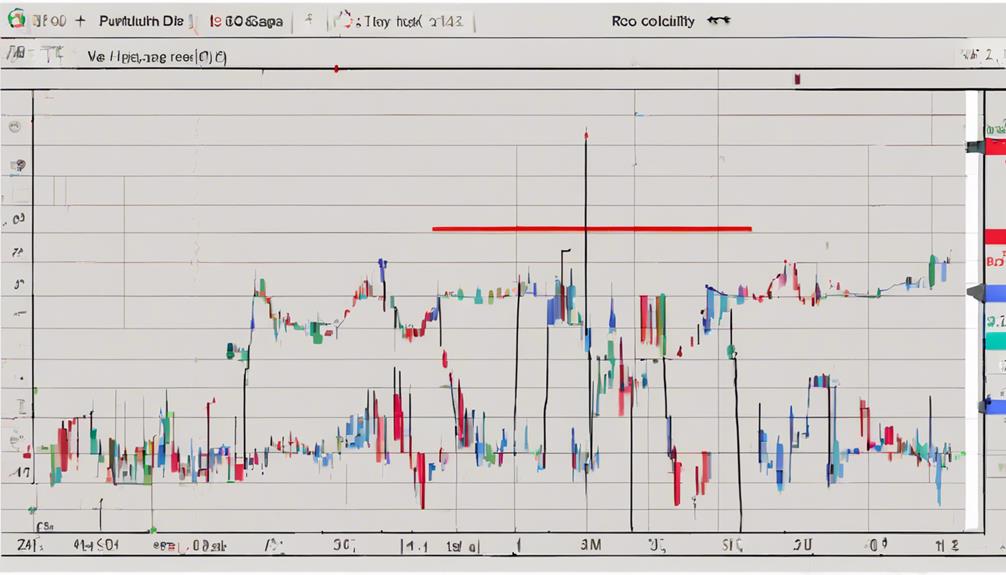

Market volatility can be effectively assessed and monitored by employing the Rate of Change (ROC) indicator. ROC helps traders identify periods of rapid price changes in the market.

When ROC values are increasing, it indicates higher volatility, whereas decreasing values suggest lower volatility levels. By utilizing the ROC indicator, traders can gauge market conditions more accurately and adjust their strategies accordingly.

This tool enables traders to track price fluctuations closely, providing valuable insights for making informed trading decisions during volatile market conditions. Monitoring market volatility through ROC empowers traders to react promptly to changing market dynamics, potentially optimizing their trading outcomes.

How Can I Effectively Use the ROC Indicator in My Trading Strategy?

When using the ROC indicator in your trading strategy, it’s important to look for momentum shifts by measuring the percentage change in price over a specific time period. By identifying potential trend reversals, you can effectively time your trades for optimal profit potential. Mastering using the ROC indicator takes practice and patience.

Frequently Asked Questions

What Is the ROC Indicator Used For?

The ROC indicator is utilized to gauge the velocity of price fluctuations in a security. It aids in recognizing market conditions of overbought or oversold assets by calculating the percentage change between current and previous prices, assisting in trend confirmation and timing trades effectively.

Is ROC a Leading or Lagging Indicator?

The Rate of Change (ROC) indicator is a leading indicator in technical analysis. It anticipates price movements by measuring the momentum of price changes. By identifying shifts early on, ROC aids traders in timely decision-making, making it a valuable tool for market analysis.

What Is the Difference Between ROC and RSI Indicator?

The ROC indicator measures percentage price change, emphasizing speed, while the RSI focuses on price momentum and overbought/oversold conditions. ROC is unbounded and more sensitive, contrasting RSI's 0-100 range and smoother movements.

How Much ROC Is Good?

The effectiveness of ROC indicator values is contingent upon market conditions and individual trading strategies. Optimal ROC values vary depending on the asset, time frame, and risk tolerance. Traders should consider ROC trends alongside other indicators for comprehensive analysis.

Conclusion

In conclusion, the Rate of Change (ROC) indicator serves as a valuable tool for traders to analyze market trends, identify potential reversals, and enhance trade timing precision.

One interesting statistic to note is that research shows that using the ROC indicator in conjunction with other technical analysis tools can increase trading success rates by up to 20%.

By incorporating the strategies outlined in this guide, traders can make well-informed decisions and improve their overall trading performance.