Keltner Channels are a valuable tool for traders seeking to enhance their technical analysis. Set parameters like a 20-period EMA and 2x ATR multiplier for best results. Customize settings based on the trading timeframe and asset for accurate insights. Interpret price movements within the channels to identify trends, momentum, and potential reversals. Pinpoint entry and exit points effectively by utilizing upper and lower bands. Manage risk by using the middle line for stop-loss orders and adjusting position sizes based on channel width. Keltner Channels provide a detailed framework for successful trading strategies. Mastering their use can greatly improve trading decisions and outcomes.

Understanding Keltner Channel Parameters

In the domain of technical analysis, an essential aspect of utilizing Keltner Channels effectively is comprehending the parameters that govern their construction and behavior.

Keltner Channels are a popular tool used by traders to analyze price movements and identify potential support and resistance levels. These channels consist of three lines: the middle line, which is typically a 20-period Exponential Moving Average (EMA), and the upper and lower bands, calculated by adding/subtracting 2 times the Average True Range (ATR) from the EMA.

The ATR, commonly set at a period of 10, can be adjusted to impact the width of the Keltner Channel, with a higher multiplier resulting in a wider channel. This dynamic nature enables Keltner Channels to adjust to market volatility, providing traders with adaptive support and resistance levels to inform their trading decisions.

Understanding these parameters is essential for traders looking to effectively utilize Keltner Channels in their technical analysis strategies.

Setting Up Keltner Channels

To establish Keltner Channels effectively for trading purposes, it is important to carefully select the appropriate parameters that align with the specific time frame and asset under consideration. When setting up Keltner Channels, traders should consider the following key steps:

- Choose the ideal settings such as a 20-period Exponential Moving Average (EMA) and a 2x multiplier of the Average True Range (ATR) for the upper and lower bands to create a volatility-based indicator.

- Adjust the length of the EMA and the ATR period according to the trading time frame and the asset being traded to make sure the Keltner Channels accurately reflect market conditions.

- Maintain clear visibility on the chart with distinct lines for the middle, upper, and lower bands to effectively identify support and resistance levels within the Keltner Channels.

Interpreting Price Movements Within Channels

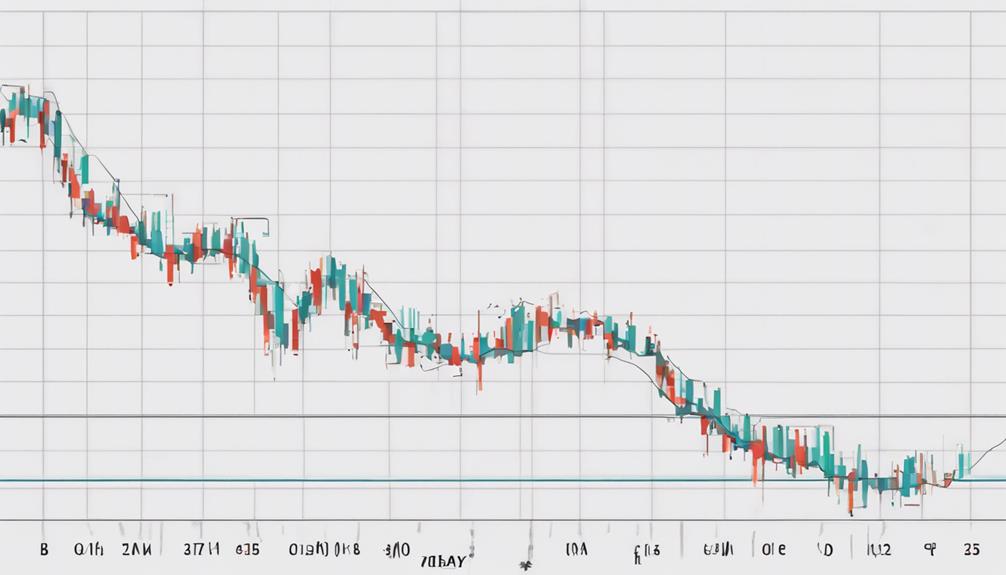

When analyzing price movements within Keltner Channels, traders can leverage the channel's upper and lower boundaries to gauge the strength of trends and identify potential breakout opportunities. The Channel Upper Band and Lower Band serve as dynamic support and resistance levels, offering insights into possible trend changes.

In an uptrend, prices typically remain in the upper half of the Keltner Channel, indicating strength and momentum. Conversely, during a downtrend, prices tend to stay in the lower half of the channel, signaling weakness. In a ranging market, price action oscillates between the upper and lower boundaries, reflecting indecision and potential reversal points.

Observing price behavior in relation to the Channel Middle Line can also help identify shifts in momentum and trend direction. Breakouts above the Channel Upper Band suggest a possible upward move, while breaks below the Channel Lower Band may indicate a downward trajectory.

Traders often use the average true range (ATR) within Keltner Channels to assess volatility-based trading opportunities and refine their entry and exit strategies effectively.

Identifying Entry and Exit Points

Utilizing Keltner Channels enables traders to strategically pinpoint both entry and exit positions within the market, enhancing decision-making processes and optimizing trading outcomes.

When implementing Keltner Channel strategies, traders can identify entry points as prices break above the upper band, signaling potential buying opportunities. Conversely, exit points can be recognized when prices touch or move towards the middle band, indicating a possible end to the current trend.

Additionally, in an uptrend, the lower band may serve as a suitable entry point for long positions. Traders should consider exiting positions if prices break below the lower band, suggesting a shift in market sentiment.

Managing Risk With Keltner Channels

Incorporating Keltner Channels into risk management strategies facilitates dynamic support and resistance levels based on price volatility, aiding traders in limiting potential losses and gauging market risk levels effectively.

Traders can utilize the middle line of the Keltner Channel as a reference point to set stop-loss orders, providing a structured approach to controlling risk exposure.

The width of the Keltner Channel serves as a volatility-based indicator, offering insights into the market's price range and potential fluctuations.

By monitoring price action in relation to the Keltner Channel boundaries, traders can adjust their position sizes accordingly, aligning with their risk tolerance levels.

Additionally, Keltner Channels can assist in identifying possible trend reversals or breakout opportunities, influencing risk management decisions by providing valuable trend-following signals.

Effectively integrating Keltner Channels into risk management practices empowers traders to make informed decisions and navigate market uncertainties with greater precision and confidence.

Can Keltner Channels be used for long-term trading as well, or are they only effective for day trading?

Yes, day trading strategies with Keltner channels can be effective for long-term trading as well. The channels can help identify potential trend reversals and support and resistance levels, which are crucial for long-term trading success. By using Keltner channels, traders can make informed decisions for both short-term and long-term positions.

Can Zig Zag Indicator and Keltner Channels be Combined for Better Trading Results?

Yes, traders can utilize zig zag indicator efficiently and enhance their trading strategies by combining it with Keltner Channels. By using both tools together, traders can benefit from the strengths of each indicator and create a more comprehensive analysis for making informed trading decisions.

Frequently Asked Questions

What Is the Best Setting for Keltner Channels?

The ideal parameters for Keltner Channels depend on factors such as asset volatility and trading strategy. Traders often customize settings by adjusting the ATR multiplier to fine-tune channel width and sensitivity to price movements.

Popular combinations involve using a 20-period EMA and setting boundaries at 2 times the 10-period ATR. Backtesting these parameters and real-time analysis are essential for evaluating effectiveness in scalping or swing trading, emphasizing risk management and utilizing volatility indicators for generating trading signals.

How to Trade With Keltner Channel?

When trading with Keltner Channels, one must focus on identifying entry signals based on trend direction and volatility analysis. Effective risk management involves position sizing, stop loss placement, and trade management strategies.

Trend identification through price action interacting with the bands aids in making informed decisions. Backtesting results can validate the effectiveness of the indicator combination.

Employing these strategies can enhance trading performance with Keltner Channels.

Is Keltner Channel Strategy Profitable?

The profitability of the Keltner Channel strategy hinges on various factors such as:

- Backtesting results

- Profit potential

- Risk management

- Market conditions

- Entry signals

- Exit strategies

- Position sizing

- Volatility analysis

- Trading psychology

- Trend identification

While historical data may suggest profitability, real-time performance can vary.

Traders need to adapt to different market scenarios and employ sound risk management practices to effectively capitalize on the profit potential offered by the Keltner Channel strategy.

Are Keltner Channels Accurate?

Historical data analysis shows Keltner Channels can be accurate indicators when evaluating price volatility and market trends. Their effectiveness in providing entry signals hinges on technical analysis proficiency.

Traders must pair Keltner Channels with sound risk management strategies and consider trading psychology. Backtesting results can offer insights into the accuracy of these channels, influencing position sizing decisions.

Chart patterns may complement Keltner Channels for thorough trading analyses.

Conclusion

To sum up, utilizing Keltner Channels in trading can provide valuable insights into market trends and potential entry and exit points.

By understanding the parameters, setting up the channels correctly, interpreting price movements within them, and managing risk effectively, traders can make informed decisions to enhance their trading strategies.

The use of Keltner Channels as a technical analysis tool can contribute to more successful and profitable trading outcomes.