As you navigate the intricate landscape of trading, picture the MACD Indicator as your guiding compass through the market's ebbs and flows. With its ability to reveal potential trend shifts and momentum changes, the MACD holds a wealth of information waiting to be unlocked.

Understanding how to interpret its signals and incorporate them into your trading strategy can be the key to unlocking profitable opportunities in the financial markets. But remember, mastering the MACD Indicator is just the beginning; there are deeper layers to explore, each holding valuable insights that could elevate your trading game to new heights.

MACD Indicator Overview

The MACD indicator, developed by Gerald Appel in 1979, is a powerful tool for analyzing trends in financial markets. It comprises the MACD line, signal line, and histogram, essential for trading strategies.

The MACD line is the difference between the 26-day Exponential Moving Average (EMA) and the 12-day EMA, reflecting price momentum. The signal line, a 9-day EMA of the MACD line, provides buy and sell signals based on crossovers.

Divergence between the MACD and price movement indicates potential trend reversals. The Histogram visually represents the difference between the MACD line and the signal line, aiding traders in spotting changes in momentum.

Understanding these components is crucial for utilizing the MACD effectively in your trading endeavors.

Setting the MACD Parameters

When adjusting the MACD parameters for optimal performance, consider your trading style and time frame preferences to enhance sensitivity or smoothness in response to price changes.

Here are some key points to keep in mind:

- Default settings are 12, 26, and 9 for fast EMA, slow EMA, and signal EMA.

- Adjust parameters to match your trading style and time frame.

- Shortening EMA periods increases sensitivity to price changes.

- Experiment with different settings to find the optimal configuration for your strategy.

Interpreting MACD Crossovers

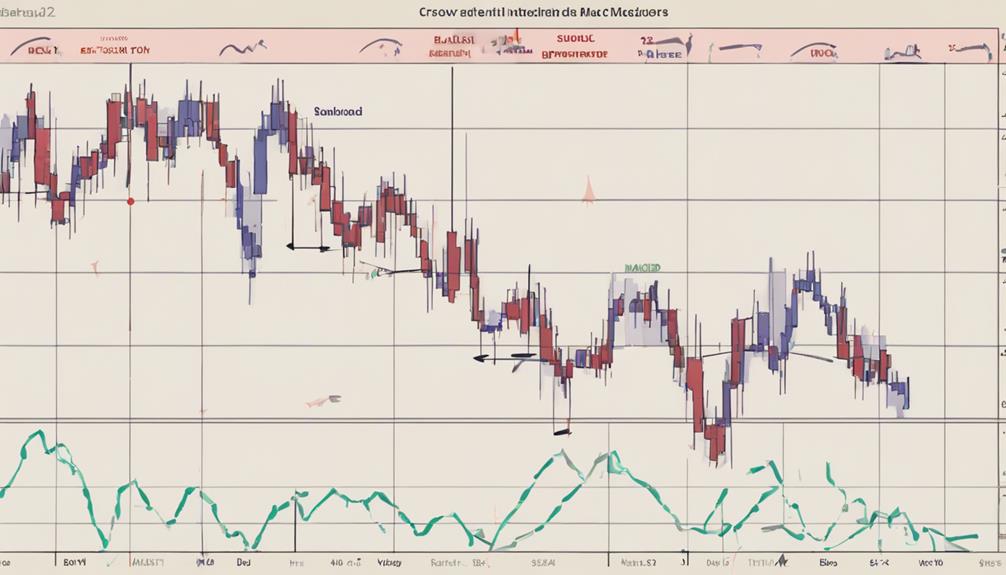

Upon observing MACD crossovers, traders assess potential buy or sell signals as the MACD line intersects with the signal line, indicating shifts in market momentum.

A bullish crossover, where the MACD line crosses above the signal line, suggests a potential uptrend and a buy opportunity. Conversely, a bearish crossover, when the MACD line crosses below the signal line, indicates a possible downtrend and a sell opportunity.

These crossovers help traders identify trend changes and determine entry/exit points in the market. By analyzing MACD crossovers, traders can gain insights into market momentum and pinpoint favorable trade opportunities.

Monitoring these interactions between the MACD line and signal line is crucial for making informed trading decisions.

Utilizing the MACD Histogram

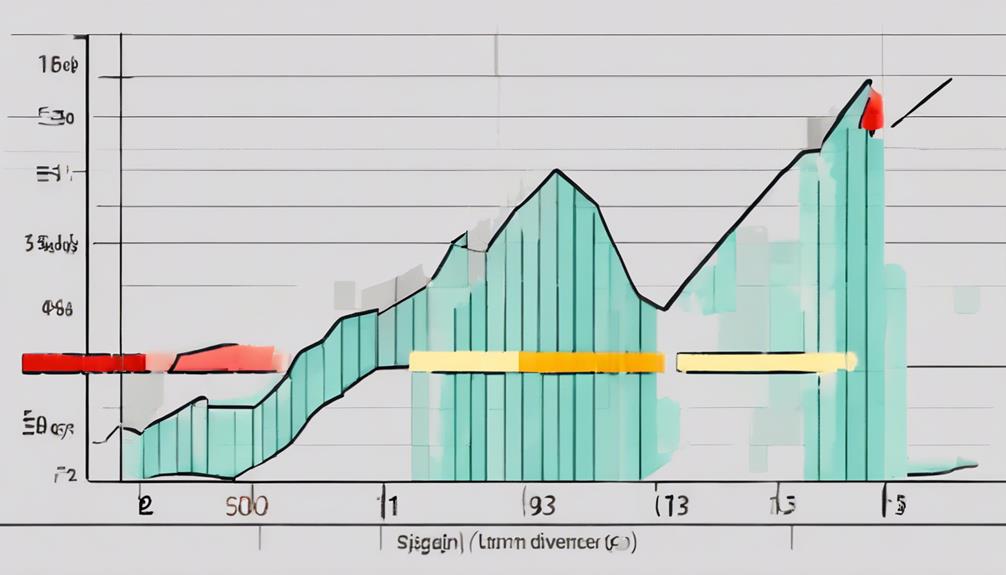

To effectively utilize the MACD Histogram, traders should focus on interpreting the difference between the MACD line and the signal line. By understanding the MACD histogram, traders can identify momentum shifts, strong signals, and gain insights into market structure.

Key strategies for using the MACD histogram include:

- Spotting Breakout Trades: Utilize the MACD histogram squeeze to identify potential breakout opportunities.

- Recognizing Low Volatility Signals: The histogram can help in signaling periods of low volatility in the market.

- Enhancing Winning Rate: Incorporating the MACD histogram into trading strategies can improve the winning rate by defining trends effectively.

- Utilizing Crossovers: Combine crossovers with the MACD histogram to make informed trading decisions.

Enhancing MACD Strategy

Enhance your MACD strategy by experimenting with various settings to optimize sensitivity and accuracy in your trading approach. Backtest different configurations to assess historical performance and refine trading rules.

Consider combining MACD with indicators like RSI or Moving Averages to enhance your strategy. Use MACD as a trend filter to confirm market direction and avoid false signals.

Adapt your MACD strategies to different timeframes to align with specific trading goals and time horizons. By fine-tuning your MACD settings, incorporating additional indicators, and adjusting to different timeframes, you can improve the effectiveness of your trading signals and overall strategy.

Experimentation and analysis are key to finding the most suitable MACD strategy for your trading style.

Can I Improve my MACD Indicator Usage with These Top Strategies?

Looking to enhance your MACD indicator usage? Start by implementing these top strategies for MACD usage. Consider using MACD crossovers, divergence analysis, and signal line crossovers. By applying these top strategies for MACD usage, you can maximize the effectiveness of this powerful trading tool.

Frequently Asked Questions

How Do You Use MACD Indicator Effectively?

To use the MACD indicator effectively, you watch for the MACD line crossing above for buy signals and below for sell signals. Divergence between price and MACD hints at market shifts. Combine MACD with RSI and Moving Averages for precise trades.

What Is the Best Time Frame for Using MACD Indicator?

In trading, your strategy's success with the MACD indicator hinges on selecting the right time frame. Tailor your choice to match your trading style – day traders opt for shorter periods, while long-term investors look to daily or weekly charts for trends.

What Are the Best Parameters for MACD Indicator?

For the MACD indicator, the best parameters vary based on your trading style and goals. Experiment with different settings to find what suits you. Shorter EMAs like 5, 13, 8 offer quick signals, while longer ones like 21, 55, 34 provide smoother trends.

What Is the Most Accurate MACD Settings?

Looking for the most accurate MACD settings? Tweak the default 12, 26, 9 to match your trading pace. Adjusting to 8, 17, 9 can provide quicker signals. Experiment with settings for enhanced precision in line with market conditions.

Conclusion

In conclusion, mastering the MACD indicator can significantly enhance your trading strategy. By understanding its components and interpreting signals effectively, you can make informed decisions on market entry and exit points.

Remember, like a skilled musician who tunes their instrument before a performance, combining MACD with other technical indicators is crucial for comprehensive analysis and successful trading.

Keep honing your skills and refining your strategy to stay ahead in the dynamic world of trading.