In your exploration of technical analysis tools, you may have encountered the term 'Ichimoku Cloud Indicator.' Understanding the top 10 basics of this simplified yet powerful tool can enhance your trading strategies significantly.

From deciphering key formulas to practical tips for application, each aspect plays a crucial role in navigating market trends effectively. By grasping the fundamentals, you pave the way for a deeper understanding of how this indicator can elevate your trading decisions.

Ichimoku Cloud Indicator Overview

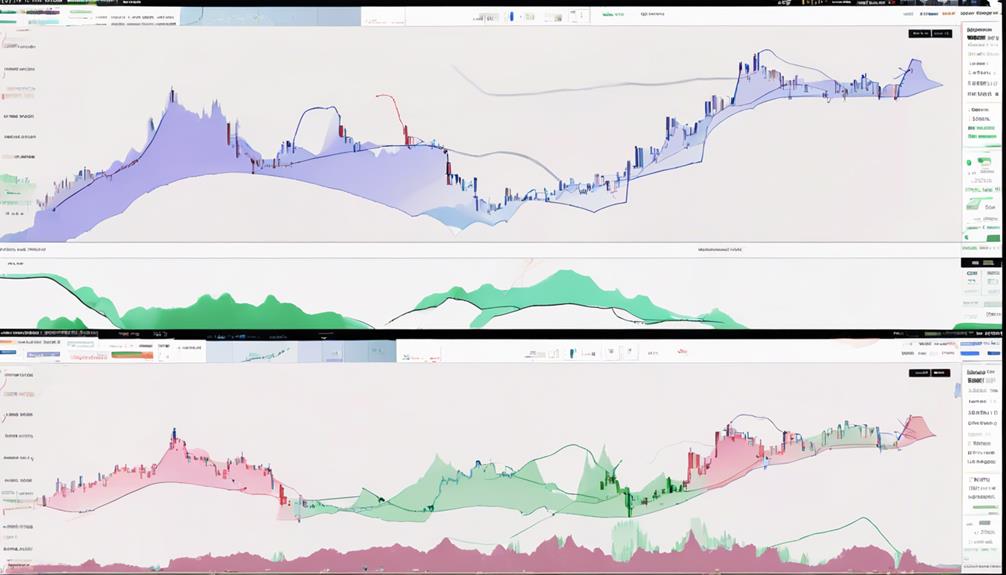

The Ichimoku Cloud Indicator, developed by Goichi Hosoda in the late 1960s, is a powerful tool that provides traders with essential insights into support and resistance levels, momentum, and trend direction. This indicator goes beyond traditional candlestick charts by offering a cloud that forecasts future support or resistance levels.

Understanding these support and resistance levels is crucial for making informed trading decisions. By utilizing the Ichimoku Cloud Indicator, traders can benefit from clear trading signals, helping them navigate the markets with more confidence. This tool is widely used across various markets such as stocks, cryptocurrency, and forex, making it a versatile component of technical analysis strategies.

Mastering the interpretation of this indicator can enhance your trading skills and improve your overall risk-adjusted returns.

Key Formulas for Simplified Ichimoku

Understanding the key formulas for the Simplified Ichimoku indicator is crucial for effectively utilizing this powerful tool in your trading strategy.

The Conversion Line is calculated as the average of the 9-period high and low, providing insight into short-term price momentum.

On the other hand, the Base Line is determined by averaging the 26-period high and low, offering a view of medium-term price momentum.

The Leading Span A combines the Conversion and Base Lines, shifted forward by 26 periods, acting as a measure of future price movement.

Leading Span B, derived from the 52-period high and low, shifted forward by 26 periods, serves as a confirmation of the overall trend's strength.

These formulas are fundamental in interpreting market trends accurately.

Interpretation of Ichimoku Cloud

Utilize price position relative to the Ichimoku Cloud as a key indicator for determining trend direction and potential reversal points. When price trades above the cloud, it suggests an uptrend, while price below the cloud indicates a downtrend.

The Ichimoku Cloud also serves as dynamic support and resistance levels, assisting in identifying potential reversal points in the market. Traders often monitor crossovers and interactions between the Conversion and Base lines to confirm shifts in momentum and trend direction.

Ichimoku Vs. Moving Averages

Price action signals from the Ichimoku Cloud and moving averages provide distinct perspectives on trend direction and potential reversals in the market. When comparing Ichimoku Cloud with moving averages, several key differences stand out:

- Calculation Method: The Ichimoku Cloud uses highs and lows divided by two to calculate averages, unlike traditional moving averages that are based on closing prices.

- Information Provided: The Ichimoku Cloud offers unique information such as support/resistance levels, momentum, and trend direction, while moving averages focus solely on historical price data.

- Strengths and Uses: Both Ichimoku Cloud and moving averages have their strengths and uses, offering traders different angles for analysis.

- Comprehensive Analysis: Traders often use both the Ichimoku Cloud and moving averages alongside other indicators for comprehensive market analysis and informed trading decisions.

Understanding Tenkan Sen and Kijun Sen

When considering Tenkan Sen and Kijun Sen in the Ichimoku Cloud indicator, focus on their calculation methods and respective roles.

Tenkan Sen, derived from a nine-period average, reacts swiftly to price changes, offering early trend signals.

In contrast, Kijun Sen, calculated over 26 periods, serves as a confirmation line with a slower response to validate trend direction.

Tenkan Sen Calculation

To understand the Tenkan Sen calculation and its relation to the Kijun Sen line in the Ichimoku Cloud indicator, you need to know that Tenkan Sen is derived by averaging the highest high and lowest low over the past 9 periods. This calculation helps provide insight into short-term price momentum and trend direction. Key points about Tenkan Sen include:

- Provides a shorter-term perspective on price momentum.

- Is one of the components used to generate trading signals in the Ichimoku Cloud indicator.

- Reacts more quickly to price changes compared to the Kijun Sen line.

- Traders often observe crossovers between the Tenkan Sen and Kijun Sen lines for potential market sentiment shifts.

Kijun Sen Significance

Understanding the significance of Kijun Sen in the Ichimoku Cloud indicator provides valuable insights into market dynamics and trend analysis. As the Baseline in this indicator, Kijun Sen acts as a robust support/resistance level, offering more stability than Tenkan Sen. Traders often look for crosses between Tenkan Sen and Kijun Sen as these points can indicate potential trend changes.

Since Kijun Sen is calculated based on the midpoint of the 26-period high and low, it carries significant weight in assessing market conditions. Utilizing Kijun Sen in conjunction with other elements of the Ichimoku Cloud can help confirm trend direction and gauge market momentum accurately. This makes it a vital component for traders seeking to make informed decisions in the market.

Exploring Senkou Spans in Ichimoku

When examining Senkou Spans in Ichimoku, you'll focus on their calculation, interpretation, and practical applications.

Understanding how Senkou Span A and B are computed is crucial for grasping the dynamics of the Ichimoku Cloud.

Interpreting the relationship between these spans can provide valuable insights into potential market trends and trading opportunities.

Senkou Span Calculation

Calculating the Senkou Spans in the Ichimoku Cloud indicator involves averaging key price points over specific periods to project future support and resistance levels. When computing Senkou Span A and Senkou Span B, remember the following:

- Senkou Span A is derived by averaging the Tenkan Sen and Kijun Sen, then plotting the result 26 periods ahead.

- Senkou Span B is calculated by averaging the highest high and lowest low over the past 52 periods, then projecting it 26 periods ahead.

- The region between Senkou Span A and Senkou Span B forms the cloud or Kumo in the Ichimoku indicator.

- This cloud acts as dynamic support and resistance levels for price movements, aiding traders in assessing potential future price action and trend direction.

Senkou Span Interpretation

Moving from the calculation of Senkou Spans to their interpretation within the Ichimoku Cloud indicator, understanding the dynamics of Senkou Span A and Senkou Span B, as well as the cloud formation, is essential.

Senkou Span A, derived from the average of the Tenkan Sen and Kijun Sen, projected 26 periods ahead, provides insight into potential future support or resistance levels.

On the other hand, Senkou Span B, calculated using the highest high and lowest low over 52 periods and also plotted 26 periods ahead, complements the analysis by offering additional confirmation of potential trend changes.

The area between these two spans forms the cloud, known as the Kumo, which serves as a forward-looking support/resistance zone, indicating potential shifts in trend direction based on how the Senkou Spans interact within the cloud.

Senkou Span Applications

Explore how traders utilize Senkou Spans within the Ichimoku Cloud indicator to anticipate potential price movements and identify key support and resistance levels.

The Senkou Span A is calculated from the Conversion Line and the Base Line, projected 26 periods ahead, while the Senkou Span B is derived from the 52-period high and low, also plotted 26 periods in the future.

Together, these two spans form the cloud, which signifies potential future support and resistance areas. Traders rely on the cloud to assess the trend's strength and use it as dynamic support or resistance for making trading decisions.

Insight Into Chikou Span Function

Utilizing the Chikou Span in Ichimoku analysis provides traders with valuable insights into current price dynamics within historical context. The Chikou Span, representing the current price shifted 26 periods back on the chart, helps traders identify potential support and resistance levels.

When the Chikou Span is above the price, it signals a bullish momentum. By analyzing the Chikou Span's position relative to the cloud and price, traders can gauge trend strength and anticipate possible reversals. This component plays a crucial role in confirming trend direction and providing a comprehensive view of the market conditions.

Incorporating the Chikou Span into your analysis can enhance your understanding of price movements and aid in making informed trading decisions.

Applying Ichimoku in Trading

When applying Ichimoku in your trading, focus on developing solid trading strategies with Ichimoku indicators.

Learn to read Ichimoku charts effectively to identify key trend information.

Interpret Ichimoku signals with precision to make informed trading decisions.

Trading Strategies With Ichimoku

Navigating the complexities of the financial markets demands a nuanced understanding of trading strategies with Ichimoku, particularly in applying this indicator effectively.

When utilizing Ichimoku Cloud Trading, focus on entry signals by observing the crossovers of the Tenkan and Kijun lines. Assess Trend Strength by analyzing the thickness of the Ichimoku Cloud.

Additionally, confirm trends using the Chikou Span line in Ichimoku analysis. For enhanced decision-making, consider combining Ichimoku with other indicators to gain confluence.

Reading Ichimoku Charts

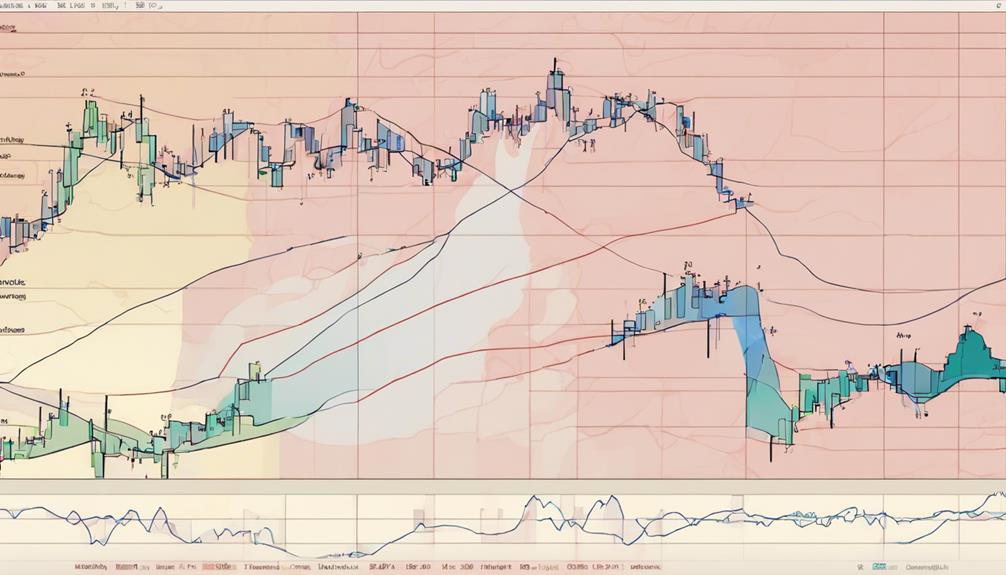

Begin your analysis of Ichimoku charts by examining the five key lines displayed, providing essential trend and momentum insights for effective trading decisions.

The Ichimoku Cloud Technical Analysis includes the Conversion Line, Base Line, Leading Span A, Leading Span B, and Lagging Span. These lines help traders identify support and resistance levels within the cloud.

When price is above the cloud, it signifies an uptrend, while being below indicates a downtrend.

Momentum signals are generated by crosses between the Conversion Line and Base Line, with bullish momentum confirmed by the shorter line crossing above the longer one.

Utilize Ichimoku charts to determine trade entries and exits, leveraging the cloud as dynamic support and resistance during trends for informed trading choices.

Ichimoku Signals Interpretation

To effectively apply Ichimoku in trading, focus on interpreting signals using the Conversion and Base lines for trend direction and momentum confirmation.

When analyzing Ichimoku signals:

- Price above both lines indicates bullish momentum.

- Crosses between the lines confirm momentum shifts.

- The Ichimoku Cloud serves as support and resistance levels.

- A bullish trend is confirmed when the price is above the Cloud, while a bearish trend is confirmed when the price is below it.

Practical Use of Ichimoku Cloud

Utilize the Ichimoku Cloud indicator to pinpoint crucial support and resistance levels, enhancing your ability to assess market trends effectively. The indicator's cloud color and position offer valuable insights into potential price levels where the market may exhibit these support and resistance dynamics.

By observing how price interacts with the cloud, traders can make informed decisions on market entry and exit points. Adjusting the Ichimoku Cloud settings is vital to align the indicator with your trading strategies, ensuring accurate analysis.

This tool is particularly beneficial for medium to long-term trading, providing a comprehensive view of market trends over extended periods. Combining Japanese candlestick signals with the Ichimoku Cloud further enhances your analysis, improving your trading strategies for better results.

Tips for Using Ichimoku Indicator

When analyzing market trends using the Ichimoku Indicator, consider these essential tips for maximizing its effectiveness:

- Focus on the Conversion and Base lines: Buy signals occur when the price is above these lines.

- Monitor Crosses of Conversion and Base lines: These indicate momentum direction in trading.

- Utilize the Ichimoku Cloud: It provides dynamic support and resistance levels.

- Confirm Trends with the Cloud: Price above the Cloud confirms uptrend, while price below confirms downtrend.

Can the Simplified Ichimoku Cloud Indicator be applied to different trading strategies?

The best basics Ichimoku cloud indicator can definitely be applied to different trading strategies. Whether it’s trend trading, breakout trading, or even mean reversion strategies, the Ichimoku cloud provides valuable information on support and resistance levels, trend direction, and momentum. It’s a versatile tool for traders of all kinds.

Frequently Asked Questions

What Is the Best Indicator for Ichimoku Cloud?

The best indicator for Ichimoku Cloud is the Tenkan-sen line, guiding short-term trends. The Kijun-sen line offers medium-term insights. The Chikou Span confirms with lagging data. Senkou Span A and B lines predict support and resistance. Combine for trend, momentum, entry/exit clarity.

What Are the 5 Lines of the Ichimoku Cloud?

The five lines of the Ichimoku Cloud are the Conversion Line, Base Line, Leading Span A, Leading Span B, and Lagging Span. The Conversion Line and Base Line form the cloud's foundation, while Leading Span A and B indicate future price momentum.

What Is 9 26 52 in Ichimoku?

In Ichimoku, 9, 26, and 52 are the periods representing calculations for the lines and cloud. The Conversion Line is from a 9-period average, Base Line from a 26-period average, and the Cloud boundaries from 52-period highs and lows.

What Are the Best Settings for Ichimoku Cloud?

For your Ichimoku Cloud settings, consider adjusting based on market conditions and personal preferences. Shorter settings offer more sensitive signals but increase false ones. Longer settings filter noise but delay signals. Experiment to find your best fit.

Conclusion

In conclusion, mastering the top 10 basics of the Simplified Ichimoku Cloud Indicator is essential for traders seeking comprehensive market insights.

By understanding key formulas, interpreting cloud formations, and utilizing unique components like Tenkan Sen and Kijun Sen, traders can make informed decisions with confidence.

Just as the Ichimoku Cloud provides a clear forecast of market trends, mastering its basics can illuminate the path to successful trading like a beacon in the storm.