Have you ever noticed how Fibonacci extensions seem to predict cryptocurrency price movements with remarkable accuracy?

These mathematical levels hold the key to unlocking hidden patterns and potential future scenarios in the volatile crypto market.

Understanding why Fibonacci extensions are essential in cryptocurrency trading can significantly impact your trading decisions and outcomes.

By exploring the intricacies of Fibonacci ratios and extensions, you can gain a competitive edge in navigating the complexities of digital asset trading.

Importance of Fibonacci Extensions in Crypto

Fibonacci Extensions in cryptocurrency serve as indispensable tools for traders seeking to pinpoint precise price targets and manage risks efficiently in the volatile digital asset market. These extensions help identify key price levels, including support and resistance levels, essential for making informed trading decisions. By visualizing potential price targets, traders can establish entry and exit points, set profit targets, and effectively navigate price movements in financial markets.

Understanding Fibonacci Extensions is crucial for predicting trend reversals and continuations, allowing traders to adjust their strategies accordingly. Whether for short-term gains or long-term investments, incorporating Fibonacci Extensions enhances trading strategies and improves overall profitability in cryptocurrency analysis.

Fibonacci Extension Strategies for Trading

To enhance your cryptocurrency trading strategies and effectively manage risk, incorporating Fibonacci extension strategies is essential for setting realistic profit targets and anticipating price movements beyond retracement levels.

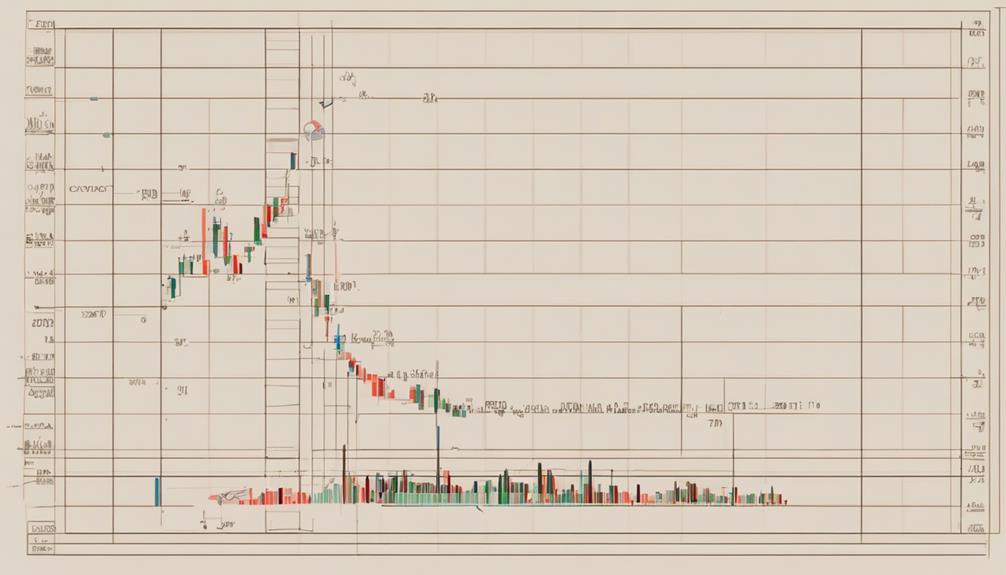

Traders utilize Fibonacci extension levels such as 1.618, 2.618, and 4.236 to establish price targets and predict potential price movements in the cryptocurrency markets. These Fibonacci extension strategies not only aid in identifying where price reversals may occur but also help in determining where trends could continue.

Enhancing Cryptocurrency Analysis With Fibonacci Extensions

Enhance your cryptocurrency analysis by incorporating Fibonacci extensions, which play a crucial role in identifying potential price targets and improving decision-making processes in trading.

These extensions help traders determine support and resistance levels, crucial for setting effective stop-loss orders and profit-taking points.

By utilizing Fibonacci extensions, you can establish realistic profit goals based on historical price trends and key Fibonacci levels.

This strategic approach enhances your trading strategies, enabling you to make informed decisions and manage risks more effectively.

Incorporating Fibonacci extensions into your cryptocurrency analysis provides a structured method for setting profit targets and understanding potential price movements, ultimately contributing to a more systematic and profitable trading experience.

Fibonacci Extension Levels for Altcoins

Utilize Fibonacci extension levels to pinpoint potential price targets and support/resistance areas for altcoins, enhancing strategic decision-making in your trading endeavors.

These levels, derived from the Fibonacci sequence, offer valuable insights into future price movements for altcoin trading. By setting profit targets using Fibonacci extensions, altcoin traders can effectively manage risk and plan their trades more efficiently.

Additionally, these levels aid in predicting trend reversals or continuations in altcoin markets, providing traders with essential information for making well-informed trading decisions.

When combined with other indicators, Fibonacci extensions become powerful tools that can enhance your overall trading strategies and improve the accuracy of your market analyses.

Maximizing Returns With Fibonacci Extensions

By identifying potential price targets beyond the usual Fibonacci retracement levels, Fibonacci Extensions in cryptocurrency analysis offer traders a strategic approach to maximizing returns. These extensions provide additional profit targets and aid in risk management, enhancing trading strategies by visualizing future price movements based on Fibonacci ratios like 1.618, 2.618, and 4.236.

Incorporating Fibonacci Extensions into your analysis can help you set realistic profit targets and make informed decisions, ultimately improving profitability in the cryptocurrency market. By utilizing these tools effectively, you can adjust your trading approach to align with calculated price levels, increasing the likelihood of successful trades and optimizing your returns.

Embracing Fibonacci Extensions empowers you to trade with more precision and confidence, leading to enhanced profitability.

How Can Fibonacci Extensions Benefit Cryptocurrency Trading?

Fibonacci extensions in analysis can benefit cryptocurrency trading by identifying potential price targets and support/resistance levels. Traders use these extensions to predict future price movements and make informed decisions. By incorporating Fibonacci extensions into their analysis, cryptocurrency traders can gain a better understanding of market trends and maximize their profits.

Frequently Asked Questions

What Is Fibonacci in Cryptocurrency?

Fibonacci in cryptocurrency involves projecting ratios onto price charts to identify potential levels. Traders utilize these levels to predict price movements, set profit targets, and manage risk effectively. Understanding Fibonacci allows you to adjust trading strategies strategically.

Why Is Fibonacci Important in Trading?

Fibonacci is important in trading as it helps set realistic targets and manage risk effectively. By identifying key levels and predicting reversals, you can make informed decisions that enhance profitability and optimize your strategies.

How Do I Use FIB Extension in Crypto?

To use Fib extensions in crypto, identify trends, plot Fibonacci levels, and project potential price targets. Set profit goals and manage risk based on calculated extensions. Combine with other analysis tools for strategic insights, aiding decision-making and profitability.

What Are Fibonacci Extensions?

As you explore Fibonacci extensions, discover these horizontal lines that highlight potential price levels based on the Fibonacci sequence. Utilize ratios like 0.618 and 1.618 to gauge support and resistance levels for informed trading decisions.

Conclusion

In conclusion, incorporating Fibonacci extensions into your cryptocurrency trading strategy is like having a compass in a stormy sea. It guides you towards profitable opportunities and helps you navigate market uncertainties with confidence.

By leveraging these powerful tools, you can set realistic profit targets, identify key price levels, and make informed decisions that maximize your returns in the dynamic world of digital currencies.

Embrace Fibonacci extensions to unlock the full potential of your trading endeavors.