The Parabolic SAR indicator stands as a reliable instrument in the arsenal of traders, offering insights into market trends and potential entry and exit points. Its ability to adapt to changing price dynamics and provide a visual representation of trend direction makes it a favored choice among traders seeking clarity in their strategies.

By incorporating the Parabolic SAR indicator into technical analysis, traders can gain a competitive edge in navigating volatile markets and optimizing their trading performance. Its significance lies not only in trend identification but also in its role of refining trading decisions.

Benefits of Parabolic SAR Indicator

The Parabolic SAR indicator offers traders a valuable tool for identifying potential trend reversals and establishing optimal entry and exit points in asset markets. This technical analysis tool is renowned for its ability to assist traders in determining the direction in which an asset's price is moving. The indicator's easy interpretation through visual representation simplifies the process of recognizing trend direction changes. Traders, regardless of their experience level, can benefit from incorporating Parabolic SAR into their trading strategies.

One of the key advantages of the Parabolic SAR indicator is its provision of clear entry and exit points, aiding traders in making well-informed decisions. However, it is crucial for traders to exercise proper risk management when using this indicator, as false signals may occur, particularly in sideways markets. By understanding the benefits and limitations of the Parabolic SAR indicator, traders can enhance their ability to navigate dynamic market conditions effectively.

Enhanced Market Analysis With Parabolic SAR

Building on the benefits of the Parabolic SAR indicator for identifying potential trend reversals and establishing entry and exit points, incorporating this tool into market analysis can significantly enhance traders' decision-making processes.

Enhanced Market Analysis With Parabolic SAR:

- Trailing Stop-Loss Orders: Utilizing Parabolic SAR allows traders to efficiently set trailing stop-loss orders, helping to protect profits during price fluctuations.

- Real-Time Signals: Due to its dynamic adjustments based on price movement, Parabolic SAR provides traders with real-time signals, enabling timely responses to market changes.

- Combining Indicators for Accuracy: By combining Parabolic SAR with other technical indicators, traders can enhance the accuracy of their market analysis, gaining deeper insights into asset prices and market trends.

Incorporating Parabolic SAR into market analysis not only offers clear guidance on entry and exit points but also facilitates the implementation of effective risk management strategies, ultimately leading to more informed trading decisions and improved overall performance.

Improving Trading Strategy With Parabolic SAR

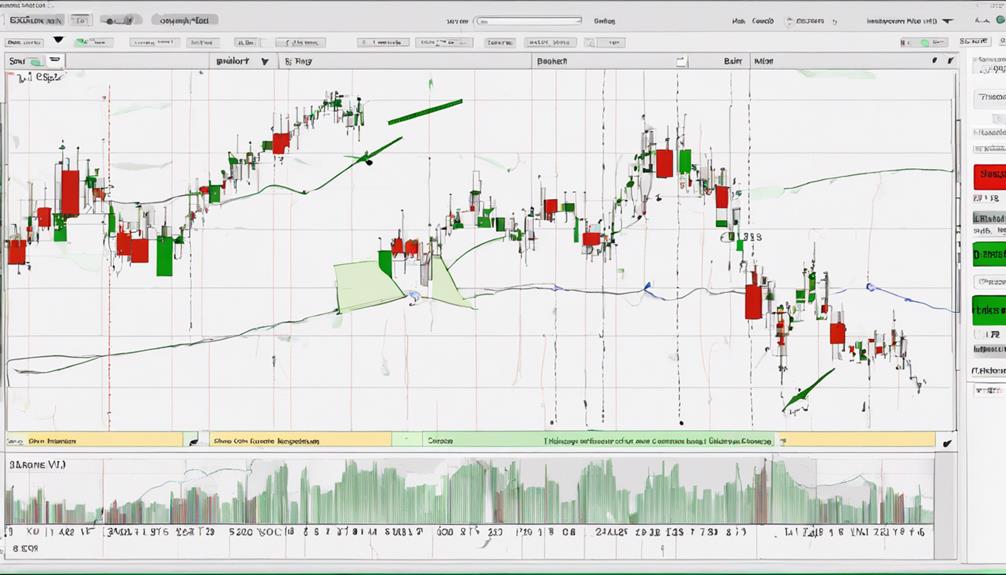

Enhancing trading strategies with the implementation of Parabolic SAR can lead to improved decision-making and optimized risk management. The Parabolic SAR indicator is valuable for identifying potential trend reversals and determining entry/exit points within trading strategies. It offers visual cues on price charts through dots positioned above or below the price, indicating shifts in market direction.

By utilizing Parabolic SAR, traders can effectively set trailing stop-loss orders, enhancing risk management practices. Moreover, combining Parabolic SAR with other indicators such as the Average Directional Index (ADX) can strengthen trend analysis and aid in informed decision-making. This amalgamation allows traders to capture trend momentum accurately, thereby optimizing both entry and exit points for more profitable trades.

Parabolic SAR for Informed Decision Making

Implementing Parabolic SAR into trading strategies offers a comprehensive tool for making well-informed decisions by effectively identifying potential trend reversals and providing clear signals for entry and exit based on price movements. Traders benefit from this indicator in various ways:

- Identification of Trend Reversals: Parabolic SAR assists traders in recognizing key points where trends may reverse, enabling timely adjustments to trading positions.

- Entry and Exit Signals: By generating precise signals based on price movements, Parabolic SAR aids traders in determining optimal points to enter or exit trades, enhancing overall decision-making.

- Trailing Stop-Loss Orders and Risk Management: The indicator supports traders in setting trailing stop-loss orders, crucial for managing risk effectively and protecting profits as trends evolve.

In utilizing Parabolic SAR, traders can capture trend momentum, navigate volatile financial markets, and refine their decision-making processes to align with market dynamics efficiently. This tool serves as a valuable asset in enhancing trading strategies and fostering a disciplined approach to trading activities.

Increasing Profitability Using Parabolic SAR

Utilizing the Parabolic SAR indicator can significantly enhance traders' profitability by providing clear signals for entry and exit points, thereby maximizing gains in trending markets.

The indicator's ability to capture strong trends and generate precise entry and exit signals allows traders to capitalize on profitable opportunities while effectively managing risk.

By incorporating the trailing stop feature, traders can secure profits as a trend progresses, reducing the likelihood of missing out on potential gains.

Following the SAR dots enables traders to ride trends for extended periods, increasing the probability of successful trades and overall profitability.

When combined with other indicators and robust risk management strategies, such as setting stop-loss orders and position sizing, Parabolic SAR can play a crucial role in boosting trading profitability.

Its simplicity and effectiveness in identifying trends make it a valuable tool for traders seeking to maximize profits and make informed trading decisions in dynamic market environments.

What Are the Benefits of Using the Parabolic SAR Indicator?

The parabolic SAR indicator importance lies in its ability to identify potential trend reversals in the market. By displaying entry and exit points, this tool helps traders make informed decisions and manage their positions more effectively. Its simplicity and effectiveness make it a valuable asset for any trader.

Frequently Asked Questions

How Accurate Is the Parabolic SAR Indicator?

The accuracy of the Parabolic SAR indicator varies with market conditions and trend strength. It excels in strong trends for signaling entry and exit points. Yet, in choppy markets, it may yield false signals. Combining it with the ADX can enhance its reliability.

What Is the Best Strategy for Parabolic Sar?

The best strategy for Parabolic SAR involves utilizing it in trending markets effectively. Traders can enhance its signals by combining it with indicators like ADX and moving averages. Backtesting various combinations can help identify the most effective strategy.

Is Parabolic SAR Good for Scalping?

Parabolic SAR emerges as a strategic ally for scalping due to its adeptness in swiftly signaling entry and exit points amidst volatile price shifts. When coupled with complementary indicators, it aids scalpers in seizing fleeting profit opportunities.

What Timeframe Is Best for Parabolic Sar?

The best timeframe for Parabolic SAR depends on trader preferences and objectives. Shorter timeframes like 15-minute or 1-hour charts offer more frequent signals for quick trades. Longer timeframes such as daily or weekly charts provide more reliable signals for trend-following strategies.

Conclusion

In conclusion, the Parabolic SAR indicator offers valuable insights for traders by identifying potential reversals, providing clear entry and exit points, and confirming trading signals.

By utilizing this tool, traders can enhance their market analysis, improve their trading strategies, and make informed decisions to increase profitability.

For example, a trader using the Parabolic SAR indicator correctly predicted a trend reversal in a volatile market, resulting in significant profits.