Explore mastering Elliott Wave Theory with a structured approach, real-world applications, visual aids, and practical examples. Learn how to identify wave patterns, forecast market trends, and enhance analytical skills in financial markets. Utilize note-taking techniques, engage with practical examples, and develop patience and persistence in learning. Understand the critical application of Elliott Wave Theory by analyzing Fibonacci relationships, avoiding common pitfalls, and shifting to practical application for success. This detailed step-by-step guide offers a pathway to deepen your understanding and proficiency in utilizing this powerful tool for market analysis and prediction.

Logical Progression

In exploring the complex domain of Elliott Wave Theory, establishing a logical progression in study serves as the fundamental pillar for comprehending its nuances and applications effectively. A sequential reading progression is essential in unraveling the intricacies of Elliott Wave theory. By following a structured approach, learners can grasp the theory's principles in a systematic manner, laying a solid foundation for more advanced concepts.

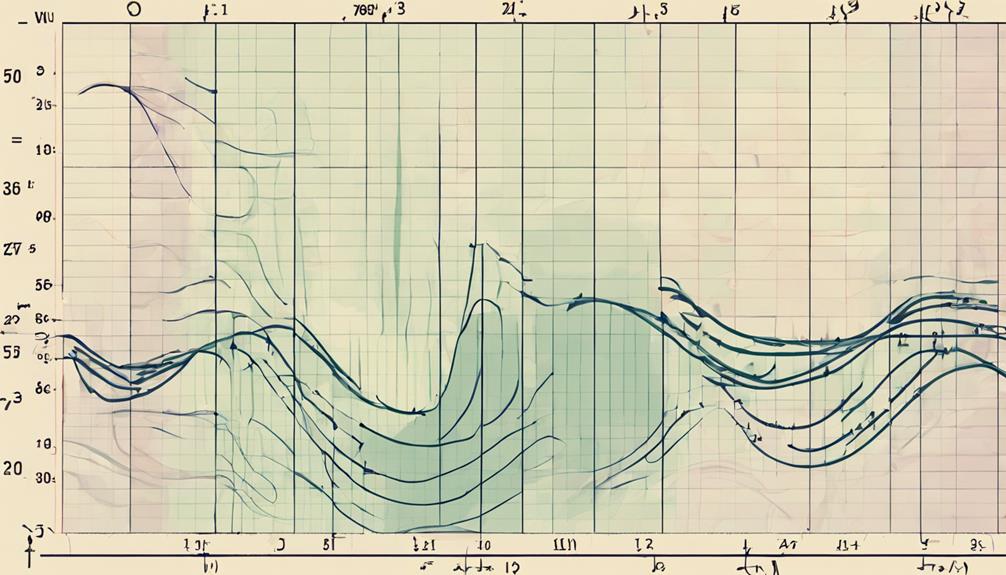

Real-world applications play a pivotal role in reinforcing understanding. Engaging with practical examples that demonstrate how Elliott Wave theory is applied in financial markets can provide valuable insights. Visual aids such as charts and diagrams offer a tangible representation of theoretical concepts, making them easier to comprehend and remember.

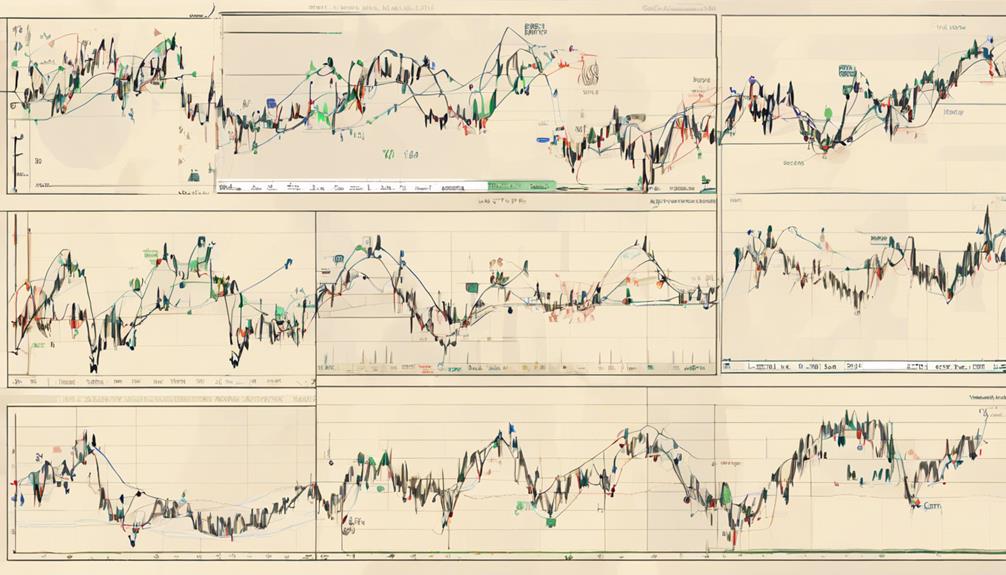

Furthermore, analyzing historical and current market charts is essential for practical application. By practicing on real-time data, individuals can test their understanding and refine their skills in identifying wave patterns. This hands-on experience enhances proficiency and fosters a deeper comprehension of Elliott Wave theory's complexities.

Practical Examples Engagement

Engaging with practical examples is essential for a thorough understanding and effective application of Elliott Wave Theory. To master this complex theory, it is vital to apply it to real-life scenarios and market forecasting. Utilizing charts and diagrams can greatly aid in visualizing wave patterns and trends. Here are four key ways to engage with practical examples effectively:

- Analyze Historical Data: Study past market movements using Elliott Wave Theory to identify wave patterns and understand how they unfolded in real-world situations.

- Apply to Current Market Trends: Practice applying the theory to current market charts to enhance your ability to forecast potential future price movements accurately.

- Summarize Key Concepts: After analyzing practical examples, summarize the key concepts learned to reinforce your understanding and retention of the theory.

- Utilize Visual Aids: Use charts and diagrams to visually represent wave patterns, making it easier to grasp the complexities of Elliott Wave Theory in different market scenarios.

Visual Aids Utilization

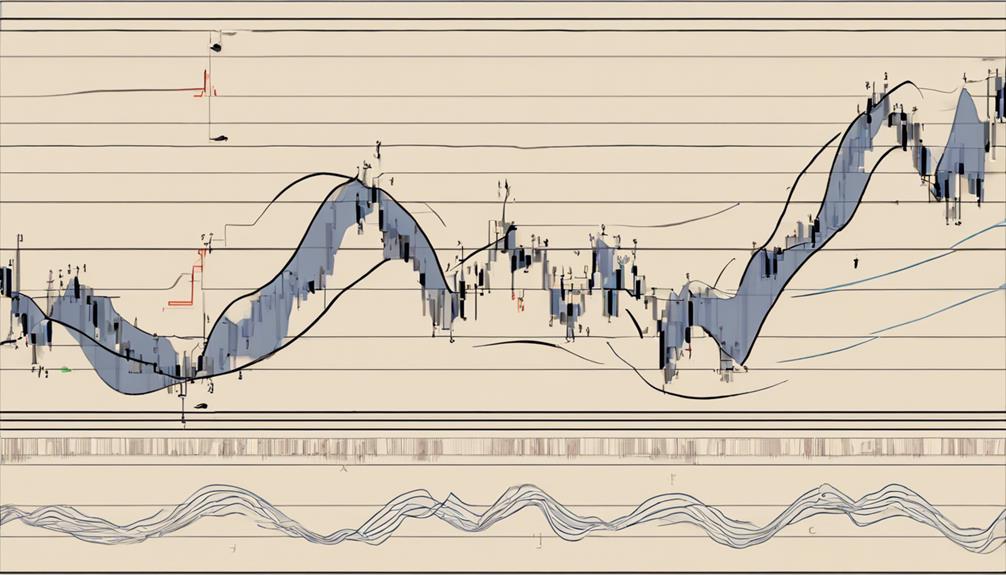

Utilizing visual aids such as charts and diagrams is essential for enhancing the comprehension and application of Elliott Wave Theory. Charts provide a visual representation of wave patterns and market behavior, aiding in the identification of various wave counts. Diagrams, on the other hand, offer a structured way to analyze wave movements and assist in forecasting future market trends. By incorporating these visual tools into the study of Elliott Wave Theory, individuals can deepen their understanding of how waves interact within the market and improve their ability to predict potential outcomes.

To further illustrate the importance of visual aids in mastering Elliott Wave Theory, consider the following table:

| Visual Aids | Description |

|---|---|

| Charts | Display historical and current market movements |

| Diagrams | Illustrate wave patterns and counts |

| Forecasting | Predict future market trends based on analysis |

| Elliott Wave | Theory of market cycles and wave patterns |

Note-Taking and Summarizing

An integral aspect of mastering Elliott Wave Theory involves the meticulous practice of note-taking and summarizing key concepts to enhance understanding and retention of the intricate market cycles and wave patterns. When delving into this complex subject matter, effective note-taking and summarizing can prove essential for comprehending the nuances of Elliott Wave Theory.

Here are some useful strategies to keep in mind:

- Utilize a Book: Referencing a reputable book on Elliott Wave Theory can provide a structured outline to organize your notes effectively.

- Acknowledge Complexity: Acknowledge the complex nature of the theory and break down intricate concepts into simpler, digestible summaries.

- Real-Life Applications: Relate theoretical concepts to real-life examples to deepen your understanding and make the material more relatable.

- Create Useful Summaries: Craft concise summaries in your own words to reinforce learning and serve as valuable study aids.

Practical Application Practice

To effectively apply Elliott Wave Theory in real-world trading scenarios, it is vital to engage in practical application practice by analyzing historical and current market charts. By delving into past market movements and applying wave analysis techniques, traders can gain valuable insights into potential future price movements. Utilizing visual aids such as charts and diagrams enhances the understanding of wave patterns and supports the identification of wave counts. Taking detailed notes on key concepts and summarizing them in one's own words aids in better retention and comprehension.

Engaging with practical examples further solidifies one's grasp on effectively applying Elliott Wave Theory. By practicing wave analysis on different charts, traders can refine their skills and align the theory with real-world trading situations. Patience and persistence are essential in this process, as mastering Elliott Wave Theory requires consistent practice and application. Through continuous analysis of charts and practical examples, traders can enhance their ability to interpret market movements and make informed trading decisions.

Clarification Seeking

Engaging in a thorough process of seeking clarification is crucial for enhancing understanding and application of complex concepts within Elliott Wave Theory. When delving into Elliott wave techniques, seeking clarification plays a pivotal role in solidifying one's grasp of the theory.

Here are four key aspects to take into account when seeking clarification in Elliott Wave Theory:

- Explanation: Request detailed explanations from experts or through reputable resources to clarify intricate wave patterns and market behaviors.

- Mark: Make notes or mark areas of confusion within wave patterns to pinpoint specific areas requiring clarification.

- Knowledge Gained: Reflect on the knowledge gained through seeking clarification to reinforce learning and retention of complex concepts.

- Real-Life Application: Apply the clarified concepts to real-life market scenarios to test understanding and make sure practical application aligns with theoretical knowledge.

Market Updates Stay Informed

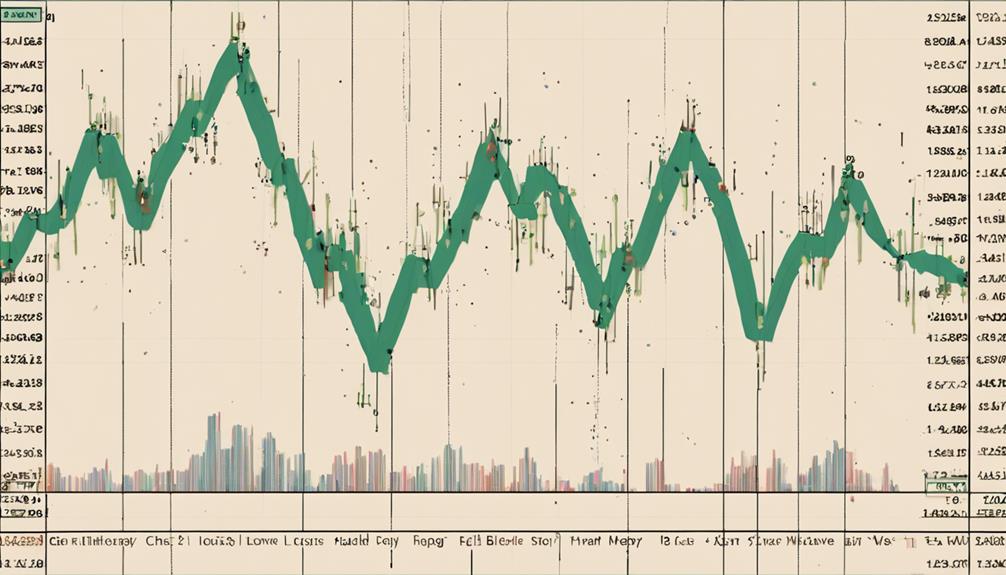

Seeking an in-depth understanding of market updates and forecasts is integral for staying informed and making informed decisions within Elliott Wave Theory. Keeping abreast of market updates allows traders and investors to access the latest insights and analysis on market trends, engage in discussions on current market conditions, and receive alerts on potential trading opportunities. In the domain of Elliott Waves, market updates play a vital role in enhancing one's understanding of market dynamics and movements. By staying informed about market updates, traders can make more educated decisions based on the evolving market scenarios.

Additionally, incorporating volume profile/analysis into market updates can provide valuable information about the strength of price movements and potential reversal points. This analytical approach aligns with the principles of Elliott Wave Theory, where understanding market volume can offer insights into the validity of wave counts and projections. As advocated by Glenn Neely, a prominent figure in Elliott Wave analysis, staying informed about market updates is essential for successful trading and investing within the framework of Elliott Waves.

Importance of Patience

Patience plays a pivotal role in the mastery of Elliott Wave Theory. It enables traders to decipher intricate wave patterns and market dynamics with precision. By exercising patience, traders can make well-thought-out decisions devoid of emotional influences, fostering a more analytical approach to trading.

This ability to wait for the opportune moment helps traders steer clear of impulsive actions that could potentially result in financial setbacks.

Patience in Learning

The mastery of Elliott Wave Theory hinges greatly on embracing the virtue of persistence when delving into the intricacies of market patterns and behaviors.

Understanding Elliott Waves requires a patient mindset to decipher the complexities of wave formations and market movements.

Achieving accurate wave counts demands patience in analyzing price action and wave patterns diligently.

Applying tools effectively necessitates a patient approach to avoid hasty decisions and guarantee precise market interpretations.

Grasping the logical rules on structure, time, and degree within Elliott Wave Theory calls for a patient learning process to internalize and apply these principles effectively.

Benefits of Waiting

Mastering Elliott Wave Theory entails recognizing the benefits of waiting, particularly in understanding wave patterns and refining market predictions with informed patience. Patience is pivotal in accurately identifying Elliott Waves and conducting precise wave counts, which are essential for developing effective trading strategies.

By waiting for clear wave patterns to emerge, traders can avoid impulsive decisions and enhance the accuracy of their market predictions. Patiently observing market behavior and waiting for confirmation of wave counts can lead to more consistent forecast accuracy and improved decision-making.

Developing patience in applying Elliott Wave Theory not only enhances trading strategies but also contributes to long-term success in maneuvering the complexities of financial markets.

Persistence in Learning

Consistent revisitation of challenging concepts is imperative for mastering Elliott Wave Theory through persistence in learning. This involves more than just initial exposure; it requires regular practice and engagement with the material.

To effectively persist in learning Elliott Wave Theory, consider the following:

- Regular Practice: Consistent practice with historical and current market charts is vital for internalizing the theory. By applying the concepts repeatedly, you enhance your understanding and ability to interpret wave patterns accurately.

- Note-Taking: Taking notes on key concepts and summarizing them can aid in retaining information effectively. This practice helps reinforce your learning and serves as a valuable reference for future study.

- Engagement with Practical Examples: Actively engaging with practical examples and real-world applications of Elliott Wave Theory can deepen your comprehension and provide insights into how the theory operates in different market scenarios.

- Continuous Learning: Staying updated with the latest developments in Elliott Wave Theory is essential for continuous learning and improvement. The financial markets evolve, and staying informed ensures that your knowledge remains relevant and up-to-date.

Critical Application Approach

Persistence in learning Elliott Wave Theory through regular practice and engagement sets the foundation for a critical application approach essential for mastering this intricate market analysis technique. To apply Elliott Waves effectively, an academic-style explanation is important. Understanding the wave principle, wave patterns, and Fibonacci relationships provides the basis for accurate wave counting. Avoiding common pitfalls like wrong wave counts is essential.

Good recipes for applying Elliott Wave Theory include patience, discipline, and continuous learning. Shifting from theoretical knowledge to practical application is essential for success in real-time trading. Neely River Trading Course, led by Mr. SP Singh, offers professional guidance emphasizing real-world examples and logical progression in mastering Elliott Wave Theory. By honing skills through structured learning programs like this, traders can enhance their ability to interpret market movements and make informed decisions based on Elliott Wave analysis. This critical approach ensures a deeper understanding of market dynamics and improves trading outcomes.

Frequently Asked Questions

How to Master Elliott Wave?

To master Elliott Wave Theory, one must explore understanding Elliott wave patterns, interpreting waves accurately, analyzing trends effectively, forecasting wave movements, and recognizing the influence of market psychology.

Mastery requires a deep comprehension of the theory's nuances, continuous practice on historical and live market charts, and the ability to apply the theory consistently in various market conditions.

Developing proficiency in Elliott Wave Theory involves a blend of knowledge, skill, and experience.

Is Elliot Wave Hard to Learn?

The learning curve for Elliott Wave Theory can be steep due to its intricate wave patterns and the subjective nature of wave interpretation. Challenges faced by learners include understanding wave structures, time frames, and market behavior.

Common misconceptions revolve around the complexity of the theory. However, breaking down the theory into simplified concepts and applying it practically through historical analysis and real-time scenarios can aid in grasping its principles effectively.

How to Count Elliott Waves Correctly?

Correctly counting Elliott Waves involves precise wave identification and accurate wave labeling. Understanding various wave degrees, applying validation techniques, and consistent wave counting practice are also essential.

By identifying wave patterns and utilizing Fibonacci ratios, practitioners can enhance their wave counting accuracy. Wave rules, guidelines, and ratios play an important role in ensuring correct wave counts.

Employing tools like Fibonacci retracements and trendlines aids in confirming Elliott Wave patterns.

What Is the Best Time Frame for Elliott Wave?

The best time frame for Elliott Wave analysis depends on the type of trading strategy employed. Short term analysis, such as intraday trading, benefits from shorter time frames like 15-minute or 1-hour charts.

For identifying long term trends and employing swing trading strategies, longer time frames such as weekly or monthly charts are more suitable.

Traders often blend multiple time frames to validate wave counts and navigate market volatility fluctuations effectively.

Conclusion

To summarize, mastering Elliott Wave Theory requires a logical progression, practical examples engagement, utilization of visual aids, note-taking, practical application practice, staying informed with market updates, patience, persistence in learning, and a critical application approach.

Remember, 'Rome wasn't built in a day.' By following these steps diligently, one can enhance their understanding and proficiency in Elliott Wave Theory, leading to more informed and successful trading decisions.