The simplified guide to the Zig Zag Indicator offers traders a valuable tool for navigating the complexities of market trends and price movements. Understanding its basics, interpreting patterns, and utilizing it in conjunction with other indicators can significantly enhance one's trading strategy.

However, to fully harness the power of this tool, traders must be mindful of common mistakes and practical tips that can optimize its effectiveness. Exploring the nuances of the Zig Zag Indicator can unveil a world of possibilities for traders seeking to elevate their market analysis and decision-making process.

Basics of Zig Zag Indicator

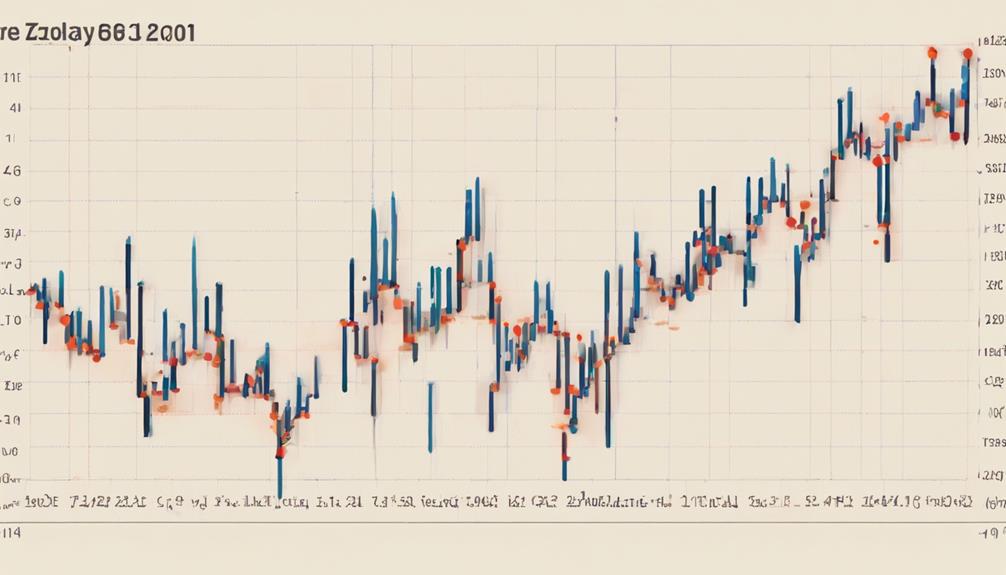

The foundation of understanding the Zig Zag Indicator lies in grasping its fundamental purpose in filtering market noise to reveal significant price movements. Traders utilize Zig Zag indicators to identify trends and potential reversals in the market. By connecting significant price peaks and troughs, this technical tool assists in spotting support and resistance levels, aiding traders in making informed decisions.

The Zig Zag Indicator is particularly beneficial for swing traders who seek to capitalize on small price movements within the market. Available on platforms like Metatrader, users can adjust parameters such as Depth, Deviation, and Backstep to customize the indicator based on varying market conditions.

Reading the Zig Zag Indicator involves analyzing the rising and falling lines to determine the trend direction and potential entry points. Overall, this technical tool serves as a valuable asset for traders looking to navigate the complexities of the market efficiently.

Interpreting Zig Zag Patterns

Interpreting Zig Zag patterns involves decoding the interplay between swing highs and swing lows to extract valuable insights into market direction and potential trading opportunities. Zigzag patterns, by connecting these swing highs and swing lows, provide a visual representation of market direction. They are particularly useful for identifying potential entry and exit points in trading.

By filtering out noise in price movements, Zig Zag patterns enable clearer analysis of price reversals and trend changes. Traders can utilize these patterns to spot areas where the price is likely to reverse or change direction, aiding in decision-making processes.

Understanding how to interpret Zig Zag patterns enhances the effectiveness of trading strategies by providing a more structured approach to analyzing price movements. By incorporating Zig Zag patterns into technical analysis, traders can gain a clearer understanding of market dynamics and improve their overall trading performance.

Using Zig Zag With Other Indicators

How can Zig Zag be effectively utilized in conjunction with other indicators to enhance trading precision and confirm trend signals?

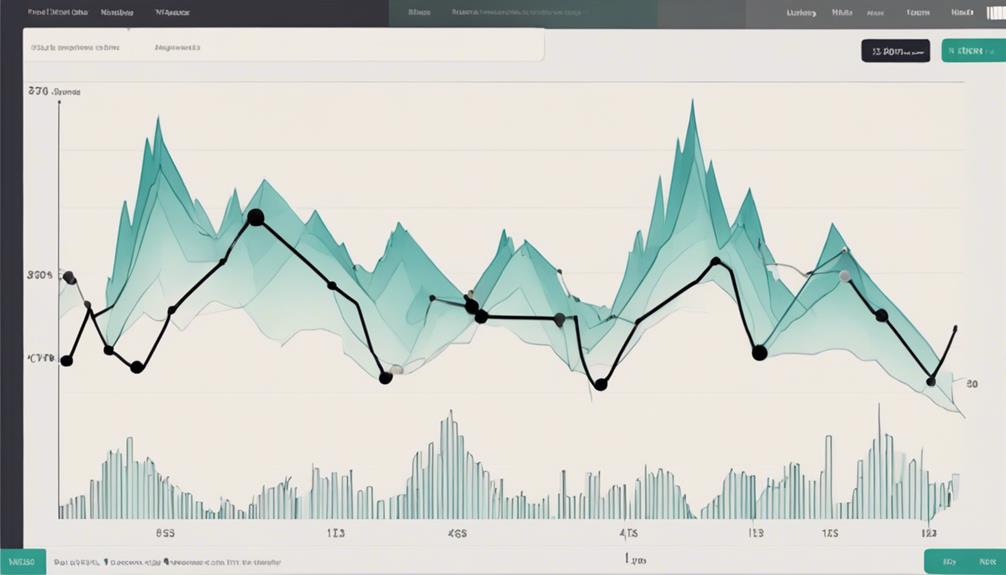

Combining the Zig Zag indicator with Fibonacci retracement levels can provide traders with more precise entry and exit points, increasing the accuracy of their trades. Additionally, incorporating moving averages into the analysis can offer further confirmation of the prevailing trend direction. Monitoring Zig Zag turning points around common moving averages can help validate the signals generated by this indicator, adding an extra layer of confidence to trading decisions.

When Zig Zag reverses after crossing a moving average, it may signal a potential trend reversal, providing traders with valuable insights for their strategies. To refine trading approaches and gain confidence in using Zig Zag with other indicators, practicing on a demo account is advisable. By experimenting with different combinations and observing how they interact, traders can develop a more robust trading strategy.

Practical Tips for Zig Zag Indicator

Building upon the effective utilization of the Zig Zag indicator in conjunction with other indicators, implementing practical tips can further enhance its performance in technical analysis.

To filter out noise and focus on significant price movements, adjusting the Depth parameter in the Zigzag Indicator is crucial.

Experimenting with different Deviation levels allows for customization tailored to various assets and market conditions.

Backtesting with different Backstep settings helps in finding the optimal configuration for your trading strategy.

Combining the Zigzag Indicator with other technical indicators provides confirmation and enhances accuracy in trend analysis.

It is advisable to practice using the Zigzag Indicator on a demo account before live trading to gain confidence and refine your approach.

Common Mistakes to Avoid With Zig Zag

When utilizing the Zig Zag indicator in technical analysis, it is crucial to steer clear of common mistakes that could hinder its effectiveness and misguide trading decisions.

One common mistake to avoid is relying solely on the Zigzag indicator for trade signals. It is recommended to use it in conjunction with other indicators to confirm trends and avoid false signals, especially in choppy or sideways markets.

Additionally, be cautious of the potential lag in the Zigzag indicator, as this may impact the timing of entries and exits. It is essential not to base trading decisions solely on the most recent Zigzag line, as it can change with new price data.

Remember that the Zigzag indicator is a tool to confirm trend direction rather than a standalone timing indicator. By avoiding these mistakes and using the Zigzag indicator appropriately as a tool for trend confirmation, traders can make more informed decisions and improve their overall trading strategies.

Can You Explain the Zig Zag Indicator in an Easy-to-Understand Way?

The simplified zig zag indicator is a popular tool in technical analysis that helps traders identify potential trend reversals. It does this by drawing lines connecting significant price peaks and troughs, showing the direction of the market’s momentum. This allows traders to make informed decisions about entering or exiting positions.

Can You Explain the Zig Zag Indicator in a Simplified Manner?

The Zig Zag indicator helps in identifying market trends by connecting significant price movements. In simple steps, interpret Zig Zag by understanding that it filters out price movements below a certain percentage, helping traders focus on major price changes rather than noise.

Can the Simplified Zig Zag Indicator Guide Help with Price Prediction?

The simplified zigzag indicator is a valuable tool for traders looking to simplify price prediction with zigzag patterns. By identifying key turning points and trends, this guide can help traders make more informed decisions about buying and selling, ultimately improving their chances of success in the market.

Frequently Asked Questions

How Do You Read a Zigzag Indicator?

When reading a Zigzag indicator, focus on its line direction: rising denotes an uptrend, falling indicates a downtrend. This tool is not for direct trade signals but helps identify market sentiment shifts on longer-term charts.

What Is the Best Zigzag Indicator Setting?

The best Zigzag indicator setting involves adjusting the Depth parameter to enhance trend identification and filter out noise. Traders commonly use a Depth value of 12-15 for accurate price movement analysis. Experimenting with different Depth levels can improve sensitivity to market changes.

What Is the Formula for Zigzag Indicator?

The formula for the Zigzag Indicator involves setting a percentage change threshold to detect significant price movements. This threshold is selected based on the asset and market conditions to accurately analyze current prices and identify trend shifts.

How Do You Use Zigzag Indicator Tradingview?

Utilize the Zigzag Indicator on Tradingview by identifying trend reversals through connecting price peaks and troughs. Customize parameters like Depth and Deviation for different assets. Combine with other indicators for trend confirmation and optimize swing trading entry and exit points.

Conclusion

In conclusion, the Zig Zag Indicator serves as a valuable tool for swing traders looking to filter out market noise, identify trends, and spot potential trend reversals.

While some may argue that relying solely on this indicator may oversimplify market analysis, when used in conjunction with other technical indicators and analysis methods, the Zig Zag can provide valuable insights and help traders make informed decisions in the dynamic world of trading.